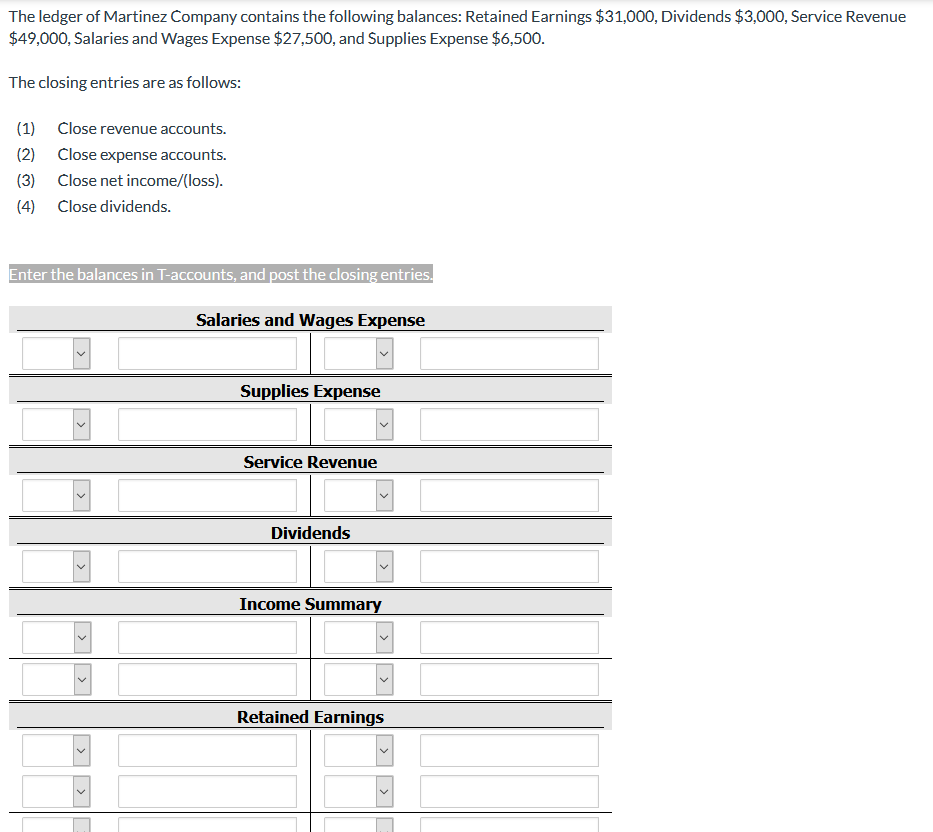

The ledger of Martinez Company contains the following balances: Retained Earnings $31,00O, Dividends $3,000, Service Revenue $49,000, Salaries and Wages Expense $27,500, and Supplies Expense $6,500. The closing entries are as follows: (1) Close revenue accounts. (2) Close expense accounts. (3) Close net income/(loss). (4) Close dividends. Enter the balances in T-accounts, and post the closing entries. Salaries and Wages Expense Supplies Expense Service Revenue Dividends Income Summary Retained Earnings >

The ledger of Martinez Company contains the following balances: Retained Earnings $31,00O, Dividends $3,000, Service Revenue $49,000, Salaries and Wages Expense $27,500, and Supplies Expense $6,500. The closing entries are as follows: (1) Close revenue accounts. (2) Close expense accounts. (3) Close net income/(loss). (4) Close dividends. Enter the balances in T-accounts, and post the closing entries. Salaries and Wages Expense Supplies Expense Service Revenue Dividends Income Summary Retained Earnings >

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 4EA: Identify the financial statement on which each of the following accounts would appear: the income...

Related questions

Question

Transcribed Image Text:The ledger of Martinez Company contains the following balances: Retained Earnings $31,00O, Dividends $3,000, Service Revenue

$49,000, Salaries and Wages Expense $27,500, and Supplies Expense $6,500.

The closing entries are as follows:

(1)

Close revenue accounts.

(2)

Close expense accounts.

(3)

Close net income/(loss).

(4)

Close dividends.

Enter the balances in T-accounts, and post the closing entries.

Salaries and Wages Expense

Supplies Expense

Service Revenue

Dividends

Income Summary

Retained Earnings

>

Expert Solution

Step 1

Closing entries are used to transfer the balance from a temporary account to a permanent account. We can say that closing entries are used to reset the balance of the temporary account.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning