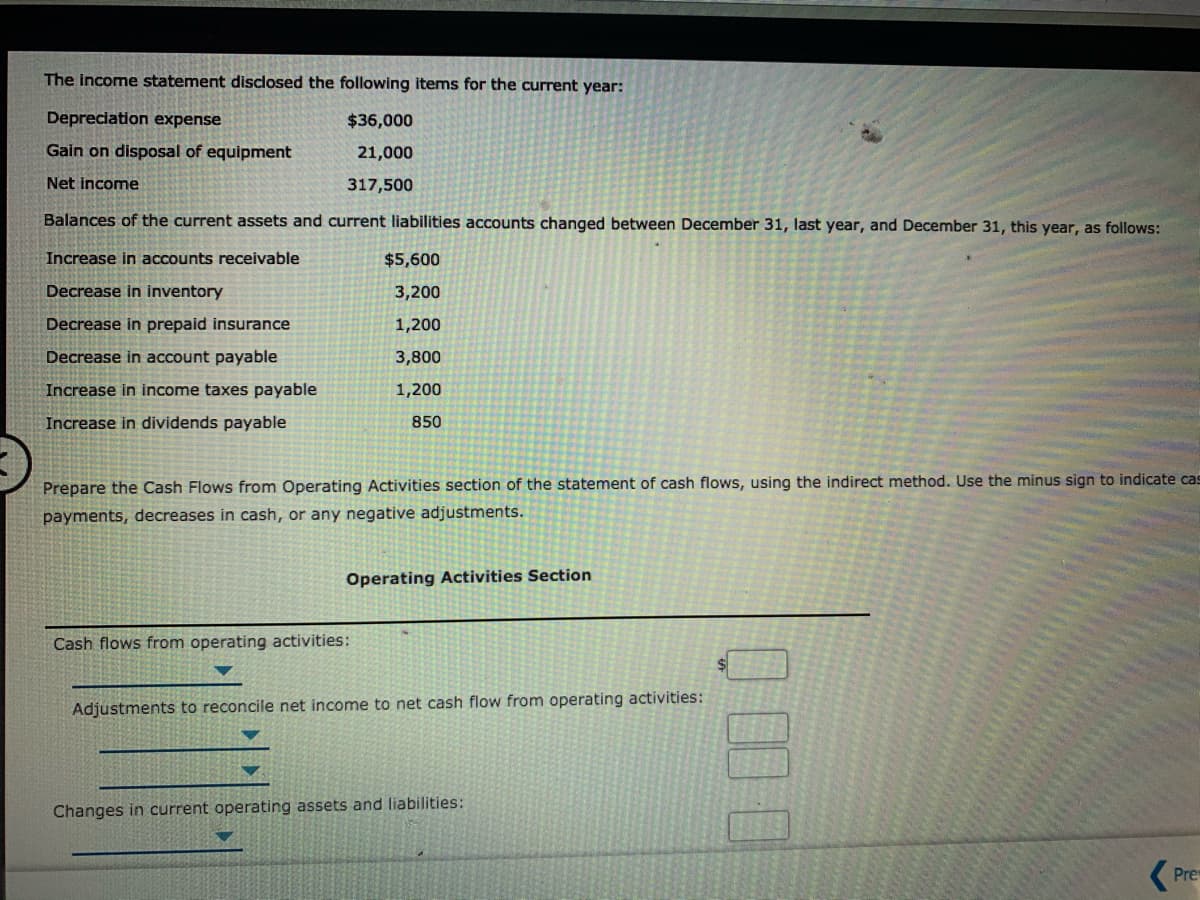

The Income statement disclosed the following items for the current year: Depreciation expense $36,000 Gain on disposal of equipment 21,000 Net income 317,500 Balances of the current assets and current liabilities accounts changed between December 31, last year, and December 31, this year, as follows: Increase in accounts receivable $5,600 Decrease in inventory 3,200 Decrease in prepaid insurance 1,200 Decrease in account payable 3,800 Increase in income taxes payable 1,200 Increase in dividends payable 850 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cas payments, decreases in cash, or any negative adjustments. Operating Activities Section Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities:

The Income statement disclosed the following items for the current year: Depreciation expense $36,000 Gain on disposal of equipment 21,000 Net income 317,500 Balances of the current assets and current liabilities accounts changed between December 31, last year, and December 31, this year, as follows: Increase in accounts receivable $5,600 Decrease in inventory 3,200 Decrease in prepaid insurance 1,200 Decrease in account payable 3,800 Increase in income taxes payable 1,200 Increase in dividends payable 850 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cas payments, decreases in cash, or any negative adjustments. Operating Activities Section Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities:

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 45E: Partial Statement of Cash Flows Service Company had net income during the current year of $65,800....

Related questions

Question

Transcribed Image Text:The income statement disclosed the following items for the current year:

Depreciation expense

$36,000

Gain on disposal of equipment

21,000

Net income

317,500

Balances of the current assets and current liabilities accounts changed between December 31, last year, and December 31, this year, as follows:

Increase in accounts receivable

$5,600

Decrease in inventory

3,200

Decrease in prepaid insurance

1,200

Decrease in account payable

3,800

Increase in income taxes payable

1,200

Increase in dividends payable

850

Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cas

payments, decreases in cash, or any negative adjustments.

Operating Activities Section

Cash flows from operating activities:

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Pre

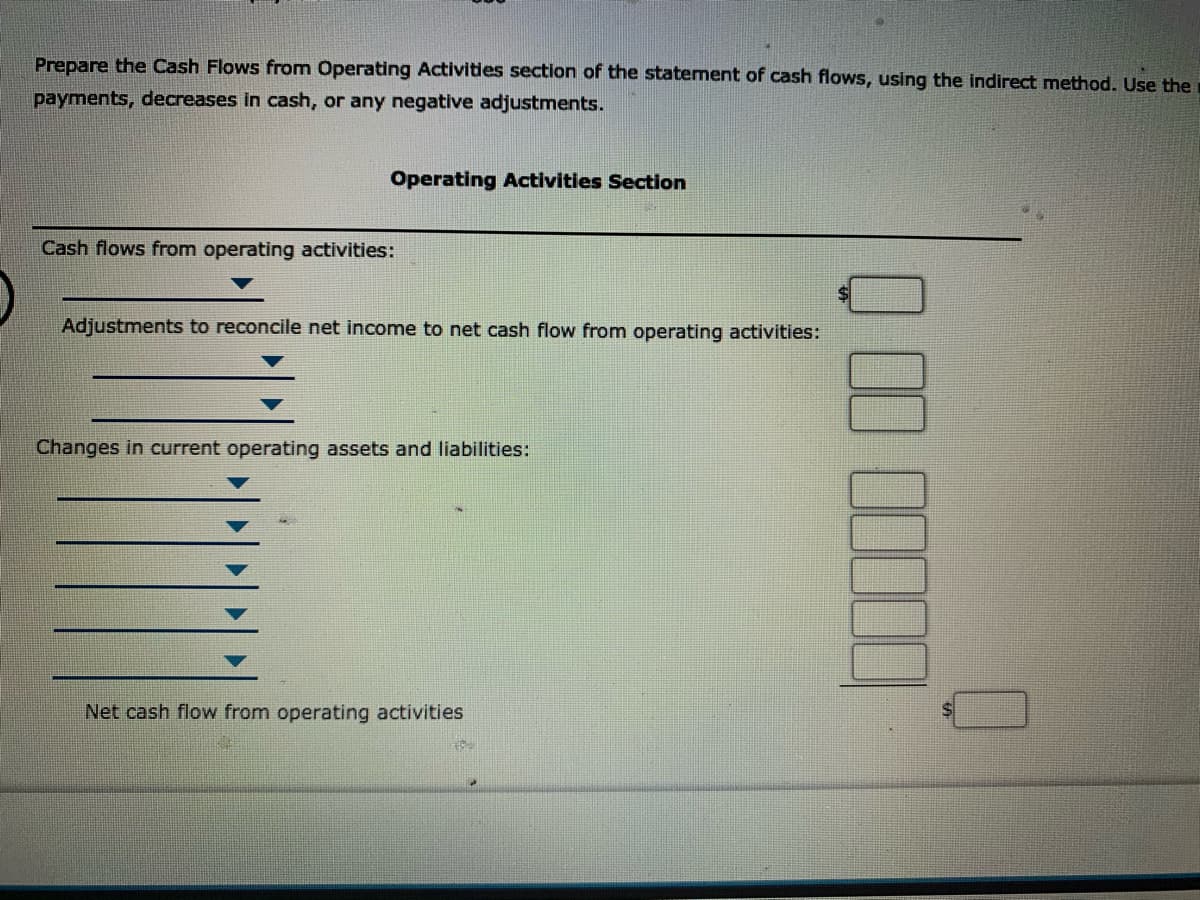

Transcribed Image Text:Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the

payments, decreases in cash, or any negative adjustments.

Operating Activities Section

Cash flows from operating activities:

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activities

Expert Solution

Step 1

Cash flows from operating activities: It is a section of Statement of cash flow that explains the sources and uses of cash from business activities.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning