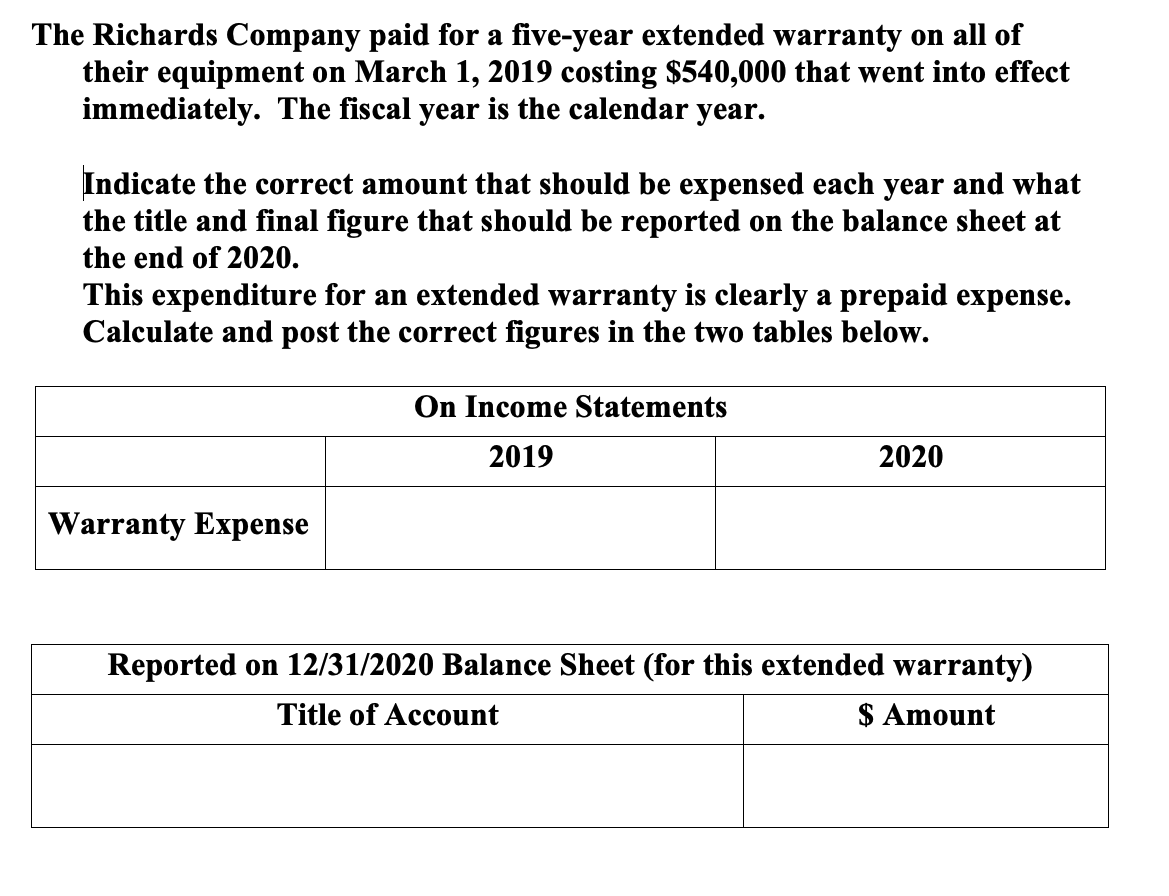

The Richards Company paid for a five-year extended warranty on all of their equipment on March 1, 2019 costing $540,000 that went into effect immediately. The fiscal year is the calendar year. Indicate the correct amount that should be expensed each year and what the title and final figure that should be reported on the balance sheet at the end of 2020. This expenditure for an extended warranty is clearly a prepaid expense. Calculate and post the correct figures in the two tables below. On Income Statements 2019 2020 Warranty Expense Reported on 12/31/2020 Balance Sheet (for this extended warranty) Title of Account $ Amount

The Richards Company paid for a five-year extended warranty on all of their equipment on March 1, 2019 costing $540,000 that went into effect immediately. The fiscal year is the calendar year. Indicate the correct amount that should be expensed each year and what the title and final figure that should be reported on the balance sheet at the end of 2020. This expenditure for an extended warranty is clearly a prepaid expense. Calculate and post the correct figures in the two tables below. On Income Statements 2019 2020 Warranty Expense Reported on 12/31/2020 Balance Sheet (for this extended warranty) Title of Account $ Amount

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 3RE: Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that...

Related questions

Question

I need help with this solution.

Transcribed Image Text:The Richards Company paid for a five-year extended warranty on all of

their equipment on March 1, 2019 costing $540,000 that went into effect

immediately. The fiscal year is the calendar year.

Indicate the correct amount that should be expensed each year and what

the title and final figure that should be reported on the balance sheet at

the end of 2020.

This expenditure for an extended warranty is clearly a prepaid expense.

Calculate and post the correct figures in the two tables below.

On Income Statements

2019

2020

Warranty Expense

Reported on 12/31/2020 Balance Sheet (for this extended warranty)

Title of Account

$ Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College