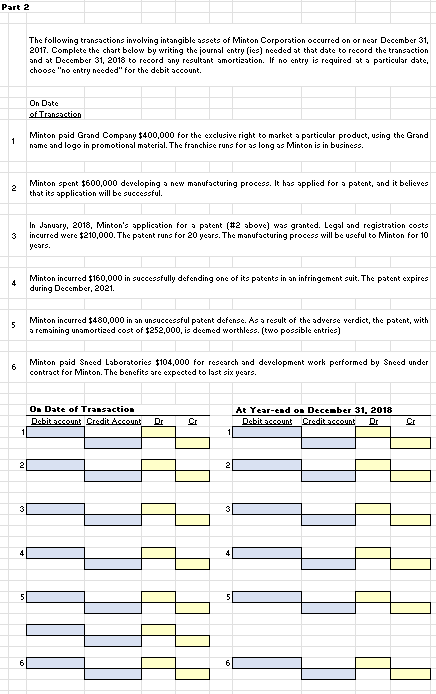

The following transactions involving intangible assets of Minton Corporation occurred on or near December 31, 2017. Complete the chart below by writing the journal entry (ies) needed at that date to record the transaction and at December 31, 2018 to record any resultant amortization. If no entry is required at a particular date, choose "no entry needed" for the debit account. On Date of Transaction Minton paid Grand Company $400,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Minton is in business. Minton spent $600,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. In January, 2018, Minton's application for a patent (#2 above) was granted. Legal and registration costs incurred were $210,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10 years. Minton incurred $160,000 in successfully defending one of its patents in an infringement suit. The patent expires during December, 2021. Minton incurred $480,000 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of $252,000, is deemed worthless. (two possible entries) Minton paid Sneed Laboratories $104,000 for research and development work performed by Sneed under contract for Minton. The benefits are expected to last six years.

The following transactions involving intangible assets of Minton Corporation occurred on or near December 31, 2017. Complete the chart below by writing the journal entry (ies) needed at that date to record the transaction and at December 31, 2018 to record any resultant amortization. If no entry is required at a particular date, choose "no entry needed" for the debit account. On Date of Transaction Minton paid Grand Company $400,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Minton is in business. Minton spent $600,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. In January, 2018, Minton's application for a patent (#2 above) was granted. Legal and registration costs incurred were $210,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10 years. Minton incurred $160,000 in successfully defending one of its patents in an infringement suit. The patent expires during December, 2021. Minton incurred $480,000 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of $252,000, is deemed worthless. (two possible entries) Minton paid Sneed Laboratories $104,000 for research and development work performed by Sneed under contract for Minton. The benefits are expected to last six years.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 8P

Related questions

Question

| Yellow cells require numbers while blue cells contain pull-down menus. |

Blue Cells are these accounts:

| Accounts |

| Franchise (BS) |

| Cash (BS) |

| R&D Expense (IS) |

| Patents (BS) |

| Legal Expense (IS) |

| Loss (write-off)(IS) |

| Amortization expense (IS) |

| "No entry needed" |

Transcribed Image Text:Part 2

1

2

3

4

6

2

3

4

5

The following transactions involving intangible assets of Minton Corporation occurred on or near December 31,

2017. Complete the chart below by writing the journal entry (ies) needed at that date to record the transaction

and at December 31, 2018 to record any resultant amortization. If no entry is required at a particular date,

choose "no entry needed" for the debit account.

5

Minton incurred $480,000 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with

a remaining unamortized cost of $252,000, is deemed worthless. (two possible entries)

6

On Date

of Transaction

Minton paid Grand Company $400,000 for the exclusive right to market a particular product, using the Grand

name and logo in promotional material. The franchise runs for as long as Minton is in business.

Minton spent $600,000 developing a new manufacturing process. It has applied for a patent, and it believes

that its application will be successful.

In January, 2018, Minton's application for a patent (#2 above) was granted. Legal and registration costs

incurred were $210,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10

years.

Minton incurred $160,000 in successfully defending one of its patents in an infringement suit. The patent expires

during December, 2021.

Minton paid Sneed Laboratories $104,000 for research and development work performed by Sneed under

contract for Minton. The benefits are expected to last six years.

On Date of Transaction

Debit account Credit Account Dr

Cr

1

2

3

4

At Year-end on December 31, 2018

Debit account Credit account Dr

Cr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning