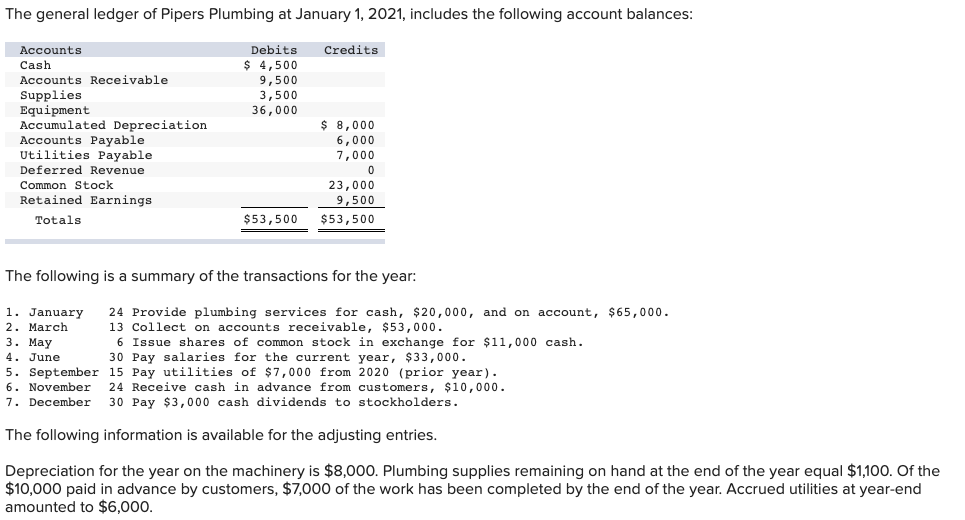

The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Debits Credits Accounts Cash Accounts Receivable 4,500 9,500 3,500 Supplies Equipment Accumulated Depreciation Accounts Payable Utilities Payable Deferred Revenue 36,000 8,000 6,000 7,000 0 Common Stock 23,000 9,500 Retained Earnings $53,500 $53,500 Totals The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65 ,000 13 Collect on accounts receivable, $53,000 6 Issue shares of common stock in exchange for $11,000 cash 30 Pay salaries for the current year, $33,000 2. March 3. Маy 4. June 5. September 15 Pay utilities of $7,000 from 2020 (prior year) 24 Receive cash in advance from customers, $10,000. 30 Pay $3,000 cash dividends to stockholders. 6. November 7. December The following information is available for the adjusting entries. Depreciation for the year on the machinery is $8,000. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. Accrued utilities at year-end amounted to $6,000. General General Income Trial Balance Balance Sheet Requirement Journal Ledger Statement 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 - 7). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8-10) 3. Review the adjusted 'Trial Balance' as of December 31, 2021 4. Prepare an income statement for the period ended December 31, 2021, in the 'Income Stateement' tab. 5. Prepare a classified balance sheet as of December 31, 2021 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 11-13)

The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Debits Credits Accounts Cash Accounts Receivable 4,500 9,500 3,500 Supplies Equipment Accumulated Depreciation Accounts Payable Utilities Payable Deferred Revenue 36,000 8,000 6,000 7,000 0 Common Stock 23,000 9,500 Retained Earnings $53,500 $53,500 Totals The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65 ,000 13 Collect on accounts receivable, $53,000 6 Issue shares of common stock in exchange for $11,000 cash 30 Pay salaries for the current year, $33,000 2. March 3. Маy 4. June 5. September 15 Pay utilities of $7,000 from 2020 (prior year) 24 Receive cash in advance from customers, $10,000. 30 Pay $3,000 cash dividends to stockholders. 6. November 7. December The following information is available for the adjusting entries. Depreciation for the year on the machinery is $8,000. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. Accrued utilities at year-end amounted to $6,000. General General Income Trial Balance Balance Sheet Requirement Journal Ledger Statement 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 - 7). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8-10) 3. Review the adjusted 'Trial Balance' as of December 31, 2021 4. Prepare an income statement for the period ended December 31, 2021, in the 'Income Stateement' tab. 5. Prepare a classified balance sheet as of December 31, 2021 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 11-13)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Can you please just do the income statement and balance sheet.

Transcribed Image Text:The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances:

Debits

Credits

Accounts

Cash

Accounts Receivable

4,500

9,500

3,500

Supplies

Equipment

Accumulated Depreciation

Accounts Payable

Utilities Payable

Deferred Revenue

36,000

8,000

6,000

7,000

0

Common Stock

23,000

9,500

Retained Earnings

$53,500

$53,500

Totals

The following is a summary of the transactions for the year:

1. January

24 Provide plumbing services for cash, $20,000, and on account, $65 ,000

13 Collect on accounts receivable, $53,000

6 Issue shares of common stock in exchange for $11,000 cash

30 Pay salaries for the current year, $33,000

2. March

3. Маy

4. June

5. September 15 Pay utilities of $7,000 from 2020 (prior year)

24 Receive cash in advance from customers, $10,000.

30 Pay $3,000 cash dividends to stockholders.

6. November

7. December

The following information is available for the adjusting entries.

Depreciation for the year on the machinery is $8,000. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the

$10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. Accrued utilities at year-end

amounted to $6,000.

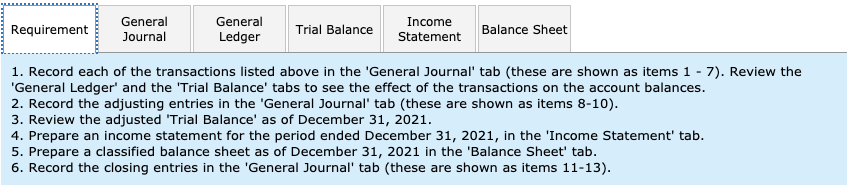

Transcribed Image Text:General

General

Income

Trial Balance

Balance Sheet

Requirement

Journal

Ledger

Statement

1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 - 7). Review the

'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances.

2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8-10)

3. Review the adjusted 'Trial Balance' as of December 31, 2021

4. Prepare an income statement for the period ended December 31, 2021, in the 'Income Stateement' tab.

5. Prepare a classified balance sheet as of December 31, 2021 in the 'Balance Sheet' tab.

6. Record the closing entries in the 'General Journal' tab (these are shown as items 11-13)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College