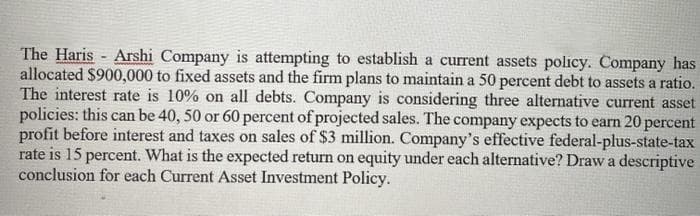

The Haris Arshi Company is attempting to establish a current assets policy. Company has allocated $900,000 to fixed assets and the firm plans to maintain a 50 percent debt to assets a ratio. The interest rate is 10% on all debts. Company is considering three alternative current asset policies: this can be 40, 50 or 60 percent of projected sales. The company expects to earn 20 p profit before interest and taxes on sales of $3 million. Company's effective federal-plus-state-tax rate is 15 percent. What is the expected return on equity under each alternative? Draw a descriptive conclusion for each Current Asset Investment Policy. 0 percent

The Haris Arshi Company is attempting to establish a current assets policy. Company has allocated $900,000 to fixed assets and the firm plans to maintain a 50 percent debt to assets a ratio. The interest rate is 10% on all debts. Company is considering three alternative current asset policies: this can be 40, 50 or 60 percent of projected sales. The company expects to earn 20 p profit before interest and taxes on sales of $3 million. Company's effective federal-plus-state-tax rate is 15 percent. What is the expected return on equity under each alternative? Draw a descriptive conclusion for each Current Asset Investment Policy. 0 percent

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 13P: Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth...

Related questions

Question

Transcribed Image Text:The Haris - Arshi Company is attempting to establish a current assets polıcy. Company has

allocated $900,000 to fixed assets and the firm plans to maintain a 50 percent debt to assets a ratio.

The interest rate is 10% on all debts. Company is considering three alternative current asset

policies: this can be 40, 50 or 60 percent of projected sales. The company expects to earn 20 percent

profit before interest and taxes on sales of $3 million. Company's effective federal-plus-state-tax

rate is 15 percent. What is the expected return on equity under each alternative? Drawa descriptive

conclusion for each Current ASset Investment Policy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning