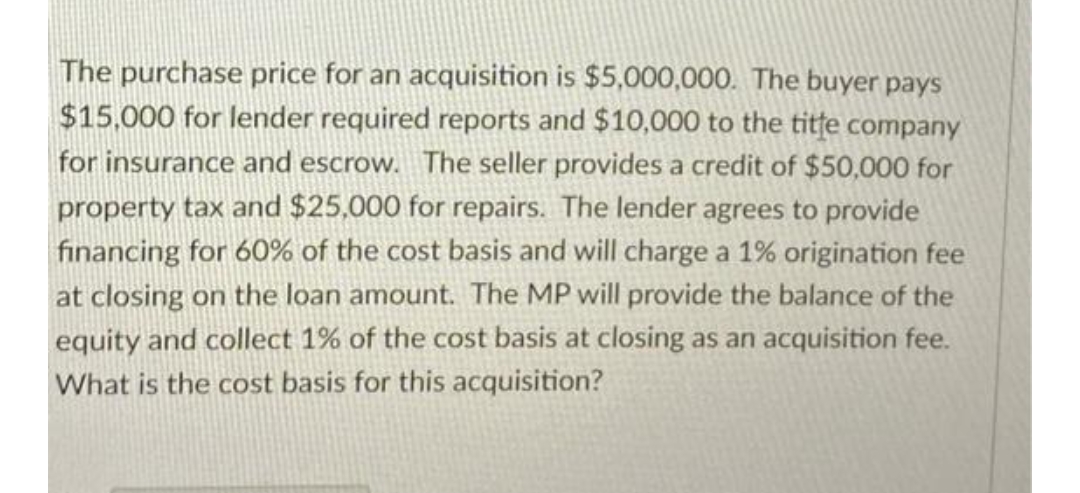

The purchase price for an acquisition is $5,000,000. The buyer pays $15,000 for lender required reports and $10,000 to the title company for insurance and escrow. The seller provides a credit of $50,000 for property tax and $25,000 for repairs. The lender agrees to provide financing for 60% of the cost basis and will charge a 1% origination fee at closing on the loan amount. The MP will provide the balance of the equity and collect 1% of the cost basis at closing as an acquisition fee. What is the cost basis for this acquisition?

The purchase price for an acquisition is $5,000,000. The buyer pays $15,000 for lender required reports and $10,000 to the title company for insurance and escrow. The seller provides a credit of $50,000 for property tax and $25,000 for repairs. The lender agrees to provide financing for 60% of the cost basis and will charge a 1% origination fee at closing on the loan amount. The MP will provide the balance of the equity and collect 1% of the cost basis at closing as an acquisition fee. What is the cost basis for this acquisition?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5EA: Steele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following...

Related questions

Question

Transcribed Image Text:The purchase price for an acquisition is $5,000,000. The buyer pays

$15,000 for lender required reports and $10,000 to the title company

for insurance and escrow. The seller provides a credit of $50,000 for

property tax and $25,000 for repairs. The lender agrees to provide

financing for 60% of the cost basis and will charge a 1% origination fee

at closing on the loan amount. The MP will provide the balance of the

equity and collect 1% of the cost basis at closing as an acquisition fee.

What is the cost basis for this acquisition?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College