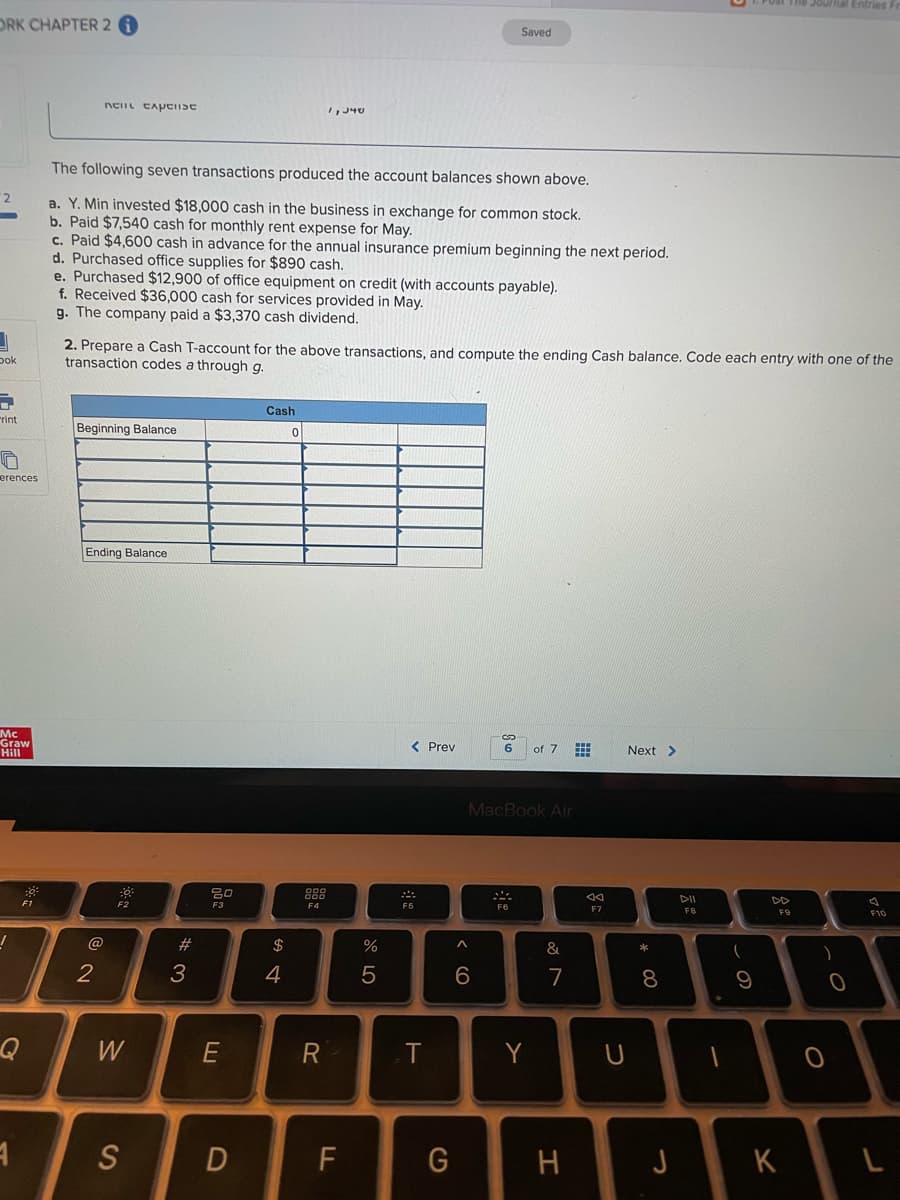

The following seven transactions produced the account balances shown above. a. Y. Min invested $18,000 cash in the business in exchange for common stock. b. Paid $7,540 cash for monthly rent expense for May. c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period. d. Purchased office supplies for $890 cash. e. Purchased $12,900 of office equipment on credit (with accounts payable). f. Received $36,000 cash for services provided in May. g. The company paid a $3,370 cash dividend. 2. Prepare a Cash T-account for the above transactions, and compute the ending Cash balance. Code each entry with one of the transaction codes a through g.

The following seven transactions produced the account balances shown above. a. Y. Min invested $18,000 cash in the business in exchange for common stock. b. Paid $7,540 cash for monthly rent expense for May. c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period. d. Purchased office supplies for $890 cash. e. Purchased $12,900 of office equipment on credit (with accounts payable). f. Received $36,000 cash for services provided in May. g. The company paid a $3,370 cash dividend. 2. Prepare a Cash T-account for the above transactions, and compute the ending Cash balance. Code each entry with one of the transaction codes a through g.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter2: Analyzing Transactions: The Accounting Equation

Section: Chapter Questions

Problem 4SEB: EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first...

Related questions

Question

Please answer and check do not reject the question thank you

![Required information

(The following information applies to the questions displayed below.]

Yi Min started an engineering firm called Min Engineering. He began operations and completed seven transactions in May,

which included his initial investment of $18,000 cash. After those seven transactions, the ledger included the following

accounts with normal balances.

$ 37,600

Cash

Office supplies

Prepaid insurance

Office equipment

Accounts payable

Common stock

Dividends

Services revenue

Rent expense

890

4,600

12,900

12,900

18,000

3,370

36,000

7,540

ces

The following seven transactions produced the account balances shown above.

a. Y. Min invested $18,000 cash in the business in exchange for common stock.

b.

c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period.

d. Purchased office supplies for $890 cash.

e. Purchased $12,900 of office equipment on credit (with accounts payable).

f. Received $36,000 cash for services provided in May.

g. The company paid a $3,370 cash dividend.

cash

r monthly rent expense for May.

2. Prepare a Cash T-account for the above transactions, and compute the ending Cash balance. Code each entry with one of the

transaction codes a through g.

Cash

Beginning Balance

Ac

raw

< Prev

of 7 E

Next >

MacBook Air

DII

DD

Ea

F7

F10

FV

F4

F1

F2

@

$

%

&

2

3

4

5

6

7

8.

9

Q

W

R

T

Y

P

S

G

H

J

K

く

Z

C

V

M

つ

B](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F72072a7e-cb22-4e0a-926e-24ea3c0f3f80%2F37b70213-1142-470b-9474-a4c3e42ec6cb%2Fzt8sh63_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

(The following information applies to the questions displayed below.]

Yi Min started an engineering firm called Min Engineering. He began operations and completed seven transactions in May,

which included his initial investment of $18,000 cash. After those seven transactions, the ledger included the following

accounts with normal balances.

$ 37,600

Cash

Office supplies

Prepaid insurance

Office equipment

Accounts payable

Common stock

Dividends

Services revenue

Rent expense

890

4,600

12,900

12,900

18,000

3,370

36,000

7,540

ces

The following seven transactions produced the account balances shown above.

a. Y. Min invested $18,000 cash in the business in exchange for common stock.

b.

c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period.

d. Purchased office supplies for $890 cash.

e. Purchased $12,900 of office equipment on credit (with accounts payable).

f. Received $36,000 cash for services provided in May.

g. The company paid a $3,370 cash dividend.

cash

r monthly rent expense for May.

2. Prepare a Cash T-account for the above transactions, and compute the ending Cash balance. Code each entry with one of the

transaction codes a through g.

Cash

Beginning Balance

Ac

raw

< Prev

of 7 E

Next >

MacBook Air

DII

DD

Ea

F7

F10

FV

F4

F1

F2

@

$

%

&

2

3

4

5

6

7

8.

9

Q

W

R

T

Y

P

S

G

H

J

K

く

Z

C

V

M

つ

B

Transcribed Image Text:The Journal Entries

ORK CHAPTER 2

Saved

The following seven transactions produced the account balances shown above.

2

a. Y. Min invested $18,000 cash in the business in exchange for common stock.

b. Paid $7,540 cash for monthly rent expense for May.

c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period.

d. Purchased office supplies for $890 cash.

e. Purchased $12,900 of office equipment on credit (with accounts payable).

f. Received $36,000 cash for services provided in May.

g. The company paid a $3,370 cash dividend.

2. Prepare a Cash T-account for the above transactions, and compute the ending Cash balance. Code each entry with one of the

transaction codes a through g.

pok

Cash

rint

Beginning Balance

erences

Ending Balance

Mc

Graw

Hill

< Prev

of 7 E

6

Next >

MacBook Air

888

F1

F2

DD

F3

F7

F8

F10

@

#3

$

&

3

4

7

8

W

E

T

Y

S

F

H

J

K

の

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning