The General Fund the trial balance of Masfout Village as of January 1, 2020, was as Follows: Debits Credits Cash $50,000 Accounts Payable $70,000 axes Receivable 80,000 Estimated Uncollectible Taxes 10,000 Fund Balance 50,000 otal 130,000 Total 130,000 The following data pertaining to General Fund operations for Masfout Village for the

The General Fund the trial balance of Masfout Village as of January 1, 2020, was as Follows: Debits Credits Cash $50,000 Accounts Payable $70,000 axes Receivable 80,000 Estimated Uncollectible Taxes 10,000 Fund Balance 50,000 otal 130,000 Total 130,000 The following data pertaining to General Fund operations for Masfout Village for the

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 6E

Related questions

Question

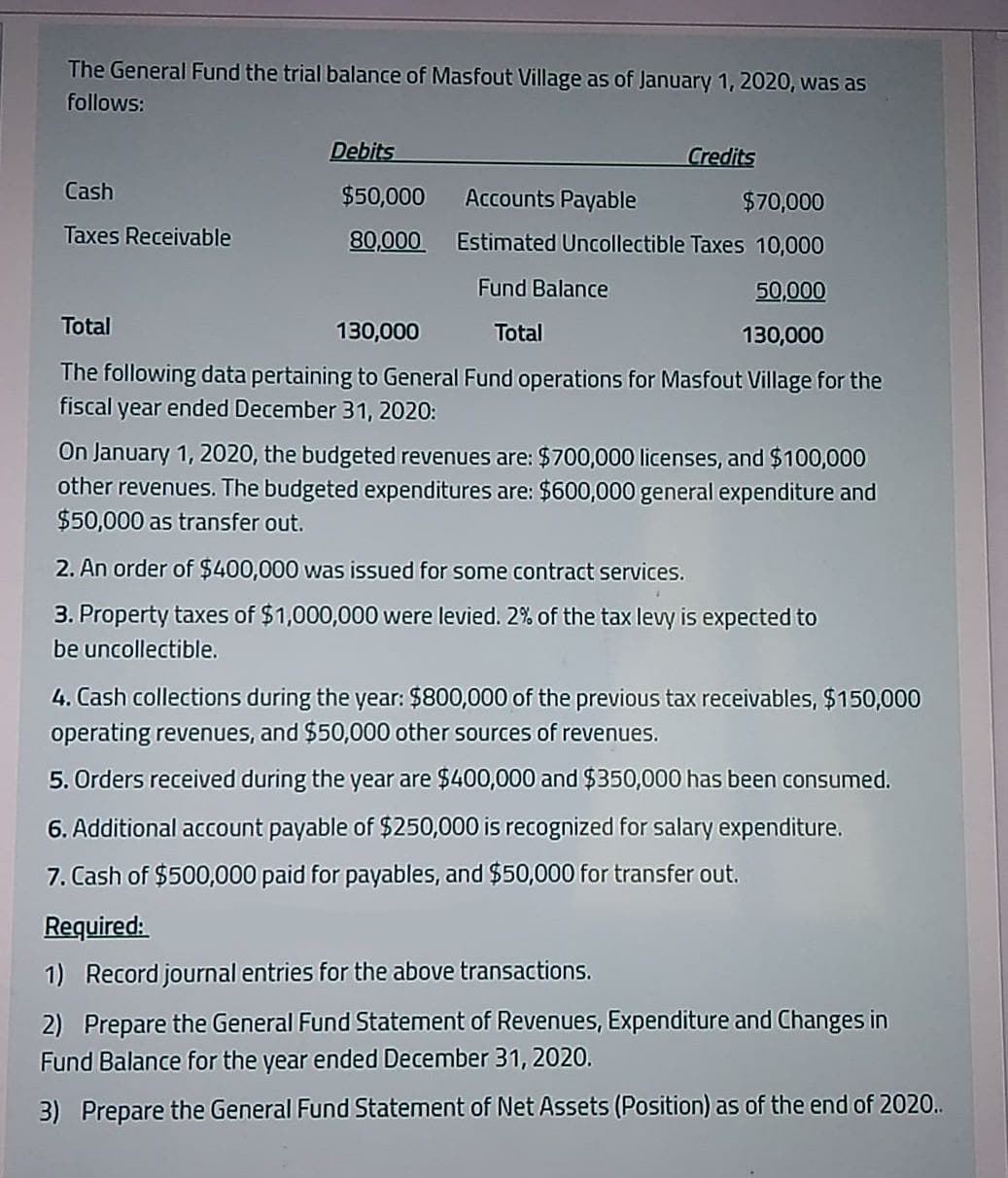

Transcribed Image Text:The General Fund the trial balance of Masfout Village as of January 1, 2020, was as

follows:

Debits

Credits

Cash

$50,000

Accounts Payable

$70,000

Taxes Receivable

80,000

Estimated Uncollectible Taxes 10,000

Fund Balance

50,000

Total

130,000

Total

130,000

The following data pertaining to General Fund operations for Masfout Village for the

fiscal year ended December 31, 2020:

On January 1, 2020, the budgeted revenues are: $700,000 licenses, and $100,000

other revenues. The budgeted expenditures are: $600,000 general expenditure and

$50,000 as transfer out.

2. An order of $400,000 was issued for some contract services.

3. Property taxes of $1,000,000 were levied. 2% of the tax levy is expected to

be uncollectible.

4. Cash collections during the year: $800,000 of the previous tax receivables, $150,000

operating revenues, and $50,000 other sources of revenues.

5. Orders received during the year are $400,000 and $350,000 has been consumed.

6. Additional account payable of $250,000 is recognized for salary expenditure.

7. Cash of $500,000 paid for payables, and $50,000 for transfer out.

Required:

1) Record journal entries for the above transactions.

2) Prepare the General Fund Statement of Revenues, Expenditure and Changes in

Fund Balance for the year ended December 31, 2020.

3) Prepare the General Fund Statement of Net Assets (Position) as of the end of 2020..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning