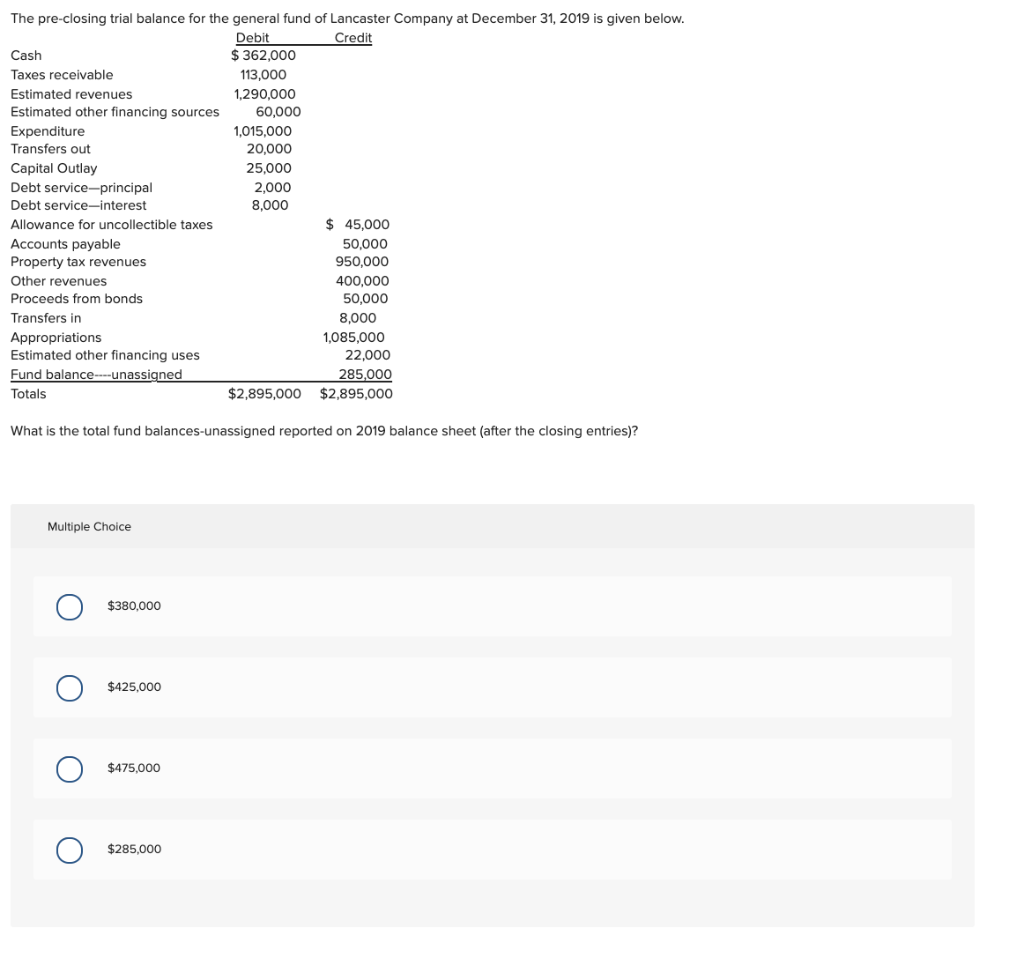

The pre-closing trial balance for the general fund of Lancaster Company at December 31, 2019 is given below. Credit Debit Cash Taxes receivable Estimated revenues Estimated other financing sources Expenditure Transfers out Capital Outlay Debt service-principal Debt service-interest Allowance for uncollectible taxes Accounts payable Property tax revenues Other revenues Proceeds from bonds Transfers in Appropriations Estimated other financing uses Fund balance----unassigned Totals Multiple Choice о O $380,000 $425,000 $475,000 $362,000 113,000 1,290,000 60,000 What is the total fund balances-unassigned reported on 2019 balance sheet (after the closing entries)? $285,000 1,015,000 20,000 25,000 2,000 8,000 $2,895,000 $ 45,000 50,000 950,000 400,000 50,000 8,000 1,085,000 22,000 285,000 $2,895,000

The pre-closing trial balance for the general fund of Lancaster Company at December 31, 2019 is given below. Credit Debit Cash Taxes receivable Estimated revenues Estimated other financing sources Expenditure Transfers out Capital Outlay Debt service-principal Debt service-interest Allowance for uncollectible taxes Accounts payable Property tax revenues Other revenues Proceeds from bonds Transfers in Appropriations Estimated other financing uses Fund balance----unassigned Totals Multiple Choice о O $380,000 $425,000 $475,000 $362,000 113,000 1,290,000 60,000 What is the total fund balances-unassigned reported on 2019 balance sheet (after the closing entries)? $285,000 1,015,000 20,000 25,000 2,000 8,000 $2,895,000 $ 45,000 50,000 950,000 400,000 50,000 8,000 1,085,000 22,000 285,000 $2,895,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 5RE

Related questions

Question

Transcribed Image Text:The pre-closing trial balance for the general fund of Lancaster Company at December 31, 2019 is given below.

Credit

Debit

$362,000

113,000

1,290,000

60,000

Cash

Taxes receivable

Estimated revenues

Estimated other financing sources

Expenditure

Transfers out

Capital Outlay

Debt service-principal

Debt service-interest

Allowance for uncollectible taxes

Accounts payable

Property tax revenues

Other revenues

Proceeds from bonds

Transfers in

Appropriations

Estimated other financing uses

Fund balance----unassigned

Totals

Multiple Choice

O

O

о

$380,000

What is the total fund balances-unassigned reported on 2019 balance sheet (after the closing entries)?

$425,000

$475,000

1,015,000

20,000

25,000

2,000

8,000

$285,000

$2,895,000

$ 45,000

50,000

950,000

400,000

50,000

8,000

1,085,000

22,000

285,000

$2,895,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT