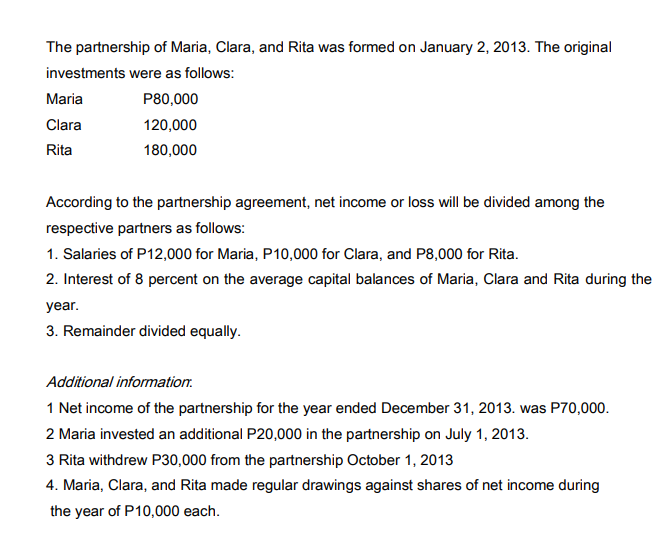

The partnership of Maria, Clara, and Rita was formed on January 2, 2013. The original investments were as follows: Maria P80,000 Clara 120,000 Rita 180,000 According to the partnership agreement, net income or loss will be divided among the respective partners as follows: 1. Salaries of P12,000 for Maria, P10,000 for Clara, and P8,000 for Rita. 2. Interest of 8 percent on the average capital balances of Maria, Clara and Rita during the year. 3. Remainder divided equally. Additional information. 1 Net income of the partnership for the year ended December 31, 2013. was P70,000. 2 Maria invested an additional P20,000 in the partnership on July 1, 2013. 3 Rita withdrew P30,000 from the partnership October 1, 2013 4. Maria, Clara, and Rita made regular drawings against shares of net income during the year of P10,000 each.

The partnership of Maria, Clara, and Rita was formed on January 2, 2013. The original investments were as follows: Maria P80,000 Clara 120,000 Rita 180,000 According to the partnership agreement, net income or loss will be divided among the respective partners as follows: 1. Salaries of P12,000 for Maria, P10,000 for Clara, and P8,000 for Rita. 2. Interest of 8 percent on the average capital balances of Maria, Clara and Rita during the year. 3. Remainder divided equally. Additional information. 1 Net income of the partnership for the year ended December 31, 2013. was P70,000. 2 Maria invested an additional P20,000 in the partnership on July 1, 2013. 3 Rita withdrew P30,000 from the partnership October 1, 2013 4. Maria, Clara, and Rita made regular drawings against shares of net income during the year of P10,000 each.

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Required:

a. Prepare schedule showing the division of net income among the partners.

b. Prepare a Statement of Changes in Partners' Equity on December 31, 2013

Transcribed Image Text:The partnership of Maria, Clara, and Rita was formed on January 2, 2013. The original

investments were as follows:

Maria

P80,000

Clara

120,000

Rita

180,000

According to the partnership agreement, net income or loss will be divided among the

respective partners as follows:

1. Salaries of P12,000 for Maria, P10,000 for Clara, and P8,000 for Rita.

2. Interest of 8 percent on the average capital balances of Maria, Clara and Rita during the

year.

3. Remainder divided equally.

Additional information.

1 Net income of the partnership for the year ended December 31, 2013. was P70,000.

2 Maria invested an additional P20,000 in the partnership on July 1, 2013.

3 Rita withdrew P30,000 from the partnership October 1, 2013

4. Maria, Clara, and Rita made regular drawings against shares of net income during

the year of P10,000 each.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning