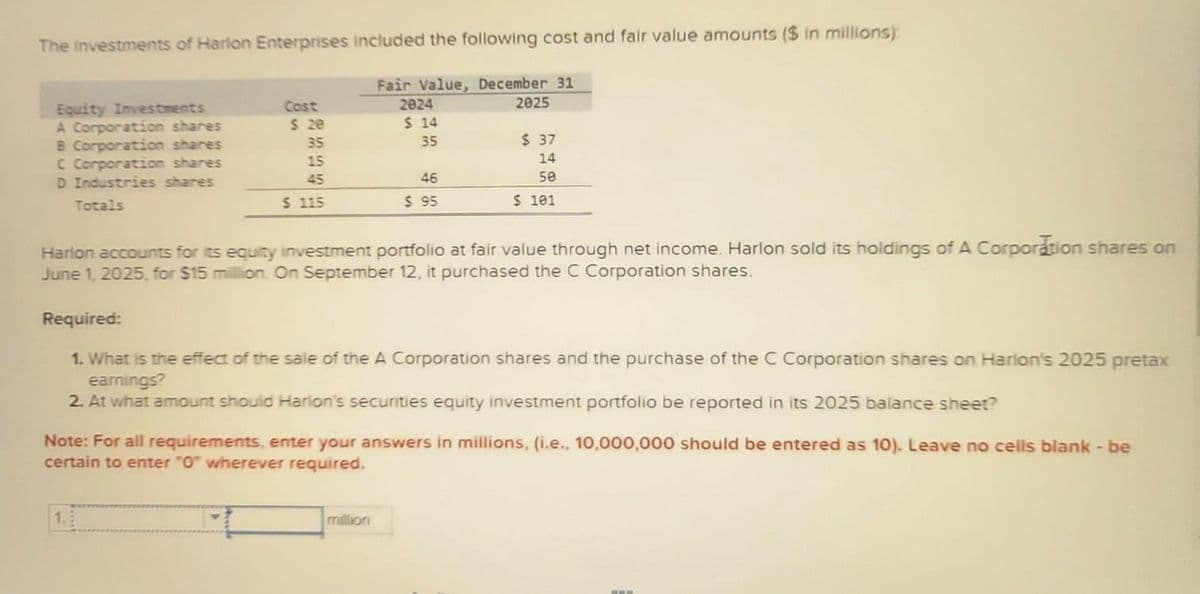

The investments of Harlon Enterprises included the following cost and fair value amounts ($ in millions) Fair Value, December 31 2024 2025 $ 14 35 Equity Investments A Corporation shares 8 Corporation shares C Corporation shares D Industries shares Totals Cost $ 20 35 15 45 $ 115 46 $ 95 $ 37 14 50 $ 101

The investments of Harlon Enterprises included the following cost and fair value amounts ($ in millions) Fair Value, December 31 2024 2025 $ 14 35 Equity Investments A Corporation shares 8 Corporation shares C Corporation shares D Industries shares Totals Cost $ 20 35 15 45 $ 115 46 $ 95 $ 37 14 50 $ 101

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15E

Related questions

Question

5

Transcribed Image Text:The investments of Harlon Enterprises included the following cost and fair value amounts ($ in millions)

Equity Investments

A Corporation shares

B Corporation shares

C Corporation shares

D Industries shares

Totals

Cost

$ 20

35

15

45

$ 115

Fair Value, December 31

2024

2025

$ 14

35

46

$ 95

million

$ 37

14

50

$ 101

Harlon accounts for its equity investment portfolio at fair value through net income. Harlon sold its holdings of A Corporation shares on

June 1, 2025, for $15 million. On September 12, it purchased the C Corporation shares.

Required:

1. What is the effect of the sale of the A Corporation shares and the purchase of the C Corporation shares on Harlon's 2025 pretax

earnings?

2. At what amount should Harlon's securities equity investment portfolio be reported in its 2025 balance sheet?

Note: For all requirements, enter your answers in millions, (i.e., 10,000,000 should be entered as 10). Leave no cells blank - be

certain to enter "0" wherever required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT