The prices of a set of zero-coupon government bonds with a face value of £100 and a time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, £95.24, £91.57, £88.90, £87.14 and £86.26. These bonds can be assumed to be risk-free. You also observe the prices of a set of zero-coupon corporate bonds, just issued by Manchester plc, each of which has a credit rating of BBB. Each bond has a face value of £100. The prices of the bonds with time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, £88.50, £78.31, £69.31, £61.33 and £54.28. a) Using the prices of the zero-coupon government bonds, calculate the price of a coupon-bearing government bond with a face value of £10,000, a coupon rate of 5%

The prices of a set of zero-coupon government bonds with a face value of £100 and a time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, £95.24, £91.57, £88.90, £87.14 and £86.26. These bonds can be assumed to be risk-free. You also observe the prices of a set of zero-coupon corporate bonds, just issued by Manchester plc, each of which has a credit rating of BBB. Each bond has a face value of £100. The prices of the bonds with time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, £88.50, £78.31, £69.31, £61.33 and £54.28. a) Using the prices of the zero-coupon government bonds, calculate the price of a coupon-bearing government bond with a face value of £10,000, a coupon rate of 5%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter20: Hybrid Financing: Preferred Stock, Warrants, And Convertibles

Section: Chapter Questions

Problem 7Q

Related questions

Question

How would you do this ?

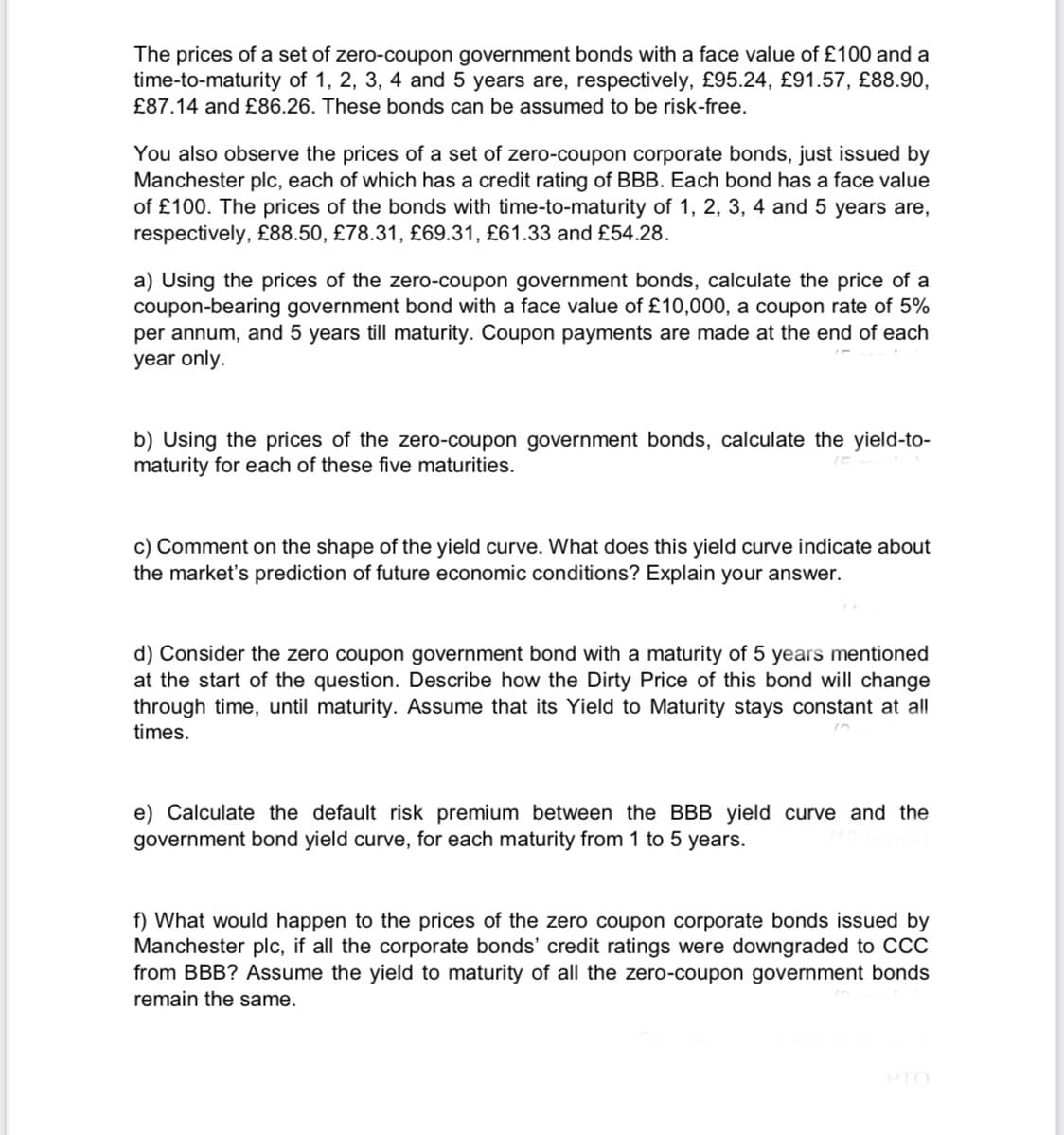

Transcribed Image Text:The prices of a set of zero-coupon government bonds with a face value of £100 and a

time-to-maturity of 1, 2, 3, 4 and 5 years are, respectively, £95.24, £91.57, £88.90,

£87.14 and £86.26. These bonds can be assumed to be risk-free.

You also observe the prices of a set of zero-coupon corporate bonds, just issued by

Manchester plc, each of which has a credit rating of BBB. Each bond has a face value

of £100. The prices of the bonds with time-to-maturity of 1, 2, 3, 4 and 5 years are,

respectively, £88.50, £78.31, £69.31, £61.33 and £54.28.

a) Using the prices of the zero-coupon government bonds, calculate the price of a

coupon-bearing government bond with a face value of £10,000, a coupon rate of 5%

per annum, and 5 years till maturity. Coupon payments are made at the end of each

year only.

b) Using the prices of the zero-coupon government bonds, calculate the yield-to-

maturity for each of these five maturities.

c) Comment on the shape of the yield curve. What does this yield curve indicate about

the market's prediction of future economic conditions? Explain your answer.

d) Consider the zero coupon government bond with a maturity of 5 years mentioned

at the start of the question. Describe how the Dirty Price of this bond will change

through time, until maturity. Assume that its Yield to Maturity stays constant at all

times.

e) Calculate the default risk premium between the BBB yield curve and the

government bond yield curve, for each maturity from 1 to 5 years.

f) What would happen to the prices of the zero coupon corporate bonds issued by

Manchester plc, if all the corporate bonds' credit ratings were downgraded to CC

from BBB? Assume the yield to maturity of all the zero-coupon government bonds

remain the same.

PTO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT