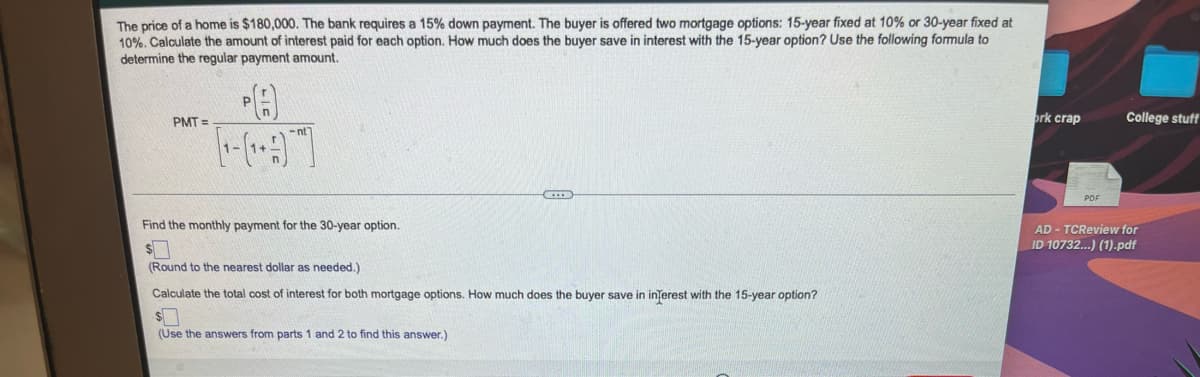

The price of a home is $180,000. The bank requires a 15% down payment. The buyer is offered two mortgage options: 15-year fixed at 10% or 30-year fixed at 10%. Calculate the amount of interest paid for each option. How much does the buyer save in interest with the 15-year option? Use the following formula to determine the regular payment amount. P. PMT = ... Find the monthly payment for the 30-year option. (Round to the nearest dollar as needed.) Calculate the total cost of interest for both mortgage options. How much does the buyer save in interest with the 15-year option? (Use the answers from parts 1 and 2 to find this answer.)

The price of a home is $180,000. The bank requires a 15% down payment. The buyer is offered two mortgage options: 15-year fixed at 10% or 30-year fixed at 10%. Calculate the amount of interest paid for each option. How much does the buyer save in interest with the 15-year option? Use the following formula to determine the regular payment amount. P. PMT = ... Find the monthly payment for the 30-year option. (Round to the nearest dollar as needed.) Calculate the total cost of interest for both mortgage options. How much does the buyer save in interest with the 15-year option? (Use the answers from parts 1 and 2 to find this answer.)

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter7: Percents

Section7.7: Simple And Compound Interest

Problem 14E

Related questions

Question

Transcribed Image Text:The price of a home is $180,000. The bank requires a 15% down payment. The buyer is offered two mortgage options: 15-year fixed at 10% or 30-year fixed at

10%. Calculate the amount of interest paid for each option. How much does the buyer save in interest with the 15-year option? Use the following formula to

determine the regular payment amount,

PMT =

ork crap

College stuff

PDF

Find the monthly payment for the 30-year option.

AD - TCReview for

ID 10732..) (1).pdf

(Round to the nearest dollar as needed.)

Calculate the total cost of interest for both mortgage options. How much does the buyer save in inferest with the 15-year option?

(Use the answers from parts 1 and 2 to find this answer.)

Transcribed Image Text:Find the monthly payment for the 30-year option.

(Round to the nearest dollar as needed.)

O Time Remaining: 01:51:45

Next

APR

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Elementary Algebra

Algebra

ISBN:

9780998625713

Author:

Lynn Marecek, MaryAnne Anthony-Smith

Publisher:

OpenStax - Rice University