The pre-tax income statements for Moonstone Ltd. for two years (summarized) wer 20X8 20X9 Revenues 266,000 $ 330,000 Expenses 181,000 237,000 Pre-tax income $ 85,000 $ 93,000 For tax purposes, the following income tax differences existed: evenues on the 20X9 statement of profit and loss include $37,000 rent, which is tax nearned at the end of 20X8 for accounting purposes. xpenses on the 20X9 statement of profit and loss include political contributions of S

The pre-tax income statements for Moonstone Ltd. for two years (summarized) wer 20X8 20X9 Revenues 266,000 $ 330,000 Expenses 181,000 237,000 Pre-tax income $ 85,000 $ 93,000 For tax purposes, the following income tax differences existed: evenues on the 20X9 statement of profit and loss include $37,000 rent, which is tax nearned at the end of 20X8 for accounting purposes. xpenses on the 20X9 statement of profit and loss include political contributions of S

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 12M

Related questions

Question

Transcribed Image Text:I need last two requirement i.e 4 and 5

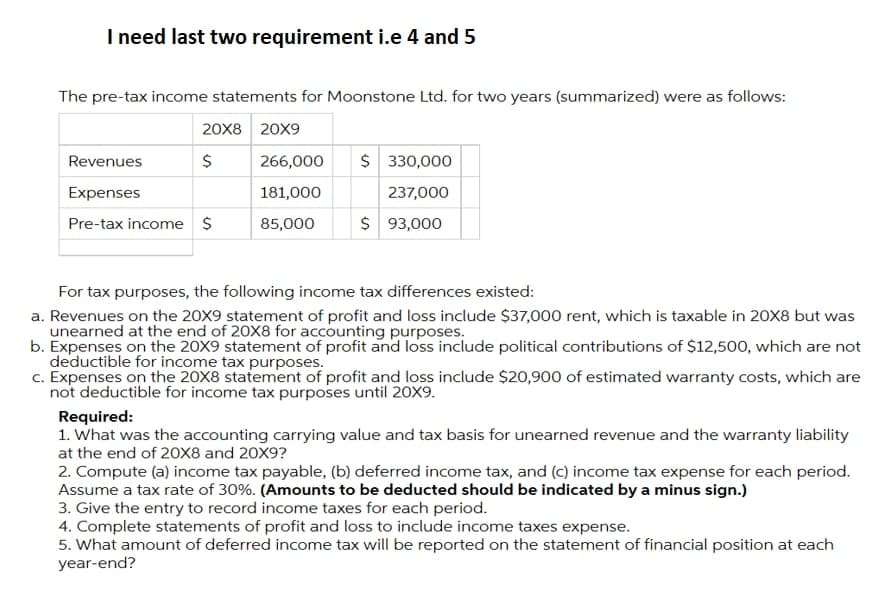

The pre-tax income statements for Moonstone Ltd. for two years (summarized) were as follows:

20X8 20X9

Revenues

$

266,000

$ 330,000

Expenses

181,000

237,000

Pre-tax income $

85,000

$ 93,000

For tax purposes, the following income tax differences existed:

a. Revenues on the 20X9 statement of profit and loss include $37,000 rent, which is taxable in 20X8 but was

unearned at the end of 20X8 for accounting purposes.

b. Expenses on the 20X9 statement of profit and loss include political contributions of $12,500, which are not

deductible for income tax purposes.

c. Expenses on the 20X8 statement of profit and loss include $20,900 of estimated warranty costs, which are

not deductible for income tax purposes until 20X9.

Required:

1. What was the accounting carrying value and tax basis for unearned revenue and the warranty liability

at the end of 20X8 and 20X9?

2. Compute (a) income tax payable, (b) deferred income tax, and (c) income tax expense for each period.

Assume a tax rate of 30%. (Amounts to be deducted should be indicated by a minus sign.)

3. Give the entry to record income taxes for each period.

4. Complete statements of profit and loss to include income taxes expense.

5. What amount of deferred income tax will be reported on the statement of financial position at each

year-end?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning