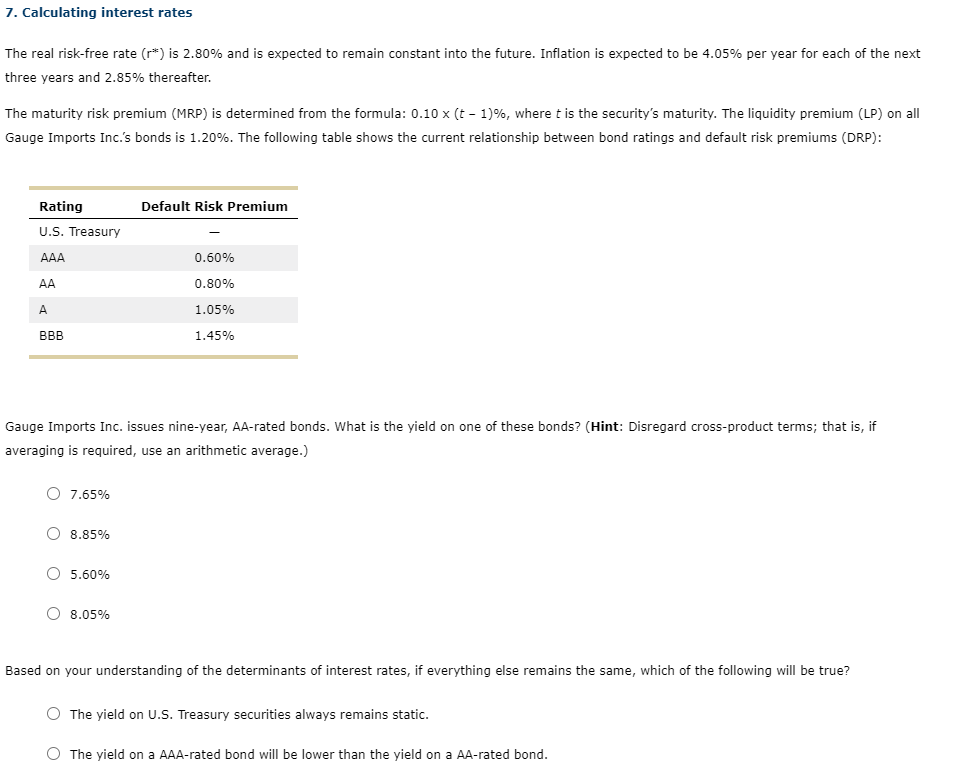

The real risk-free rate (r*) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 4.05% per year for each of the next three years and 2.85% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.10 x (t - 1)%, where t is the security's maturity. The liquidity premium (LP) on all Gauge Imports Inc.'s bonds is 1.20%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Gauge Imports Inc. issues nine-year, AA-rated bonds. What is the yield on one of these bonds? (Hint: Disregard cross-product terms; that is, if averaging is required, use an arithmetic average.) O 7.65% 8.85% 5.60% 8.05% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? The yield on U.S. Treasury securities always remains static. The yield on a AAA-rated bond will be lower than the yield on a AA-rated bond.

The real risk-free rate (r*) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 4.05% per year for each of the next three years and 2.85% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.10 x (t - 1)%, where t is the security's maturity. The liquidity premium (LP) on all Gauge Imports Inc.'s bonds is 1.20%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Gauge Imports Inc. issues nine-year, AA-rated bonds. What is the yield on one of these bonds? (Hint: Disregard cross-product terms; that is, if averaging is required, use an arithmetic average.) O 7.65% 8.85% 5.60% 8.05% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? The yield on U.S. Treasury securities always remains static. The yield on a AAA-rated bond will be lower than the yield on a AA-rated bond.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Question

100%

Transcribed Image Text:7. Calculating interest rates

The real risk-free rate (r*) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 4.05% per year for each of the next

three years and 2.85% thereafter.

The maturity risk premium (MRP) is determined from the formula: 0.10 x (t - 1)%, where t is the security's maturity. The liquidity premium (LP) on all

Gauge Imports Inc.'s bonds is 1.20%. The following table shows the current relationship between bond ratings and default risk premiums (DRP):

Rating

Default Risk Premium

U.S. Treasury

AAA

0.60%

AA

0.80%

A.

1.05%

BBB

1.45%

Gauge Imports Inc. issues nine-year, AA-rated bonds. What is the yield on one of these bonds? (Hint: Disregard cross-product terms; that is, if

averaging is required, use an arithmetic average.)

7.65%

8.85%

5.60%

8.05%

Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true?

The yield on U.S. Treasury securities always remains static.

O The yield on a AAA-rated bond will be lower than the yield on a AA-rated bond.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning