The following table depicts the budgeted sales volume and per unit costs and profits for an English manufacturer (Toys Ltd.) of two different children’s toys, both of which are produced in the same factory: Calculate the contribution per unit and total contribution for each of the two products. Since product B is unprofitable, calculate its break-even outpute. sales quantity. Should management discontinue its production? Explain and justify your answer.

Question 2 – A multi-product company

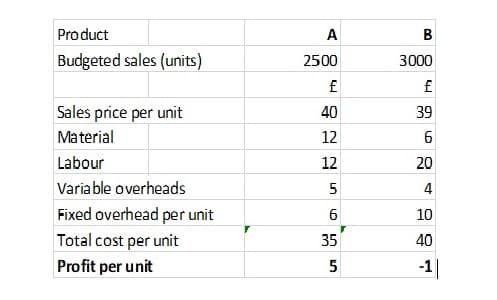

The following table depicts the budgeted sales volume and per unit costs and profits for an English manufacturer (Toys Ltd.) of two different children’s toys, both of which are produced in the same factory:

- Calculate the contribution per unit and total contribution for each of the two products. Since product B is unprofitable, calculate its break-even outpute. sales quantity. Should management discontinue its production? Explain and justify your answer.

contribution per unit

A: 40-12-12-5 = 11

B: 39-6-20-4 = 9

total contribution

A: 11*2500 = 27 500

B: 9*3000 = 27 000

break-even output (B)

FC=10*3 000 = 30 000

BEP= 30 000/9 = 3 333,33 units

The BEP is below the budgeted sales volume, but they should still keep producing, because they have prositive contribution. The contribution is at 9 and the FC is at 10 so they almost cover all fixed cost. If they stop producing they would face even higher losses.

(b) Consider Toys Ltd. again. Assume that the production manager is considering a new packaging machine. For a total investment of £10,000, Fixed

Investment= 10 000

FC = reduced by 5000 =

Reduce material A= 10.8 B= 5.4

And labour A =10.8 B= 18

Total Profit with investment of 10 000: A(2500*(40-10.8-10.8-5) – 2 500*6) + B(3000*(39-5.4-18-4) – 3000*10) -10 000+5000 = A(3 3500-15 000) + B(34 800-30 000) -5000 = £18 300

Original total Profit: A(2 500*5) + B(3000*-1) = £9500

They increase their profits by £9300 if they make the investment, thus make the investment fot the new packaging machine.

Step by step

Solved in 3 steps