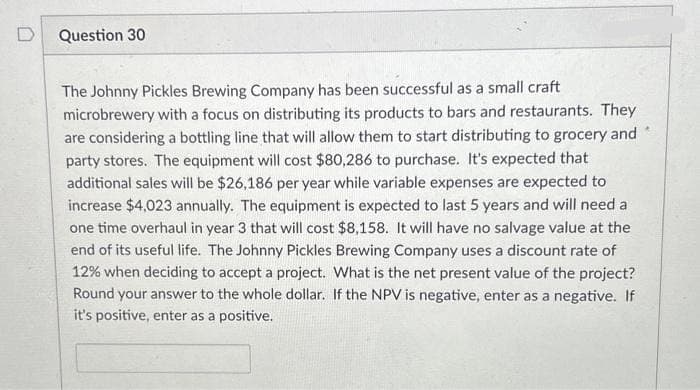

The Johnny Pickles Brewing Company has been successful as a small craft microbrewery with a focus on distributing its products to bars and restaurants. They are considering a bottling line that will allow them to start distributing to grocery and party stores. The equipment will cost $80,286 to purchase. It's expected that additional sales will be $26,186 per year while variable expenses are expected to increase $4,023 annually. The equipment is expected to last 5 years and will need a one time overhaul in year 3 that will cost $8,158. It will have no salvage value at the end of its useful life. The Johnny Pickles Brewing Company uses a discount rate of 12% when deciding to accept a project. What is the net present value of the project? Round your answer to the whole dollar. If the NPV is negative, enter as a negative. If it's positive, enter as a positive.

The Johnny Pickles Brewing Company has been successful as a small craft microbrewery with a focus on distributing its products to bars and restaurants. They are considering a bottling line that will allow them to start distributing to grocery and party stores. The equipment will cost $80,286 to purchase. It's expected that additional sales will be $26,186 per year while variable expenses are expected to increase $4,023 annually. The equipment is expected to last 5 years and will need a one time overhaul in year 3 that will cost $8,158. It will have no salvage value at the end of its useful life. The Johnny Pickles Brewing Company uses a discount rate of 12% when deciding to accept a project. What is the net present value of the project? Round your answer to the whole dollar. If the NPV is negative, enter as a negative. If it's positive, enter as a positive.

Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Question

Godo

Transcribed Image Text:D

Question 30

The Johnny Pickles Brewing Company has been successful as a small craft

microbrewery with a focus on distributing its products to bars and restaurants. They

are considering a bottling line that will allow them to start distributing to grocery and

party stores. The equipment will cost $80,286 to purchase. It's expected that

additional sales will be $26,186 per year while variable expenses are expected to

increase $4,023 annually. The equipment is expected to last 5 years and will need a

one time overhaul in year 3 that will cost $8,158. It will have no salvage value at the

end of its useful life. The Johnny Pickles Brewing Company uses a discount rate of

12% when deciding to accept a project. What is the net present value of the project?

Round your answer to the whole dollar. If the NPV is negative, enter as a negative. If

it's positive, enter as a positive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you