The quick ratio is equal to Plugging in the relevant values for current assets, current liabilities, and inventories (calculated using the previous identity) yields a quick ratio of approximately 1.4583 Suppose that Niles could reduce its DSO from 18.25 to 12. Given the formula for DSO from the video, as well as the same annual sales of $2,500,000, the new value accounts receivable (associated with the new DSO) must be $20,547.95, all else equal. The change (or the absolute value of the difference between the original and new values) in accounts receivable represents an amount of approximately in cash generated. As a result of the stock buy back, the ROA and ROE both increase Suppose Niles uses the cash generated by the lower DSO to buy back common stock at book value, thus reducing common equity. As a result of this new, lower, DSO, total debt debt/total capital ratio must and total capital . This means that the total

The quick ratio is equal to Plugging in the relevant values for current assets, current liabilities, and inventories (calculated using the previous identity) yields a quick ratio of approximately 1.4583 Suppose that Niles could reduce its DSO from 18.25 to 12. Given the formula for DSO from the video, as well as the same annual sales of $2,500,000, the new value accounts receivable (associated with the new DSO) must be $20,547.95, all else equal. The change (or the absolute value of the difference between the original and new values) in accounts receivable represents an amount of approximately in cash generated. As a result of the stock buy back, the ROA and ROE both increase Suppose Niles uses the cash generated by the lower DSO to buy back common stock at book value, thus reducing common equity. As a result of this new, lower, DSO, total debt debt/total capital ratio must and total capital . This means that the total

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.2DC

Related questions

Topic Video

Question

Only answer fill in the blanks.

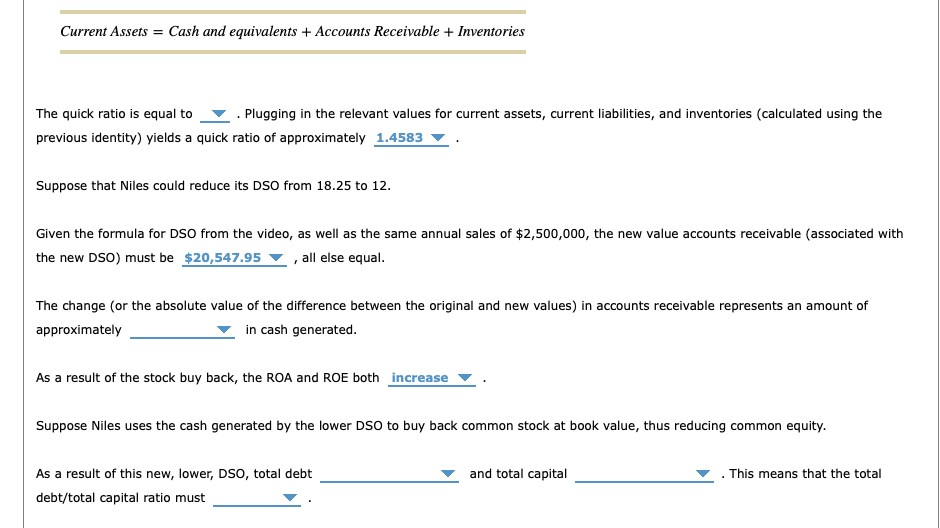

Transcribed Image Text:Current Assets = Cash and equivalents + Accounts Receivable + Inventories

The quick ratio is equal to . Plugging in the relevant values for current assets, current liabilities, and inventories (calculated using the

previous identity) yields a quick ratio of approximately 1.4583

Suppose that Niles could reduce its DSO from 18.25 to 12.

Given the formula for DSO from the video, as well as the same annual sales of $2,500,000, the new value accounts receivable (associated with

the new DSO) must be $20,547.95 , all else equal.

The change (or the absolute value of the difference between the original and new values) in accounts receivable represents an amount of

approximately

in cash generated.

As a result of the stock buy back, the ROA and ROE both increase

Suppose Niles uses the cash generated by the lower DSO to buy back common stock at book value, thus reducing common equity.

As a result of this new, lower, DSO, total debt

debt/total capital ratio must

and total capital

. This means that the total

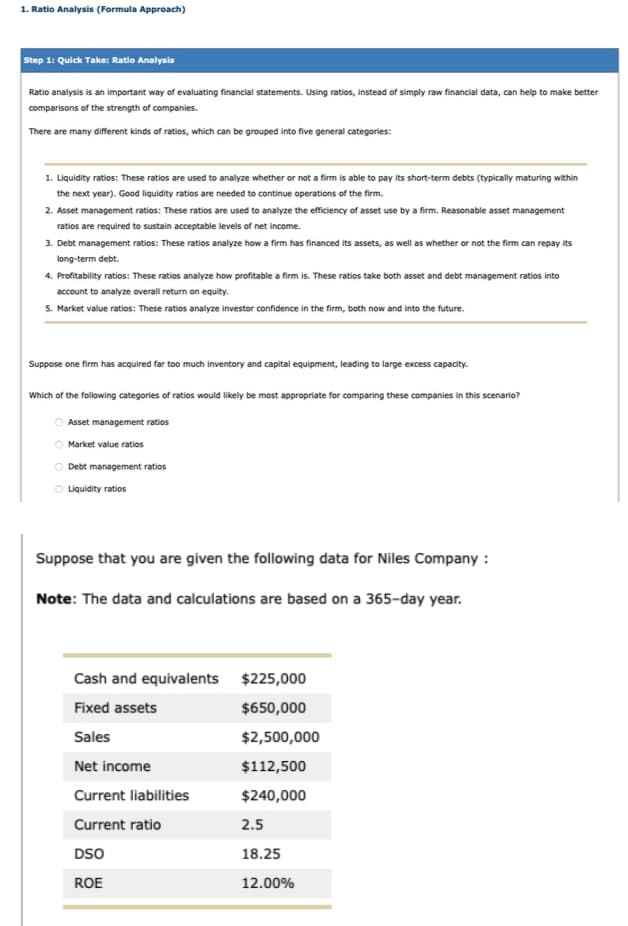

Transcribed Image Text:1. Ratio Analysis (Formula Approach)

Step 1: Quick Take: Ratio Analysis

Ratio analysis is an important way of evaluating financial statements. Using ratios, instead of simply raw financial data, can help to make better

comparisons of the strength of companies.

There are many different kinds of ratios, which can be grouped into five general categories:

1. Liquidity ratios: These ratios are used to analyze whether or not a firm is able to pay its short-term debts (typically maturing within

the next year). Good liquidity ratios are needed to continue operations of the firm.

2. Asset management ratios: These ratios are used to analyze the efficiency of asset use by a firm. Reasonable asset management

ratios are required to sustain acceptable levels of net income.

3. Debt management ratios: These ratios analyze how a firm has financed its assets, as well as whether or not the firm can repay its

long-term debt.

4. Profitability ratios: These ratios analyze how profitable a firm is. These ratios take both asset and debt management ratios into

account to analyze overall return on equity.

5. Market value ratios: These ratios analyze investor confidence in the firm, both now and into the future.

Suppose one firm has acquired far too much inventory and capital equipment, leading to large excess capacity.

Which of the following categories of ratios would likely be most appropriate for comparing these companies in this scenario?

Asset management ratios

Market value ratios

O

O Debt management ratios

O Liquidity ratios

Suppose that you are given the following data for Niles Company :

Note: The data and calculations are based on a 365-day year.

Cash and equivalents

Fixed assets

Sales

Net income

Current liabilities

Current ratio

DSO

ROE

$225,000

$650,000

$2,500,000

$112,500

$240,000

2.5

18.25

12.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning