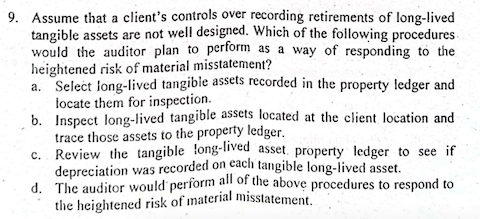

the heightened risk of material misstatement. d. The auditor would perform all of the above procedures to respond to 9. Assume that a client's controls over recording retirements of long-lived tangible assets are not well designed. Which of the following procedures would the auditor plan to perform as a way of responding to the heightened risk of material misstatement? a. Select long-lived tangible assets recorded in the property ledger and locate them for inspection. b. Inspect long-lived tangible assets located at the client location and trace those assets to the property ledger. c. Review the tangible long-lived asset. property ledger to see if depreciation was recorded on cach tangible long-lived asset.

the heightened risk of material misstatement. d. The auditor would perform all of the above procedures to respond to 9. Assume that a client's controls over recording retirements of long-lived tangible assets are not well designed. Which of the following procedures would the auditor plan to perform as a way of responding to the heightened risk of material misstatement? a. Select long-lived tangible assets recorded in the property ledger and locate them for inspection. b. Inspect long-lived tangible assets located at the client location and trace those assets to the property ledger. c. Review the tangible long-lived asset. property ledger to see if depreciation was recorded on cach tangible long-lived asset.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 24CYBK

Related questions

Question

Transcribed Image Text:9. Assume that a client's controls over recording retirements of long-lived

tangible assets are not well designed. Which of the following procedures-

would the auditor plan to perform as a way of responding to the

heightened risk of material misstatement?

a. Select long-lived tangibie assets recorded in the property ledger and

locate them for inspection.

b. Inspect long-lived tangible assets located at the client location and

trace those assets to the property ledger.

c. Review the tangible long-lived asset, property ledger to see if

depreciation was recorded on cach tangible long-lived asset.

d. The auditor would perform all of the above procedures to respond to

the heightened risk of material misstatement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub