The issued share capital of a company consists of 1,680,000 ordinary shares of £1 each. Half way through its financial year the company made a rights issue of 2 for 4 at an exercise price of £1.66 a share. The market value of the company's shares was £2.19 a share just before the rights issue.. The company reported a net profit after taxation for the year of £672,000. The market value of each ordinary share at the end of the year was £2.82. Calculate the theoretical ex-rights value per share in £ to two decimal places.

The issued share capital of a company consists of 1,680,000 ordinary shares of £1 each. Half way through its financial year the company made a rights issue of 2 for 4 at an exercise price of £1.66 a share. The market value of the company's shares was £2.19 a share just before the rights issue.. The company reported a net profit after taxation for the year of £672,000. The market value of each ordinary share at the end of the year was £2.82. Calculate the theoretical ex-rights value per share in £ to two decimal places.

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 19EA: Jupiter Corporation earned net income of $90,000 this year. The company began the year with 600...

Related questions

Question

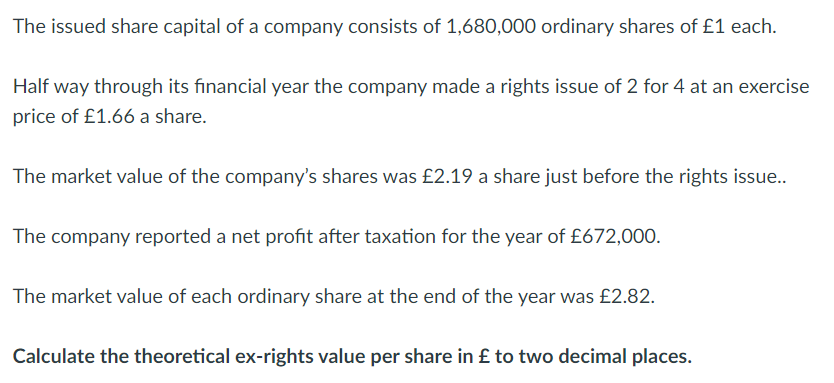

Transcribed Image Text:The issued share capital of a company consists of 1,680,000 ordinary shares of £1 each.

Half way through its financial year the company made a rights issue of 2 for 4 at an exercise

price of £1.66 a share.

The market value of the company's shares was £2.19 a share just before the rights issue..

The company reported a net profit after taxation for the year of £672,000.

The market value of each ordinary share at the end of the year was £2.82.

Calculate the theoretical ex-rights value per share in £ to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning