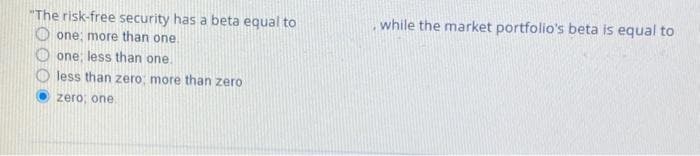

"The risk-free security has a beta equal to one; more than one. one; less than one. less than zero; more than zero zero; one. while the market portfolio's beta is equal to

Q: Kit Fox is the finance manager at Builtrite and she just noticed that one employee-Terry Dactel-has…

A: Retirement planning is a method of annuity payments used to make deposits or withdrawals while…

Q: You want to buy a car and therefore you borrowed $10,000 from a bank today for 6 years. The nominal…

A: Since, the periodic payments are made at the end of each month, it is an ordinary annuity. The…

Q: Dividend constraints The Howe Company's stockholders' equity account is as follows: The earnings…

A: Maximum Dividend per share is the highest amount a company can distribute to its shareholders for…

Q: Eleanor is trying to determine whether Techno Wiz (TW), a publicly traded company, is over- or…

A: Here,CurrentMarket price is $4.50EPS is $1.50Dividend Payout Ratio is 1/5Growth Rate is 5%Required…

Q: You took out a student loan in college and now have to pay $1,200 every year for 10 years, starting…

A: A loan refers to a contract where a sum is borrowed on the promise of the future repayment of the…

Q: Required information [The following information applies to the questions displayed below.) A pension…

A: ParticularsExpected ReturnStandard DeviationStock Fund S16%32%Stock Fund B10%23%Risk-free…

Q: a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after…

A: Capital budgeting is a critical financial process that involves evaluating and making decisions…

Q: Binomial Model The current price of a stock is $22. In 1 year, the price will be either $27 or $14.…

A: Option Market is a Stock Market Strategy. Under which investor will not purchase the shares of the…

Q: A 20-year maturity bond with par value of $1,000 makes semiannual coupon payments at a coupon rate…

A: yield to maturity of the bond is computed by following formula:-yield to maturity = whereRV =…

Q: (a) How much (in $) would the account be worth after 10 years? $ (b) How much (in $) would the…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: U.S. Treasury STRIPS, close of business February 15, 2019: Maturity Feb 2020 Feb 2021 94.770 Feb…

A: A STRIP, or Separate Trading of Registered Interest and Principal Securities, is a financial product…

Q: The Gecko Company and the Gordon Company are two firms whose business risk is the same but that have…

A: Pretax required return on Gordon's stock can be calculated by using equation below.Pretax return on…

Q: Cookies R Us Incorporated is evaluating a new cookie cutting machine that will cost $500,000. The…

A: NPV is also known as Net Present value. It is a capital budgeting technique which helps in decision…

Q: Metallica Bearings, Incorporated, is a young startup company. No dividends will be paid on the stock…

A: DDM dividend discount model is used to the predict the price of stock based on dividend and growth…

Q: tment will give you monthly payments of $1972.19 for 8 years. You will receive your first payment…

A: Present value is the equivalent value today of the future money that is going to be received in the…

Q: The Valentine Company has decided to buy a machine costing $20,000. Estimated cash savings from…

A: RR is also known as Net Present Value. It is a capital budegting technqiues which helps in decision…

Q: What about D-J?

A: IRR is also known as Net Present calue. It is a capital budgeting techniques which helps in decision…

Q: Corf's Dog House is considering the installation of a new computerized pressure cooker for hot dogs.…

A: Increase in sales$9,500Annual operating cost$13,300Purchase and installation cost$50,100Estimated…

Q: You paid cash for $1,600 worth of stock a year ago. Today the portfolio is worth $2,626. a. What…

A: First I'm going to list the formula and then solve it in Excel.In margin trading, you purchase a…

Q: ption is currently selling for $4.2. It has a strike price of $85 and three months to maturity. The…

A: Options are those derivatives which provide a right to buy or sell the options on the exercise date…

Q: A firm has EBIT of $30 million. It has debt of $100 million and the cost of debt is 7%. Its…

A: The value of unlevered firm can be calculated by using equation below.Unlevered firm value…

Q: CASE STUDY Cucumber Ltd is a company, based in Manchester UK and established in 2005, that produces…

A: Businesses implement capital budgeting procedures, which are financial processes and instruments, to…

Q: Consider the following two Treasury securities: Bond A is sold at $120 with 5 years of modified…

A: The modified duration is an adjusted version of the Macaulay duration, which accounts for changing…

Q: On May 1, 2017, Skysong Ltd. issued a series of bonds in order to raise money for some upcoming…

A: Bond amortization is the systematic reduction of the premium or discount on a bond to align its…

Q: Below are three different investment alternatives, along with information on their expected return…

A: A utility function in economics and decision theory represents an individual's or entity's…

Q: For the second mortgage application, calculate the percentage of appraised value and the potential…

A: We need to use the below equation to calculate percentage of appraised value and potential…

Q: Suppose we observe the following rates: 1R₁ = 0.80%, 1R₂ = 1.25%, and E(271) = 0.941%. If the…

A: Variables in the question: 1R1=0.80% =0.0081R2=1.25% =0.0125E(2r1)=0.941% =0.00941

Q: A. Your firm uses a fixed order quantity system and operates 52 weeks per year. One of the items…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Granville Company issued a $6,300,000 in 8%, 10-year bonds when the market rate of interest is 10%…

A: Bond refers to the financial instruments issued by the government and financial institutions for the…

Q: a. What is its yield to maturity (YTM)? Round your answer to two decimal places b. Assume that the…

A: A bond's price is determined by the bond's future cash flows, which include periodic interest…

Q: (Related to Checkpoint 9.3) (Bond valuation) Calculate the value of a bond that matures in 12 years…

A: A bond is a kind of debt security issued by the government and private companies to the public for…

Q: Company A has 279,000 basic shares outstanding and 26,000 outstanding options and warrants. The…

A: Fully diluted shares include covertly preferred stocks, or stocks that can be claimed through…

Q: Shekhar plans to invest $3,560 in a mutual fund at the end of each of the next 8 years. If he earns…

A: Future value is that amount which will be require to paid at some specified period of time. It…

Q: I purchased a call option on Canadian dollar for $.018 per unit. The strike price was $.08 and the…

A: Here,Option Premium is $0.018 per unitStrike Price is $0.08 per unitSpot Price at the time of…

Q: FV = 1000; Coupon rate = 0; maturity 20 years; bond yield = 12% Commission = 4% Calculate Sale…

A: Face Value (FV) = $1,000Coupon Rate = 0% (which means it's a zero-coupon bond)Maturity = 20…

Q: Required: a. Compute the present value of the tax shield resulting from depreciation. b. Compute the…

A: Present Value (PV) is a financial concept that pertains to the valuation of future cash flows in…

Q: 2. If the stated annual rate of interest compounded semi-annually is 12.5% then what is the…

A: The nominal rate of interest is the rate used for computing the value of the amount invested if…

Q: The advertised month-end financing payments on a $28,757.72 car are $699 for a four- ear term. What…

A: Loan amount =28757.72Monthly payment =699Period of loan =n=4 years =48 months Find out effective…

Q: One-year Treasury bills currently earn 2.10 percent. You expect that one year from now, 1-year…

A: The expectations theory refers to the relationship between the long-term spot rate and the…

Q: P12-20 RISK-ADJUSTED DISCOUNT RATES: BASIC Country Wallpapers is considering investing in one of…

A: Capital budgeting is a financial process used by businesses to evaluate and select investment…

Q: Ou've collected the following information from your favorite financial website. 52-Week Price Lo…

A: The dividend yield is a financial ratio that indicates the percentage return an investor can expect…

Q: The board of Wicker Home Health Care, Inc., is exploring ways to expand the number of shares…

A: GivenEarnings per share is $3.70price per share is $40Dividend per share is $1.44

Q: serve three decimal places for non-terminating decimal values. Draw the cashflow diagram for each…

A: Money have time value and value of money increases with time due to time value of money.

Q: Kolby has made deposits of $140.00 into his savings account at the end of every three months for 20…

A: Given that, Interest Rate per annum = 9% Number of years = 20 Number of Payments…

Q: a. Show the effect on the equity accounts and per-share data of a 10% stock dividend.

A: The Dividend Discount Model (DDM) is a valuation method used in finance and investment analysis to…

Q: Burke's Corner currently sells blue jeans and T-shirts. Management is considering adding fleece tops…

A: Variables in the question: Tops Jeans…

Q: The most recent financial statements for Cardinal, Incorporated, are shown here: Income Statement…

A: External financing refers to the funds that are generated from outside the business in the form of…

Q: You are considering making a movie. The movie is expected to cost $10.7 million up front and take a…

A: Payback period is the amount of time to recover the initial investment. The decision criteria to…

Q: Cookies 'n Cream, Incorporated, recently issued new securities to finance a new TV show. The project…

A: Debt equity ratio:The debt equity ratio is a financial metric that measures the proportion of a…

Q: Based on this information, earnings per share was: Select one: a. $1.20 b. $1.00 c. $0.80 d.…

A: Earnings per share (EPS) shows how much of a company's profits are distributed to each outstanding…

6

Step by step

Solved in 3 steps

- Which of the following statements about the Security Market Line are correct? I. The intercept point is the market rate of return. II. The slope of the line is beta. III. An investor should accept any return located above the SML line. IV. A beta of 0.0 indicates the risk-free rate of returna) Suppose the risk-free rate is `X'% and the expected rate of return on the market portfolio is 10%. In your view, the expected rate of return of a security is 12.2%. Given that this security has a beta of 1.4, do you consider it to be overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model? Please provide the details of your calculations and discuss your results. b) Using a graph, explain when a security is overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model. Plot your answer from (a) onto this graph.A portfolio that is positively correlated with the market portfolio but not particularly sensitive to market risk factors would have a beta that is A. Equal to zero. B. Equal to one. C. Less than zero. D. Between 0 and 1. E. Greater than 1.

- Consider the following information (Assume that Security M and Security N are in the same financial market and the market is efficient): Standard Deviation BetaSecurity M 20% 1.25Security N 30% 0.80 Which security has more systematic risk? Group of answer choices Security M Security N EqualThe beta of a risk-free security is _____ and the beta of the overall market is _____: a. 0; 1. b. 0; 0. c. 1; 0. d. 1; 1.The risk-free rate and the expected market rate of return are 0.06 and 0.12 respectively. Using the CAPM model the expected rate of return of a security with a beta of 1.2 would be

- Consider the following information (Assume that Security M and Security N are in the same financial market): Standard Deviation BetaSecurity M 20% 1.25Security N 30% 0.80 Which security has more total risk? Group of answer choices Security M Security N EqualWhich of the following is NOT one of the 3 parameters of the Security Market Line (SML)? Group of answer choices 1. The Expected Return on the Market Portfolio 2. Beta 3. The Risk Free Rate 4. AlphaThe risk-free rate and the expected market rate of return and 0.056 and 0.125. Using the CAPM model, the expected rate of return of a security, that you are interested in, has a beta of 1.25 would be equal to Calculate the expected rate of return

- Consider the following information: Standard Deviation. Beta Security T 30% 1.90 Security K. 30% 1.20 a. Which security has more total risk? b. Which security has more systematic risk? c. Which security should have the higher expected return? d. What does the total risk consist of? What kind of risk is eliminated with portfolio diversification?What is the expected return of a zero-beta security?a. Market rate of return.b. Zero rate of return.c. Negative rate of return.d. Risk-free rate of return.Consider the following information: Standard Deviation Beta Security T 30% 1.90 Security K 30% 1.20 Which security has more total risk? Which security has more systematic risk? Which security should have the higher expected return? What does the total risk consist of? What kind of risk is eliminated with portfolio diversification?