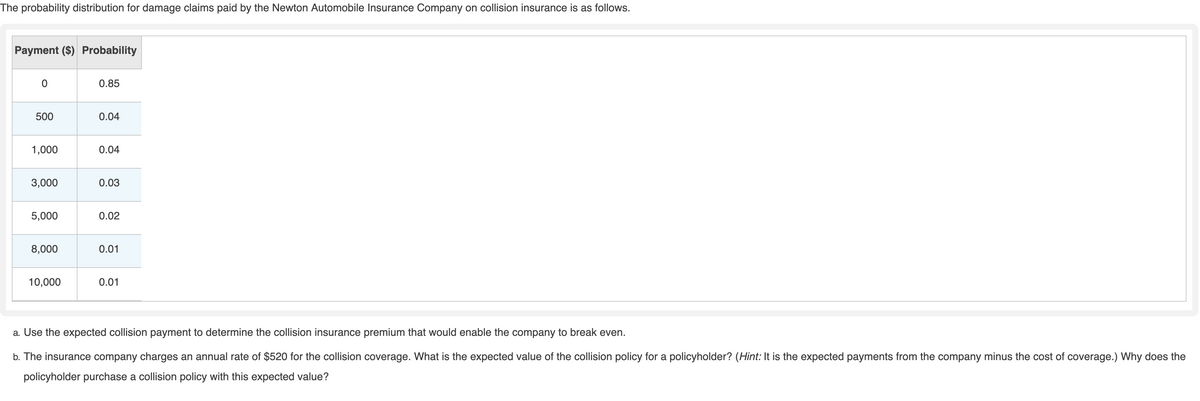

The probability distribution for damage claims paid by the Newton Automobile Insurance Company on collision insurance is as follows. Payment ($) Probability 0.85 500 0.04 1,000 0.04 3,000 0.03 5,000 0.02 8,000 0.01 10,000 0.01 a Use the expected collision payment to determine the collision insurance premium that would enable the company to break even. b. The insurance company charges an annual rate of $520 for the collision coverage. What is the expected value of the collision policy for a policyholder? (Hint: It is the expected payments from the company minus the cost of coverage.) Why does the policyholder purchase a collision policy with this expected value?

The probability distribution for damage claims paid by the Newton Automobile Insurance Company on collision insurance is as follows. Payment ($) Probability 0.85 500 0.04 1,000 0.04 3,000 0.03 5,000 0.02 8,000 0.01 10,000 0.01 a Use the expected collision payment to determine the collision insurance premium that would enable the company to break even. b. The insurance company charges an annual rate of $520 for the collision coverage. What is the expected value of the collision policy for a policyholder? (Hint: It is the expected payments from the company minus the cost of coverage.) Why does the policyholder purchase a collision policy with this expected value?

Chapter8: Sequences, Series,and Probability

Section8.7: Probability

Problem 50E: Flexible Work Hours In a recent survey, people were asked whether they would prefer to work flexible...

Related questions

Topic Video

Question

Can someone solve this using Microsoft Excel.

Transcribed Image Text:The probability distribution for damage claims paid by the Newton Automobile Insurance Company on collision insurance is as follows.

Payment ($) Probability

0.85

500

0.04

1,000

0.04

3,000

0.03

5,000

0.02

8,000

0.01

10,000

0.01

a. Use the expected collision payment to determine the collision insurance premium that would enable the company to break even.

b. The insurance company charges an annual rate of $520 for the collision coverage. What is the expected value of the collision policy for a policyholder? (Hint: It is the expected payments from the company minus the cost of coverage.) Why does the

policyholder purchase a collision policy with this expected value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Recommended textbooks for you