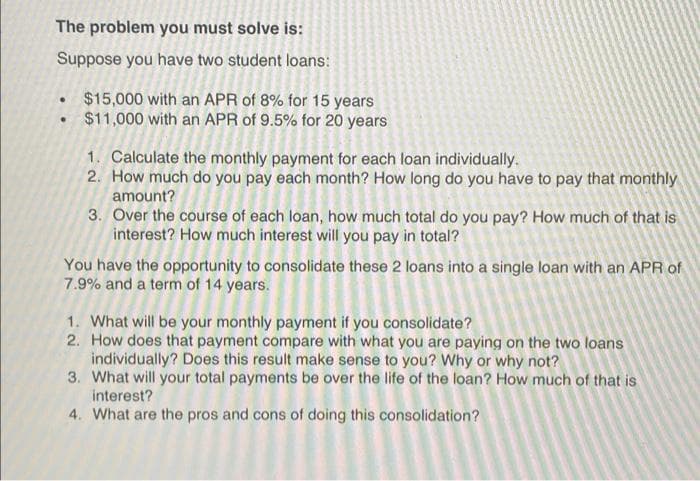

The problem you must solve is: Suppose you have two student loans: • $15,000 with an APR of 8% for 15 years $11,000 with an APR of 9.5% for 20 years 1. Calculate the monthly payment for each loan individually. 2. How much do you pay each month? How long do you have to pay that monthly amount? 3. Over the course of each loan, how much total do you pay? How much of that is interest? How much interest will you pay in total?

The problem you must solve is: Suppose you have two student loans: • $15,000 with an APR of 8% for 15 years $11,000 with an APR of 9.5% for 20 years 1. Calculate the monthly payment for each loan individually. 2. How much do you pay each month? How long do you have to pay that monthly amount? 3. Over the course of each loan, how much total do you pay? How much of that is interest? How much interest will you pay in total?

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 56SE: To get the best loan rates available, the Riches want to save enough money to place 20% down on a...

Related questions

Question

(please solve within 15 minutes I will give thumbs up)

Transcribed Image Text:The problem you must solve is:

Suppose you have two student loans:

$15,000 with an APR of 8% for 15 years

$11,000 with an APR of 9.5% for 20 years

1. Calculate the monthly payment for each loan individually.

2. How much do you pay each month? How long do you have to pay that monthly

amount?

3. Over the course of each loan, how much total do you pay? How much of that is

interest? How much interest will you pay in total?

You have the opportunity to consolidate these 2 loans into a single loan with an APR of

7.9% and a term of 14 years.

1. What will be your monthly payment if you consolidate?

2. How does that payment compare with what you are paying on the two loans

individually? Does this result make sense to you? Why or why not?

3. What will your total payments be over the life of the loan? How much of that is

interest?

4. What are the pros and cons of doing this consolidation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you