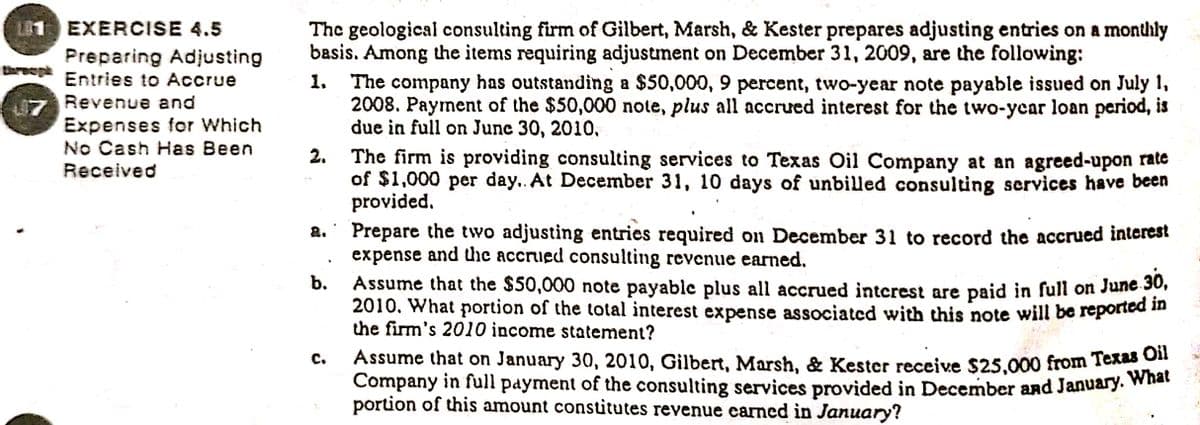

The geological consulting firm of Gilbert, Marsh, & Kester prepares adjusting entries on a monthly basis. Among the items requiring adjustment on December 31, 2009, are the following: 1. The company has outstanding a $50,000, 9 percent, two-year note payable issued on July 1, 2008. Payment of the $50,000 note, plus all accrued interest for the two-ycar loan period, is due in full on June 30, 2010, 2. The firm is providing consulting services to Texas Oil Company at an agreed-upon rate of $1,000 per day.. At December 31, 10 days of unbilled consulting services have been provided. Prepare the two adjusting entries required on December 31 to record the accrued interest expense and the accrued consulting revenue earned. Assume that the $50,000 note payable plus all accrued interest are paid in full on June 30, 2010. What portion of the total interest expense associated with this note will be reported in the firm's 2010 income statement? Assume that on January 30, 2010, Gilbert, Marsh, & Kester receive $25,000 from Tex Company in full payment of the consulting services provided in December and January. wihe portion of this amount constitutes revenue carned in January? с.

The geological consulting firm of Gilbert, Marsh, & Kester prepares adjusting entries on a monthly basis. Among the items requiring adjustment on December 31, 2009, are the following: 1. The company has outstanding a $50,000, 9 percent, two-year note payable issued on July 1, 2008. Payment of the $50,000 note, plus all accrued interest for the two-ycar loan period, is due in full on June 30, 2010, 2. The firm is providing consulting services to Texas Oil Company at an agreed-upon rate of $1,000 per day.. At December 31, 10 days of unbilled consulting services have been provided. Prepare the two adjusting entries required on December 31 to record the accrued interest expense and the accrued consulting revenue earned. Assume that the $50,000 note payable plus all accrued interest are paid in full on June 30, 2010. What portion of the total interest expense associated with this note will be reported in the firm's 2010 income statement? Assume that on January 30, 2010, Gilbert, Marsh, & Kester receive $25,000 from Tex Company in full payment of the consulting services provided in December and January. wihe portion of this amount constitutes revenue carned in January? с.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.18E: Interest Payable—Quarterly Adjustments Glendive takes out a 12%, 90-day, $100,000 loan with Second...

Related questions

Question

financial accounting

please give me the answer of this question thnaks

Transcribed Image Text:L1 EXERCISE 4.5

The geological consulting firm of Gilbert, Marsh, & Kester prepares adjusting entries on a monthly

basis. Among the items requiring adjustment on December 31, 2009, are the following:

The company has outstanding a $50,000, 9 percent, two-year note payable issued on July 1,

2008. Payment of the $50,000 note, plus all accrued interest for the two-ycar loan period, is

due in full on Junc 30, 2010,

Preparing Adjusting

Breep Entries to Accrue

Revenue and

Expenses for Which

No Cash Has Been

Received

2. The firm is providing consulting services to Texas Oil Company at an agreed-upon rate

of $1,000 per day.. At December 31, 10 days of unbilled consulting services have been

provided.

Prepare the two adjusting entries required on December 31 to record the accrued interest

expense and the accrued consulting revenue earned.

Assume that the $50,000 note payable plus all accrued interest are paid in full on June 30,

2010. What portion of the total interest expense associated with this note will be reported in

the firm's 2010 income statement?

Assume that on January 30, 2010, Gilbert, Marsh, & Kester receive $25,000 from Textet

Company in full payment of the consulting services provided in December and January. what

portion of this amount constitutes revenue earned in January?

b.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning