The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security of $6,000 will be worth $7,895.59 seven years in the future, assuming that no additional deposits or withdrawals are made, what is the implied interest rate the investor will earn on the security? 3.00% 3.20% 4.00% 4.80% If an investment of $30,000 is earning an interest rate of 6.00% compounded annually, it will take value of $45,108.91-assuming that no additional deposits or withdrawals are made during this time 0.2 years Which of the following statements is true, assuming that no additional deposits or withdrawals are 1.5 years 6.7 years It takes 10.5 years for $500 to double if invested at an annual rate of 5%. It takes 14.2 years for $500 to double if invested at an annual rate of 5%. 7.0 years for this investment to grow to a

The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security of $6,000 will be worth $7,895.59 seven years in the future, assuming that no additional deposits or withdrawals are made, what is the implied interest rate the investor will earn on the security? 3.00% 3.20% 4.00% 4.80% If an investment of $30,000 is earning an interest rate of 6.00% compounded annually, it will take value of $45,108.91-assuming that no additional deposits or withdrawals are made during this time 0.2 years Which of the following statements is true, assuming that no additional deposits or withdrawals are 1.5 years 6.7 years It takes 10.5 years for $500 to double if invested at an annual rate of 5%. It takes 14.2 years for $500 to double if invested at an annual rate of 5%. 7.0 years for this investment to grow to a

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 12MC: (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest...

Related questions

Question

Need all parts.....

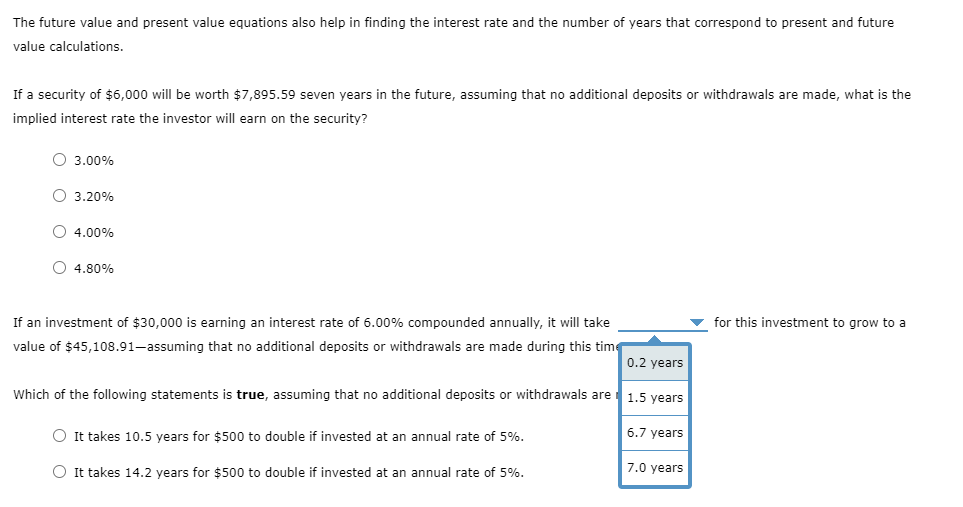

Transcribed Image Text:The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future

value calculations.

If a security of $6,000 will be worth $7,895.59 seven years in the future, assuming that no additional deposits or withdrawals are made, what is the

implied interest rate the investor will earn on the security?

O 3.00%

O 3.20%

O 4.00%

Ⓒ 4.80%

If an investment of $30,000 is earning an interest rate of 6.00% compounded annually, it will take

value of $45,108.91-assuming that no additional deposits or withdrawals are made during this time

0.2 years

Which of the following statements is true, assuming that no additional deposits or withdrawals are 1.5 years

O It takes 10.5 years for $500 to double invested at an annual rate of 5%.

O It takes 14.2 years for $500 to double if invested at an annual rate of 5%.

6.7 years

7.0 years

for this investment to grow to a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning