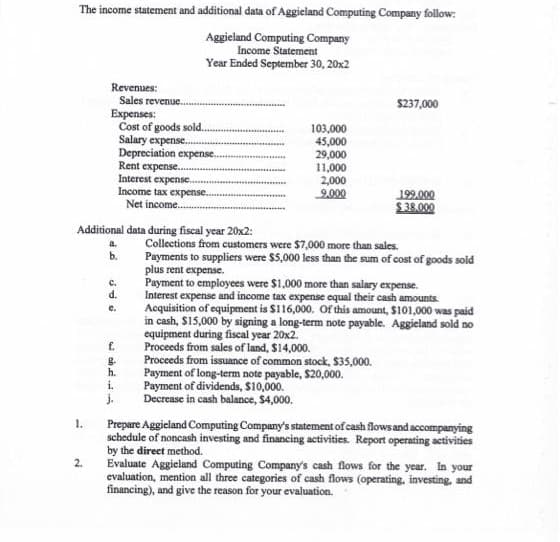

The income statement and additional data of Aggieland Computing Company follow: Aggieland Computing Company Income Statement Year Ended September 30, 20x2 Revenues: Sales revenue... Expenses: Cost of goods sold.. Salary expense... Depreciation expense.. 2. Additional data during fiscal year 20x2: C. d. c. f. & h. Rent expense.... Interest expense Income tax expense.... Net income... i. j. 103,000 45,000 29,000 11,000 2,000 9.000 $237,000 Proceeds from sales of land, $14,000. Proceeds from issuance of common stock, $35,000. Payment of long-term note payable, $20,000. Payment of dividends, $10,000. Decrease in cash balance, $4,000. 199.000 $38.000 Collections from customers were $7,000 more than sales. Payments to suppliers were $5,000 less than the sum of cost of goods sold plus rent expense. Payment to employees were $1,000 more than salary expense. Interest expense and income tax expense equal their cash amounts. Acquisition of equipment is $116,000. Of this amount, $101,000 was paid in cash, $15,000 by signing a long-term note payable. Aggieland sold no equipment during fiscal year 20x2. Prepare Aggieland Computing Company's statement of cash flows and accompanying schedule of noncash investing and financing activities. Report operating activities by the direct method. Evaluate Aggieland Computing Company's cash flows for the year. In your evaluation, mention all three categories of cash flows (operating, investing, and financing), and give the reason for your evaluation.

The income statement and additional data of Aggieland Computing Company follow: Aggieland Computing Company Income Statement Year Ended September 30, 20x2 Revenues: Sales revenue... Expenses: Cost of goods sold.. Salary expense... Depreciation expense.. 2. Additional data during fiscal year 20x2: C. d. c. f. & h. Rent expense.... Interest expense Income tax expense.... Net income... i. j. 103,000 45,000 29,000 11,000 2,000 9.000 $237,000 Proceeds from sales of land, $14,000. Proceeds from issuance of common stock, $35,000. Payment of long-term note payable, $20,000. Payment of dividends, $10,000. Decrease in cash balance, $4,000. 199.000 $38.000 Collections from customers were $7,000 more than sales. Payments to suppliers were $5,000 less than the sum of cost of goods sold plus rent expense. Payment to employees were $1,000 more than salary expense. Interest expense and income tax expense equal their cash amounts. Acquisition of equipment is $116,000. Of this amount, $101,000 was paid in cash, $15,000 by signing a long-term note payable. Aggieland sold no equipment during fiscal year 20x2. Prepare Aggieland Computing Company's statement of cash flows and accompanying schedule of noncash investing and financing activities. Report operating activities by the direct method. Evaluate Aggieland Computing Company's cash flows for the year. In your evaluation, mention all three categories of cash flows (operating, investing, and financing), and give the reason for your evaluation.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 2AP

Related questions

Question

someone help me with excel plz also show me how can i use the execl

Transcribed Image Text:The income statement and additional data of Aggieland Computing Company follow:

Aggieland Computing Company

Income Statement

Year Ended September 30, 20x2

1.

Revenues:

Sales revenue.

Expenses:

Cost of goods sold...

Salary expense...

Depreciation expense..

Additional data during fiscal year 20x2:

2.

Rent expense...

Interest expense....

Income tax expense...

Net income.....

a.

b.

C.

d.

C.

f.

g

h.

i.

j.

103,000

45,000

29,000

11,000

2,000

9.000

$237,000

199.000

$38.000

Collections from customers were $7,000 more than sales.

Payments to suppliers were $5,000 less than the sum of cost of goods sold

plus rent expense.

Proceeds from sales of land, $14,000.

Proceeds from issuance of common stock, $35,000.

Payment of long-term note payable, $20,000.

Payment of dividends, $10,000.

Decrease in cash balance, $4,000.

Payment to employees were $1,000 more than salary expense.

Interest expense and income tax expense equal their cash amounts.

Acquisition of equipment is $116,000. Of this amount, $101,000 was paid

in cash, $15,000 by signing a long-term note payable. Aggieland sold no

equipment during fiscal year 20x2.

Prepare Aggieland Computing Company's statement of cash flows and accompanying

schedule of noncash investing and financing activities. Report operating activities

by the direct method.

Evaluate Aggieland Computing Company's cash flows for the year. In your

evaluation, mention all three categories of cash flows (operating, investing, and

financing), and give the reason for your evaluation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning