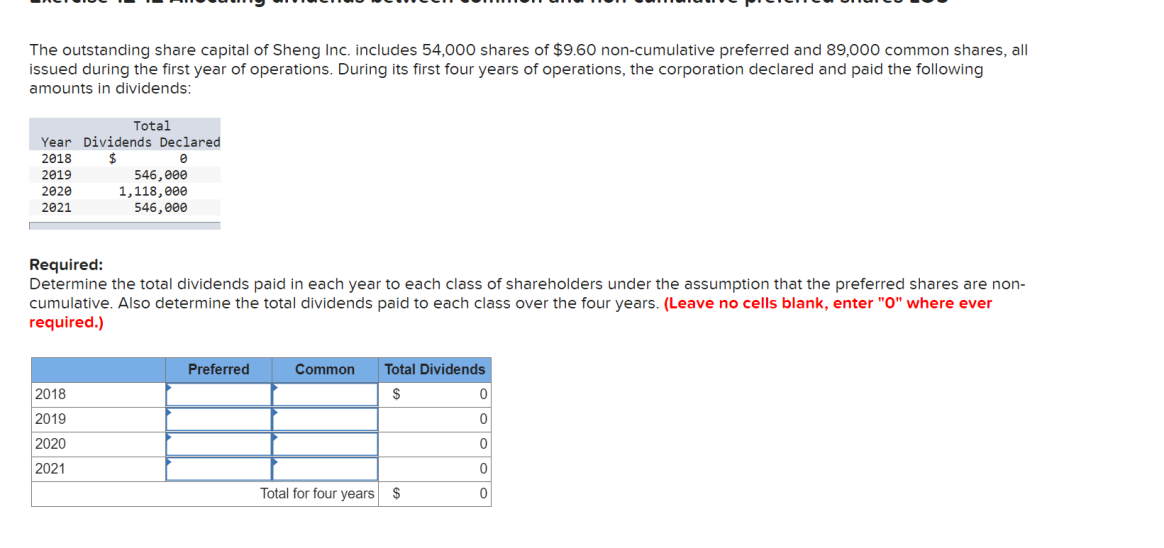

The outstanding share capital of Sheng Inc. includes 54,000 shares of $9.60 non-cumulative preferred and 89,000 common shares, all issued during the first year of operations. During its first four years of operations, the corporation declared and paid the following amounts in dividends: Total Year Dividends Declared 2018 2$ 546,000 1,118,000 546,000 2019 2020 2021 Required: Determine the total dividends paid in each year to each class of shareholders under the assumption that the preferred shares are non- cumulative. Also determine the total dividends paid to each class over the four years. (Leave no cells blank, enter "O" where ever required.) Preferred Common Total Dividends 2018 $ 2019 2020 2021 Total for four years $

The outstanding share capital of Sheng Inc. includes 54,000 shares of $9.60 non-cumulative preferred and 89,000 common shares, all issued during the first year of operations. During its first four years of operations, the corporation declared and paid the following amounts in dividends: Total Year Dividends Declared 2018 2$ 546,000 1,118,000 546,000 2019 2020 2021 Required: Determine the total dividends paid in each year to each class of shareholders under the assumption that the preferred shares are non- cumulative. Also determine the total dividends paid to each class over the four years. (Leave no cells blank, enter "O" where ever required.) Preferred Common Total Dividends 2018 $ 2019 2020 2021 Total for four years $

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

answer the following questions?

Transcribed Image Text:The outstanding share capital of Sheng Inc. includes 54,000 shares of $9.60 non-cumulative preferred and 89,000 common shares, all

issued during the first year of operations. During its first four years of operations, the corporation declared and paid the following

amounts in dividends:

Total

Year Dividends Declared

2018

$

2019

546,000

1,118,e00

546, 000

2020

2021

Required:

Determine the total dividends paid in each year to each class of shareholders under the assumption that the preferred shares are non-

cumulative. Also determine the total dividends paid to each class over the four years. (Leave no cells blank, enter "O" where ever

required.)

Preferred

Common

Total Dividends

2018

$

2019

2020

2021

Total for four years $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning