The Red Hat Company began operations in January 2018 and reported the following results of operations for each of its first three years of operations: 2018- P 600,000; 2019- P 240,000 loss; 2020- P 3,900,000 profit. At December 31,2020, the company's capital accounts were as follows: 9% Cumulative Preference share capital, P 100 par; 100,000 shares authorized; 60,000 shares issued and outstanding P 6,000,000 Ordinary Share Capital, P 10 par; 1,000,000 shares authorized; 800,000 shares issued and outstanding 8,000,000 Red Hat Company has never paid a cash or bonus issue and there has been no change in the capital accounts since it began operations.

The Red Hat Company began operations in January 2018 and reported the following results of operations for each of its first three years of operations: 2018- P 600,000; 2019- P 240,000 loss; 2020- P 3,900,000 profit. At December 31,2020, the company's capital accounts were as follows: 9% Cumulative Preference share capital, P 100 par; 100,000 shares authorized; 60,000 shares issued and outstanding P 6,000,000 Ordinary Share Capital, P 10 par; 1,000,000 shares authorized; 800,000 shares issued and outstanding 8,000,000 Red Hat Company has never paid a cash or bonus issue and there has been no change in the capital accounts since it began operations.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 67E: Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its...

Related questions

Question

Transcribed Image Text:EXERCISE I 5

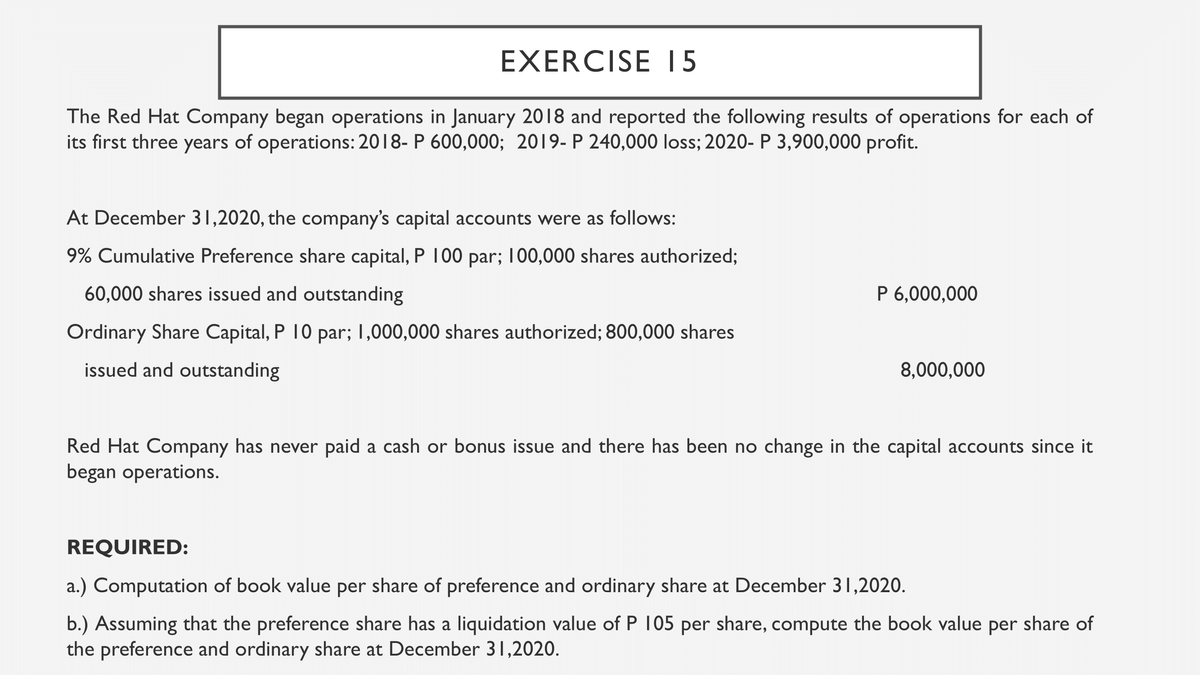

The Red Hat Company began operations in January 2018 and reported the following results of operations for each of

its first three years of operations: 2018- P 600,000; 2019- P 240,000 loss; 2020- P 3,900,000 profit.

At December 31,2020, the company's capital accounts were as follows:

9% Cumulative Preference share capital, P 100 par; 100,000 shares authorized;

60,000 shares issued and outstanding

P 6,000,000

Ordinary Share Capital, P 10 par; 1,000,000 shares authorized; 800,000 shares

issued and outstanding

8,000,000

Red Hat Company has never paid a cash or bonus issue and there has been no change in the capital accounts since it

began operations.

REQUIRED:

a.) Computation of book value per share of preference and ordinary share at December 31,2020.

b.) Assuming that the preference share has a liquidation value of P 105 per share, compute the book value per share of

the preference and ordinary share at December 31,2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning