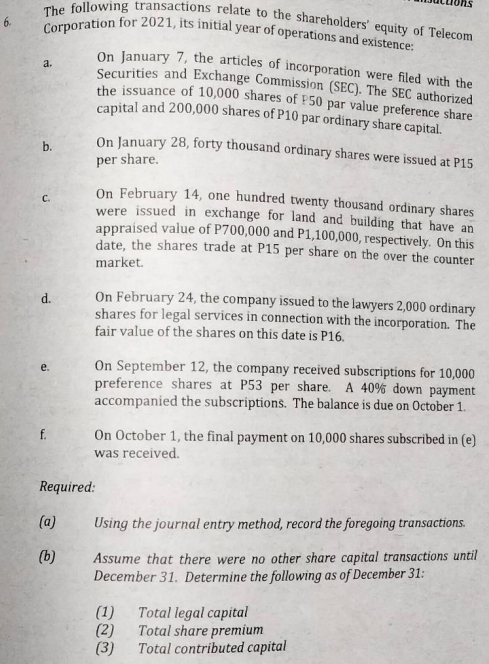

The following transactions relate to the shareholders' equity of Telecom Corporation for 2021, its initial year of operations and existence: 6. a. On January 7, the articles of incorporation were filed with the Securities and Exchange Commission (SEC). The SEC authorized the issuance of 10,000 shares of P50 par value preference share capital and 200,000 shares of P10 par ordinary share capital. On January 28, forty thousand ordinary shares were issued at P15 per share. On February 14, one hundred twenty thousand ordinary shares were issued in exchange for land and building that have an appraised value of P700,000 and P1,100,000, respectively. On this date, the shares trade at P15 per share on the over the counter market. On February 24, the company issued to the lawyers 2,000 ordinary shares for legal services in connection with the incorporation. The fair value of the shares on this date is P16. On September 12, the company received subscriptions for 10,000 preference shares at P53 per share. A 40% down payment accompanied the subscriptions. The balance is due on October 1. On October 1, the final payment 10,000 shares subscribed in (e) was received. Using the journal entry method, record the foregoing transactions. Assume that there were no other share capital transactions until December 31. Determine the following as of December 31: (1) Total legal capital (2) Total share premium (3) Total contributed capital d. f. Required: (a) (b)

The following transactions relate to the shareholders' equity of Telecom Corporation for 2021, its initial year of operations and existence: 6. a. On January 7, the articles of incorporation were filed with the Securities and Exchange Commission (SEC). The SEC authorized the issuance of 10,000 shares of P50 par value preference share capital and 200,000 shares of P10 par ordinary share capital. On January 28, forty thousand ordinary shares were issued at P15 per share. On February 14, one hundred twenty thousand ordinary shares were issued in exchange for land and building that have an appraised value of P700,000 and P1,100,000, respectively. On this date, the shares trade at P15 per share on the over the counter market. On February 24, the company issued to the lawyers 2,000 ordinary shares for legal services in connection with the incorporation. The fair value of the shares on this date is P16. On September 12, the company received subscriptions for 10,000 preference shares at P53 per share. A 40% down payment accompanied the subscriptions. The balance is due on October 1. On October 1, the final payment 10,000 shares subscribed in (e) was received. Using the journal entry method, record the foregoing transactions. Assume that there were no other share capital transactions until December 31. Determine the following as of December 31: (1) Total legal capital (2) Total share premium (3) Total contributed capital d. f. Required: (a) (b)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 4MC: Effective May 1, the shareholders of Baltimore Corporation approved a 2-for-1 split of the companys...

Related questions

Question

Transcribed Image Text:The following transactions relate to the shareholders' equity of Telecom

Corporation for 2021, its initial year of operations and existence:

6.

a.

On January 7, the articles of incorporation were filed with the

Securities and Exchange Commission (SEC). The SEC authorized

the issuance of 10,000 shares of P50 par value preference share

capital and 200,000 shares of P10 par ordinary share capital.

On January 28, forty thousand ordinary shares were issued at P15

per share.

On February 14, one hundred twenty thousand ordinary shares

were issued in exchange for land and building that have an

appraised value of P700,000 and P1,100,000, respectively. On this

date, the shares trade at P15 per share on the over the counter

market.

On February 24, the company issued to the lawyers 2,000 ordinary

shares for legal services in connection with the incorporation. The

fair value of the shares on this date is P16.

On September 12, the company received subscriptions for 10,000

preference shares at P53 per share. A 40% down payment

accompanied the subscriptions. The balance is due on October 1.

On October 1, the final payment on 10,000 shares subscribed in (e)

was received.

Using the journal entry method, record the foregoing transactions.

Assume that there were no other share capital transactions until

December 31. Determine the following as of December 31:

(1) Total legal capital

(2)

Total share premium

(3)

Total contributed capital

b.

d.

f.

Required:

(a)

(b)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College