The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Balance Sheets 2019 2018 Plant assets Equipment Accumulated depreciation-Equipment $ 180,000 (100, еее) $ 80,000 Equipment, net Buildings Accumulated depreciation-Buildings $ 270,000 (210, еее) $ 60,000 $ 400,000 (285,000) $ 115,000 $ 380, еее (100, еее) $ 280,000 Buildings, net

The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Balance Sheets 2019 2018 Plant assets Equipment Accumulated depreciation-Equipment $ 180,000 (100, еее) $ 80,000 Equipment, net Buildings Accumulated depreciation-Buildings $ 270,000 (210, еее) $ 60,000 $ 400,000 (285,000) $ 115,000 $ 380, еее (100, еее) $ 280,000 Buildings, net

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 6RE: Oz Corporation has the following assets at year-end: Patents (net), 26,000; Land, 50,000; Buildings,...

Related questions

Question

![Required information

[The following information applies to the questions displayed below.]

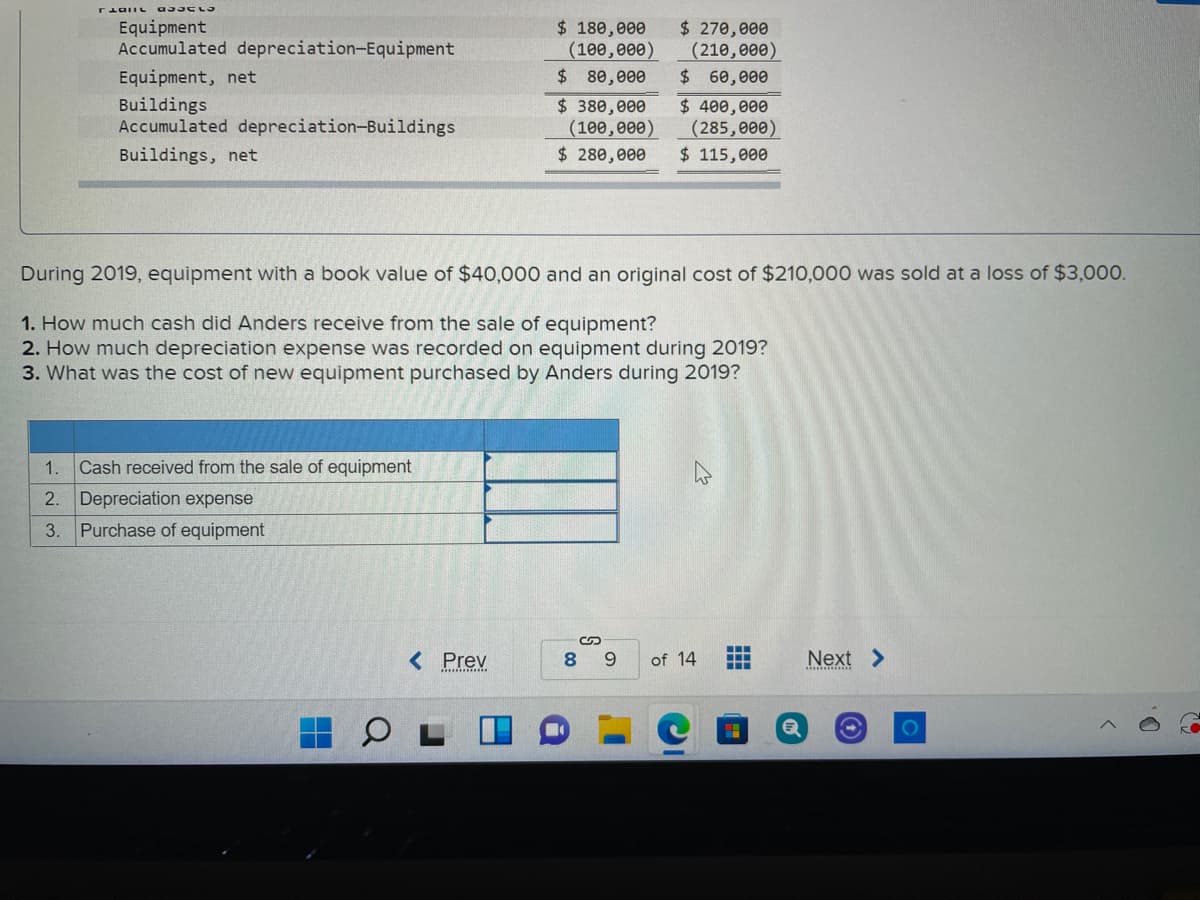

The plant assets section of the comparative balance sheets of Anders Company is reported below.

ANDERS COMPANY

Comparative Balance Sheets

2019

2018

Plant assets

Equipment

Accumulated depreciation-Equipment

$ 180,000

(100,000)

$ 270,000

(210,000)

$ 60,000

$ 400,000

(285,000)

Equipment, net

$ 80,000

Buildings

Accumulated depreciation-Buildings

$ 380, еее

(100,000)

$ 280,000

Buildings, net

$ 115,000

ing 2019, equipment with a book value of $40,000 and an originartost of $210,000 was sold at a loss of $3,000.

low much cash did Anders receive from the sale of equipment?

Low much denreciation

ano w rocorded a nouinnmant c ring 0102

< Prev

8.

9.

of 14

Next >

10](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F79311005-f463-43a3-afa9-05e613006775%2F0013ced3-b6b5-40a1-af2c-51555bbb564c%2F0oveqwk_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

The plant assets section of the comparative balance sheets of Anders Company is reported below.

ANDERS COMPANY

Comparative Balance Sheets

2019

2018

Plant assets

Equipment

Accumulated depreciation-Equipment

$ 180,000

(100,000)

$ 270,000

(210,000)

$ 60,000

$ 400,000

(285,000)

Equipment, net

$ 80,000

Buildings

Accumulated depreciation-Buildings

$ 380, еее

(100,000)

$ 280,000

Buildings, net

$ 115,000

ing 2019, equipment with a book value of $40,000 and an originartost of $210,000 was sold at a loss of $3,000.

low much cash did Anders receive from the sale of equipment?

Low much denreciation

ano w rocorded a nouinnmant c ring 0102

< Prev

8.

9.

of 14

Next >

10

Transcribed Image Text:畫墨

$ 180,000

(100, өөө)

$80,000

$ 270,000

(210, еее)

$ 60,000

$ 400,000

(285,000)

$ 115,000

Equipment

Accumulated depreciation-Equipment

Equipment, net

Buildings

Accumulated depreciation-Buildings

$ 380,000

(100, eее)

$ 280,000

Buildings, net

During 2019, equipment with a book value of $40,000 and an original cost of $210,000 was sold at a loss of $3,000.

1. How much cash did Anders receive from the sale of equipment?

2. How much depreciation expense was recorded on equipment during 2019?

3. What was the cost of new equipment purchased by Anders during 2019?

Cash received from the sale of equipment

2. Depreciation expense

1.

3. Purchase of equipment

< Prev

8.

6.

of 14

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning