The following statements pertain to the pr Which is not in accordance with generally Long-term notes receivables which nominal unreasonably low should be stated at face Receivables denominated in foreign currene the exchange rate on Statement of Financia Credit balances in customer's accounts rec

The following statements pertain to the pr Which is not in accordance with generally Long-term notes receivables which nominal unreasonably low should be stated at face Receivables denominated in foreign currene the exchange rate on Statement of Financia Credit balances in customer's accounts rec

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 15QE

Related questions

Question

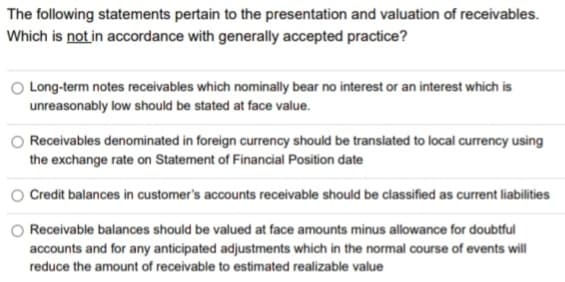

Transcribed Image Text:The following statements pertain to the presentation and valuation of receivables.

Which is not in accordance with generally accepted practice?

Long-term notes receivables which nominally bear no interest or an interest which is

unreasonably low should be stated at face value.

Receivables denominated in foreign currency should be translated to local currency using

the exchange rate on Statement of Financial Position date

Credit balances in customer's accounts receivable should be classified as current liabilities

Receivable balances should be valued at face amounts minus allowance for doubtful

accounts and for any anticipated adjustments which in the normal course of events will

reduce the amount of receivable to estimated realizable value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,