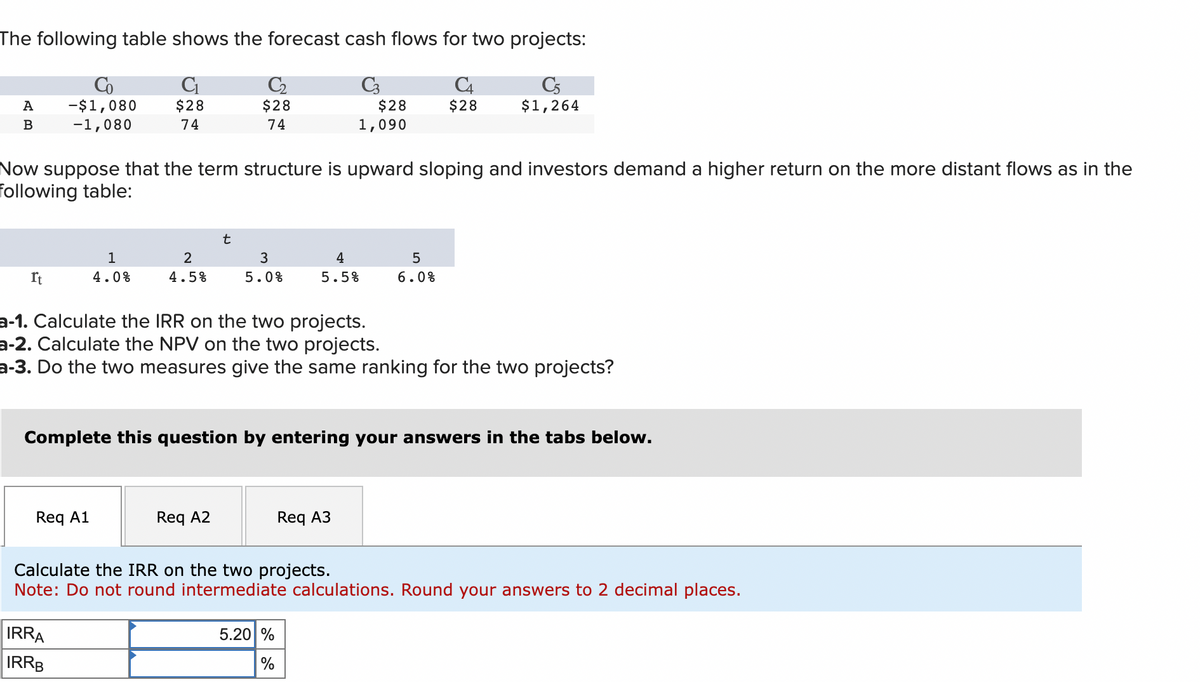

The following table shows the forecast cash flows for two projects: C₁ C4 C5 $28 $28 $1,264 74 A B It Co -$1,080 -1,080 Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the Following table: Req A1 C₂ $28 74 t IRRA IRRB 1 2 3 4.0% 4.5% 5.0% Req A2 a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the two measures give the same ranking for the two projects? $28 1,090 Complete this question by entering your answers in the tabs below. 4 5.5% 5.20 % % 5 6.0% Req A3 Calculate the IRR on the two projects. Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

The following table shows the forecast cash flows for two projects: C₁ C4 C5 $28 $28 $1,264 74 A B It Co -$1,080 -1,080 Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the Following table: Req A1 C₂ $28 74 t IRRA IRRB 1 2 3 4.0% 4.5% 5.0% Req A2 a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the two measures give the same ranking for the two projects? $28 1,090 Complete this question by entering your answers in the tabs below. 4 5.5% 5.20 % % 5 6.0% Req A3 Calculate the IRR on the two projects. Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 11P: Brook Corporation’s free cash flow for the current year (FCF0) was $3.00 million. Its investors...

Related questions

Question

Transcribed Image Text:The following table shows the forecast cash flows for two projects:

C₁

C3

C₁

C5

Co

-$1,080 $28

-1,080

$28

$1,264

74

A

B

It

Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the

following table:

1

4.0%

Req A1

2

4.5%

IRRA

IRRB

C₂

$28

74

t

Req A2

3

5.0%

a-1. Calculate the IRR on the two projects.

a-2. Calculate the NPV on the two projects.

a-3. Do the two measures give the same ranking for the two projects?

$28

1,090

Complete this question by entering your answers in the tabs below.

4

5.5%

5.20 %

%

5

6.0%

Req A3

Calculate the IRR on the two projects.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT