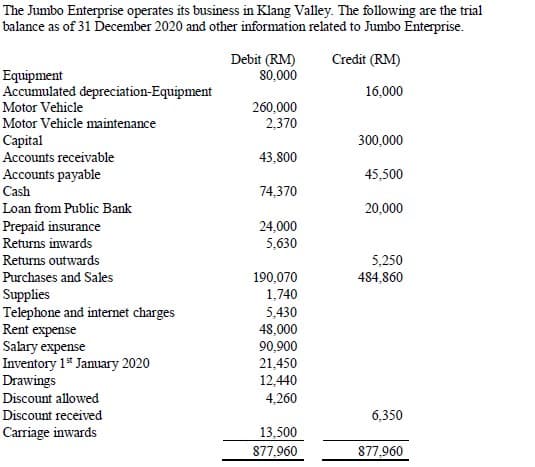

The Jumbo Enterprise operates its business in Klang Valley. The following are the trial balance as of 31 December 2020 and other information related to Jumbo Enterprise. Debit (RM) 80,000 Credit (RM) Equipment Accumulated depreciation-Equipment 16,000 Motor Vehicle 260,000 Motor Vehicle maintenance 2,370 Capital 300,000 Accounts receivable 43,800 Accounts payable 45,500 Cash 74,370 Loan from Public Bank 20,000 40 00

The Jumbo Enterprise operates its business in Klang Valley. The following are the trial balance as of 31 December 2020 and other information related to Jumbo Enterprise. Debit (RM) 80,000 Credit (RM) Equipment Accumulated depreciation-Equipment 16,000 Motor Vehicle 260,000 Motor Vehicle maintenance 2,370 Capital 300,000 Accounts receivable 43,800 Accounts payable 45,500 Cash 74,370 Loan from Public Bank 20,000 40 00

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 6MCQ: Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense...

Related questions

Question

100%

I need solution to (a)

Transcribed Image Text:The Jumbo Enterprise operates its business in Klang Valley. The following are the trial

balance as of 31 December 2020 and other information related to Jumbo Enterprise.

Debit (RM)

80,000

Credit (RM)

Equipment

Accumulated depreciation-Equipment

Motor Vehicle

16,000

260,000

2,370

Motor Vehicle maintenance

Саpital

Accounts receivable

300,000

43,800

Accounts payable

Cash

45,500

74,370

Loan from Public Bank

20,000

Prepaid insurance

Returns inwards

24,000

5,630

Returns outwards

5,250

484,860

Purchases and Sales

Supplies

Telephone and intermet charges

Rent expense

Salary expense

Inventory 1* January 2020

Drawings

190,070

1,740

5,430

48,000

90,900

21,450

12,440

4,260

Discount allowed

Discount received

6,350

Carriage inwards

13.500

877,960

877,960

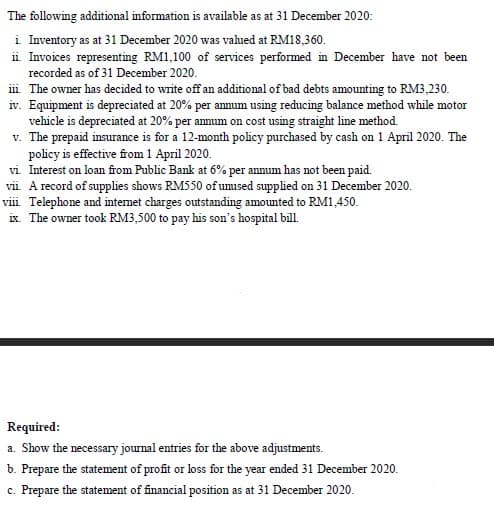

Transcribed Image Text:The following additional information is available as at 31 December 2020:

i Inventory as at 31 December 2020 was valued at RM18,360.

ii. Invoices representing RM1,100 of services performed in December have not been

recorded as of 31 December 2020.

i. The owner has decided to write off an additional of bad debts amounting to RM3,230.

iv. Equipment is depreciated at 20% per annum using reducing balance method while motor

vehicle is depreciated at 20% per annum on cost using straight line method.

v. The prepaid insurance is for a 12-month policy purchased by cash on 1 April 2020. The

policy is effective from 1 April 2020.

vi Interest on loan from Public Bank at 6% per annum has not been paid.

vii A record of supplies shows RM550 of umused supplied on 31 December 2020.

viii. Telephone and intemet charges outstanding amounted to RM1,450.

ix. The owner took RM3,500 to pay his son's hospital bill.

Required:

a. Show the necessary jounal entries for the above adjustments.

b. Prepare the statement of profit or loss for the year ended 31 December 2020.

c. Prepare the statement of financial position as at 31 December 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning