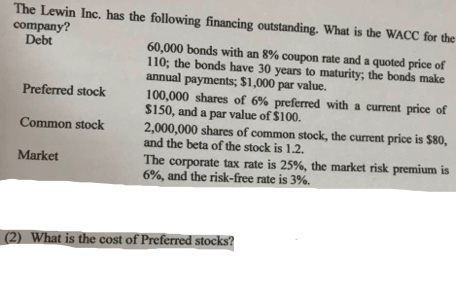

The Lewin Inc. has the following financing outstanding. What is the WACC for the company? Debt 60,000 bonds with an 8% coupon rate and a quoted price of 110; the bonds have 30 years to maturity; the bonds make annual payments; $1,000 par value. 100,000 shares of 6% preferred with a current price of $150, and a par value of $100. 2,000,000 shares of common stock, the current price is $80, and the beta of the stock is 1.2. The corporate tax rate is 25%, the market risk premium is 6%, and the risk-free rate is 3%. Preferred stock Common stock Market (2) What is the cost of Preferred stocks?

The Lewin Inc. has the following financing outstanding. What is the WACC for the company? Debt 60,000 bonds with an 8% coupon rate and a quoted price of 110; the bonds have 30 years to maturity; the bonds make annual payments; $1,000 par value. 100,000 shares of 6% preferred with a current price of $150, and a par value of $100. 2,000,000 shares of common stock, the current price is $80, and the beta of the stock is 1.2. The corporate tax rate is 25%, the market risk premium is 6%, and the risk-free rate is 3%. Preferred stock Common stock Market (2) What is the cost of Preferred stocks?

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:The Lewin Inc. has the following financing outstanding. What is the WACC for the

company?

Debt

60,000 bonds with an 8% coupon rate and a quoted price of

110; the bonds have 30 years to maturity; the bonds make

annual payments; $1,000 par value.

100,000 shares of 6% preferred with a current price of

$150, and a par value of $100.

2,000,000 shares of common stock, the current price is $80,

and the beta of the stock is 1.2.

The corporate tax rate is 25%, the market risk premium is

6%, and the risk-free rate is 3%.

Preferred stock

Common stock

Market

(2) What is the cost of Preferred stocks?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning