The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. Jan. 2 Issued Ck. No. 6981 to JSS Management Company for monthly rent, $758. 2 J. Hammond, the owner, invested an additional $3,518 in the business. 4 Bought merchandise on account from Valencia and Company, invoice no. A691, $2,932; terms 2/10, n/30; dated January 2. 4 Received check from Vega Appliance for $972.16 in payment of $992 invoice less discount. 4 Sold merchandise on account to L. Paul, invoice no. 6483, $864. 6 Received check from Petty, Inc., $653.66, in payment of $667 invoice less discount. 7 Issued Ck. No. 6982, $594.86, to Fischer and Son, in payment of invoice no. C1272 for $607 less discount. 7 Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days. 7 Sold merchandise on account to Ellison and Clay, invoice no. 6484, $803. 9 Issued credit memo no. 43 to L. Paul, $59, for merchandise returned. 11 Cash sales for January 1 through January 10, $4,846.20. 11 Issued Ck. No. 6983, $2,873.36, to Valencia and Company, in payment of $2,932 invoice less discount. 14 Sold merchandise on account to Vega Appliance, invoice no. 6485, $2,058. 18 Bought merchandise on account from Costa Products, invoice no. 7281D, $4,857; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, $164 (total $5,021). 21 Issued Ck. No. 6984, $188, to M. Miller for miscellaneous expenses not recorded previously. 21 Cash sales for January 11 through January 20, $4,572. 23 Issued Ck. No. 6985 to Forbes Freight, $96, for freight charges on merchandise purchased on January 4. 23 Received credit memo no. 163, $382, from Costa Products for merchandise returned. 29 Sold merchandise on account to Bruce Supply, invoice no. 6486, $1,844. 31 Cash sales for January 21 through January 31, $4,426. 31 Issued Ck. No. 6986, $63, to M. Miller for miscellaneous expenses not recorded previously. 31 Recorded payroll entry from the payroll register: total salaries, $6,100; employees' federal income tax withheld, $862; FICA Social Security tax withheld, $378.20, FICA Medicare tax withheld, $88.45. 31 Recorded the payroll taxes: Social Security tax, $378.20, FICA Medicare tax, $88.45; state unemployment tax, $329.40; federal unemployment tax, $48.80. 31 Issued Ck. No. 6987, $4,771.35, for salaries for the month. 31 J. Hammond, the owner, withdrew $996 for personal use, Ck. No. 6988. Required: Prepare a schedule of accounts receivable. Hammond Auto SupplySchedule of Accounts ReceivableJanuary 31, 20--

The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. Jan. 2 Issued Ck. No. 6981 to JSS Management Company for monthly rent, $758. 2 J. Hammond, the owner, invested an additional $3,518 in the business. 4 Bought merchandise on account from Valencia and Company, invoice no. A691, $2,932; terms 2/10, n/30; dated January 2. 4 Received check from Vega Appliance for $972.16 in payment of $992 invoice less discount. 4 Sold merchandise on account to L. Paul, invoice no. 6483, $864. 6 Received check from Petty, Inc., $653.66, in payment of $667 invoice less discount. 7 Issued Ck. No. 6982, $594.86, to Fischer and Son, in payment of invoice no. C1272 for $607 less discount. 7 Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days. 7 Sold merchandise on account to Ellison and Clay, invoice no. 6484, $803. 9 Issued credit memo no. 43 to L. Paul, $59, for merchandise returned. 11 Cash sales for January 1 through January 10, $4,846.20. 11 Issued Ck. No. 6983, $2,873.36, to Valencia and Company, in payment of $2,932 invoice less discount. 14 Sold merchandise on account to Vega Appliance, invoice no. 6485, $2,058. 18 Bought merchandise on account from Costa Products, invoice no. 7281D, $4,857; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, $164 (total $5,021). 21 Issued Ck. No. 6984, $188, to M. Miller for miscellaneous expenses not recorded previously. 21 Cash sales for January 11 through January 20, $4,572. 23 Issued Ck. No. 6985 to Forbes Freight, $96, for freight charges on merchandise purchased on January 4. 23 Received credit memo no. 163, $382, from Costa Products for merchandise returned. 29 Sold merchandise on account to Bruce Supply, invoice no. 6486, $1,844. 31 Cash sales for January 21 through January 31, $4,426. 31 Issued Ck. No. 6986, $63, to M. Miller for miscellaneous expenses not recorded previously. 31 Recorded payroll entry from the payroll register: total salaries, $6,100; employees' federal income tax withheld, $862; FICA Social Security tax withheld, $378.20, FICA Medicare tax withheld, $88.45. 31 Recorded the payroll taxes: Social Security tax, $378.20, FICA Medicare tax, $88.45; state unemployment tax, $329.40; federal unemployment tax, $48.80. 31 Issued Ck. No. 6987, $4,771.35, for salaries for the month. 31 J. Hammond, the owner, withdrew $996 for personal use, Ck. No. 6988. Required: Prepare a schedule of accounts receivable. Hammond Auto SupplySchedule of Accounts ReceivableJanuary 31, 20--

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 19MC: The sum of all the accounts in the accounts receivable subsidiary ledger should ________. A. equal...

Related questions

Topic Video

Question

The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30.

| Jan. | 2 | Issued Ck. No. 6981 to JSS Management Company for monthly rent, $758. | ||

| 2 | J. Hammond, the owner, invested an additional $3,518 in the business. | |||

| 4 | Bought merchandise on account from Valencia and Company, invoice no. A691, $2,932; terms 2/10, n/30; dated January 2. | |||

| 4 | Received check from Vega Appliance for $972.16 in payment of $992 invoice less discount. | |||

| 4 | Sold merchandise on account to L. Paul, invoice no. 6483, $864. | |||

| 6 | Received check from Petty, Inc., $653.66, in payment of $667 invoice less discount. | |||

| 7 | Issued Ck. No. 6982, $594.86, to Fischer and Son, in payment of invoice no. C1272 for $607 less discount. | |||

| 7 | Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days. | |||

| 7 | Sold merchandise on account to Ellison and Clay, invoice no. 6484, $803. | |||

| 9 | Issued credit memo no. 43 to L. Paul, $59, for merchandise returned. | |||

| 11 | Cash sales for January 1 through January 10, $4,846.20. | |||

| 11 | Issued Ck. No. 6983, $2,873.36, to Valencia and Company, in payment of $2,932 invoice less discount. | |||

| 14 | Sold merchandise on account to Vega Appliance, invoice no. 6485, $2,058. | |||

| 18 | Bought merchandise on account from Costa Products, invoice no. 7281D, $4,857; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, $164 (total $5,021). | |||

| 21 | Issued Ck. No. 6984, $188, to M. Miller for miscellaneous expenses not recorded previously. | |||

| 21 | Cash sales for January 11 through January 20, $4,572. | |||

| 23 | Issued Ck. No. 6985 to Forbes Freight, $96, for freight charges on merchandise purchased on January 4. | |||

| 23 | Received credit memo no. 163, $382, from Costa Products for merchandise returned. | |||

| 29 | Sold merchandise on account to Bruce Supply, invoice no. 6486, $1,844. | |||

| 31 | Cash sales for January 21 through January 31, $4,426. | |||

| 31 | Issued Ck. No. 6986, $63, to M. Miller for miscellaneous expenses not recorded previously. | |||

| 31 | Recorded payroll entry from the payroll register: total salaries, $6,100; employees' federal income tax withheld, $862; FICA Social Security tax withheld, $378.20, FICA Medicare tax withheld, $88.45. | |||

| 31 | Recorded the payroll taxes: Social Security tax, $378.20, FICA Medicare tax, $88.45; state |

|||

| 31 | Issued Ck. No. 6987, $4,771.35, for salaries for the month. | |||

| 31 | J. Hammond, the owner, withdrew $996 for personal use, Ck. No. 6988. |

Required:

Prepare a schedule of

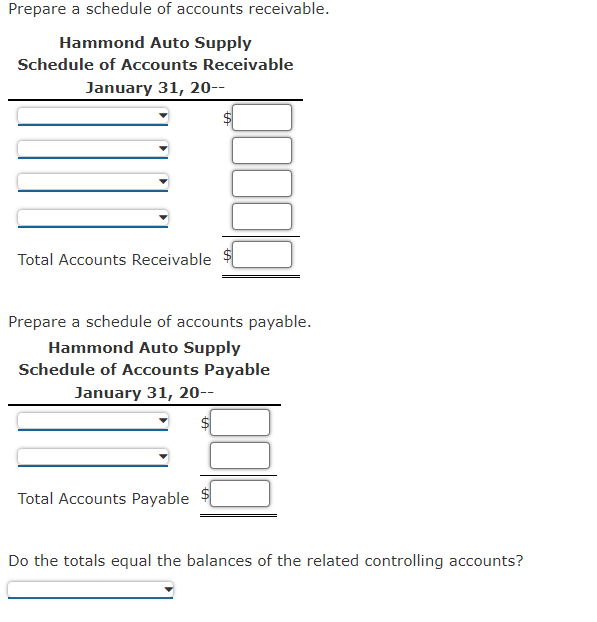

Transcribed Image Text:Prepare a schedule of accounts receivable.

Hammond Auto Supply

Schedule of Accounts Receivable

January 31, 20--

Total Accounts Receivable

Prepare a schedule of accounts payable.

Hammond Auto Supply

Schedule of Accounts Payable

January 31, 20--

Total Accounts Payable

Do the totals equal the balances of the related controlling accounts?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning