The income statement, balance sheets, and additional information for Cloud Mangu are provided. CLOUD HANGU Income Statement For the Year Ended December 31, 2024 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land $ 1,900,000 848,000 26,000 7,900 14,500 47,000 CLOUD MANGU Balance Sheets December 31 $ 2,986,000 2,043,400 $ 142,600 2024 2023 $ 190,340 $ 136,220 79,900 59,000 105,000 134,000 10,560 5,280 104,000 209,000 238,000

The income statement, balance sheets, and additional information for Cloud Mangu are provided. CLOUD HANGU Income Statement For the Year Ended December 31, 2024 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land $ 1,900,000 848,000 26,000 7,900 14,500 47,000 CLOUD MANGU Balance Sheets December 31 $ 2,986,000 2,043,400 $ 142,600 2024 2023 $ 190,340 $ 136,220 79,900 59,000 105,000 134,000 10,560 5,280 104,000 209,000 238,000

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 3E

Related questions

Question

Please do not give solution in image format ?.

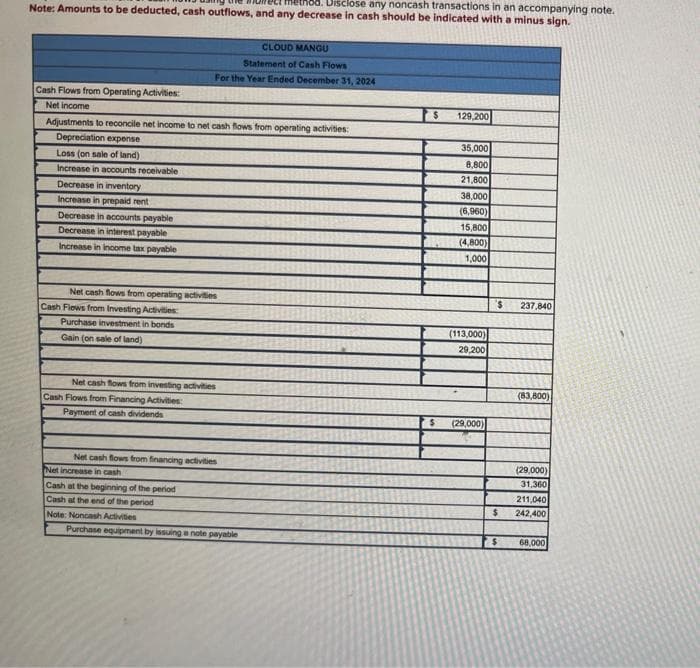

Transcribed Image Text:Note: Amounts to be deducted, cash outflows, and any decrease in cash should be indicated with a minus sign.

Disclose any noncash transactions in an accompanying note.

Cash Flows from Operating Activities:

Net income

Adjustments to reconcile net income to net cash flows from operating activities:

Depreciation expense

Loss (on sale of land)

Increase in accounts receivable

Decrease in inventory

Increase in prepaid rent

Decrease in accounts payable

Decrease in interest payable

Increase in income tax payable

Net cash flows from operating activities

Cash Flows from Investing Activities:

Purchase investment in bonds

Gain (on sale of land)

CLOUD MANGU

Statement of Cash Flows

For the Year Ended December 31, 2024

Net cash flows from investing activities

Cash Flows from Financing Activities:

Payment of cash dividends

Net cash flows from financing activities

Net increase in cash

Cash at the beginning of the period

Cash at the end of the period

Note: Noncash Activities

Purchase equipment by issuing a note payable

$

129,200

35,000

8,800

21,800

38,000

(6,960)

15,800

(4,800)

1,000

(113,000)

29,200

(29,000)

'S 237,840

$

HET

$

(83,800)

(29,000)

31,360

211,040

242,400

68,000

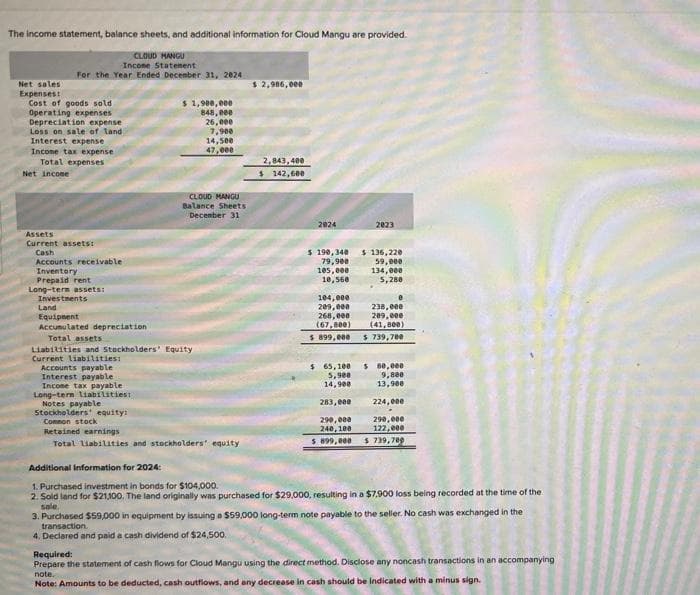

Transcribed Image Text:The income statement, balance sheets, and additional information for Cloud Mangu are provided.

CLOUD MANGU

Income Statement

For the Year Ended December 31, 2024

Net sales

Expenses:

Cost of goods sold

Operating expenses

Depreciation expense

Loss on sale of land

Interest expense

Income tax expense

Total expenses

Net income

Assets

Current assets:

Cash

Accounts receivable

Inventory

Prepaid rent

Long-term assets:

Investments

Accounts payable

Interest payable

Income tax payable.

$ 1,900,000

848,000

26,000

7,900

14,500

47,000

Land

Equipment

Accumulated depreciation

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Long-term Liabilities:

Notes payable.

Stockholders' equity:

Common stock

CLOUD MANGU

Balance Sheets

December 31

Retained earnings

Total liabilities and stockholders' equity

$ 2,986,000

2,843,400

$ 142,600

2024

$ 190,340 $ 136,220

79,900

105,000

10,560

104,000

209,000

268,000

(67,800)

$ 899,000

2023

$ 65,100

5,900

14,900

59,000

134,000

5,280

238,000

209,000

(41,800)

$ 739,700

$ 80,000

9,800

13,900

224,000

290,000

122,000

283,000

290,000

240,100

$ 899,000 $ 739,709

Additional Information for 2024:

1. Purchased investment in bonds for $104,000.

2. Sold land for $21,100. The land originally was purchased for $29,000, resulting in a $7,900 loss being recorded at the time of the

sale,

3. Purchased $59,000 in equipment by issuing a $59,000 long-term note payable to the seller. No cash was exchanged in the

transaction.

4. Declared and paid a cash dividend of $24,500.

Required:

Prepare the statement of cash flows for Cloud Mangu using the direct method. Disclose any noncash transactions in an accompanying

note.

Note: Amounts to be deducted, cash outflows, and any decrease in cash should be indicated with a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning