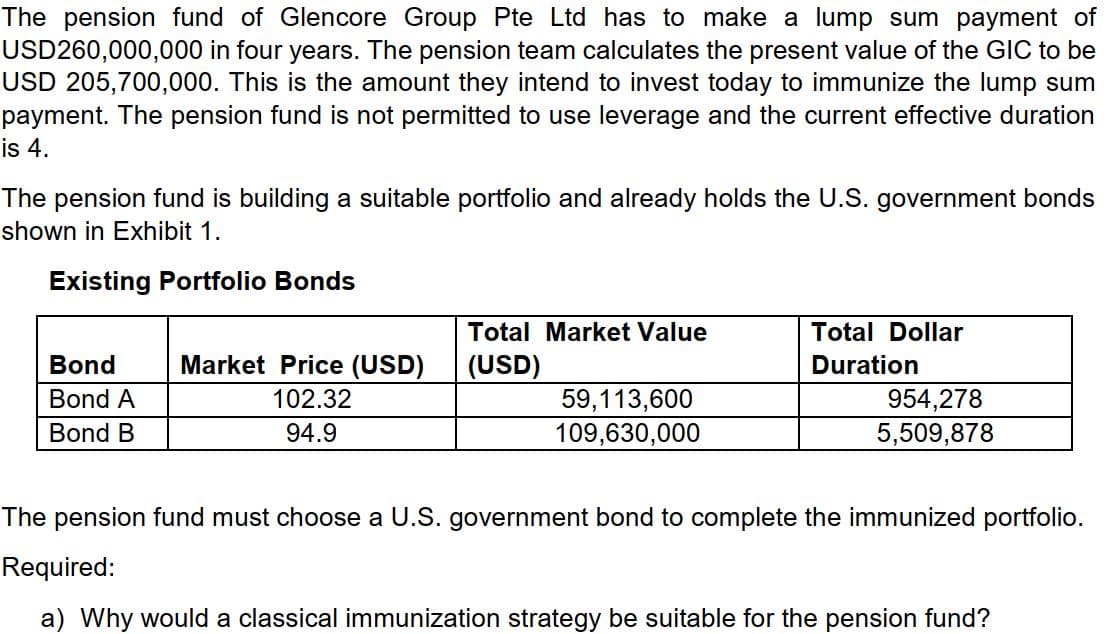

The pension fund of Glencore Group Pte Ltd has to make a lump sum payment of USD260,000,000 in four years. The pension team calculates the present value of the GIC to be USD 205,700,000. This is the amount they intend to invest today to immunize the lump sum payment. The pension fund is not permitted to use leverage and the current effective duration is 4. The pension fund is building a suitable portfolio and already holds the U.S. government bonds shown in Exhibit 1. Existing Portfolio Bonds Total Market Value Total Dollar Bond Market Price (USD) (USD) Duration Bond A 954,278 5,509,878 102.32 59,113,600 109,630,000 Bond B 94.9 The pension fund must choose a U.S. government bond to complete the immunized portfolio. Required: a) Why would a classical immunization strategy be suitable for the pension fund?

The pension fund of Glencore Group Pte Ltd has to make a lump sum payment of USD260,000,000 in four years. The pension team calculates the present value of the GIC to be USD 205,700,000. This is the amount they intend to invest today to immunize the lump sum payment. The pension fund is not permitted to use leverage and the current effective duration is 4. The pension fund is building a suitable portfolio and already holds the U.S. government bonds shown in Exhibit 1. Existing Portfolio Bonds Total Market Value Total Dollar Bond Market Price (USD) (USD) Duration Bond A 954,278 5,509,878 102.32 59,113,600 109,630,000 Bond B 94.9 The pension fund must choose a U.S. government bond to complete the immunized portfolio. Required: a) Why would a classical immunization strategy be suitable for the pension fund?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:The pension fund of Glencore Group Pte Ltd has to make a lump sum payment of

USD260,000,000 in four years. The pension team calculates the present value of the GIC to be

USD 205,700,000. This is the amount they intend to invest today to immunize the lump sum

payment. The pension fund is not permitted to use leverage and the current effective duration

is 4.

The pension fund is building a suitable portfolio and already holds the U.S. government bonds

shown in Exhibit 1.

Existing Portfolio Bonds

Total Market Value

Total Dollar

Bond

Market Price (USD)

(USD)

Duration

Bond A

102.32

59,113,600

109,630,000

954,278

Bond B

94.9

5,509,878

The pension fund must choose a U.S. government bond to complete the immunized portfolio.

Required:

a) Why would a classical immunization strategy be suitable for the pension fund?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning