the ROS On January 1, 2020 P1,000,000. The useful life is expected to be 10 years. On July 1, 2025, the Company bought a machinery costing machine's engine was replaced at a total cost of P320,000. This replacement will extend the useful life of the asset by an additional 5.5 years from the date of replacement. The old engine of the machine had a cost of 250,000. The depreciation expense for year 2025 is

the ROS On January 1, 2020 P1,000,000. The useful life is expected to be 10 years. On July 1, 2025, the Company bought a machinery costing machine's engine was replaced at a total cost of P320,000. This replacement will extend the useful life of the asset by an additional 5.5 years from the date of replacement. The old engine of the machine had a cost of 250,000. The depreciation expense for year 2025 is

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 4RE: Utica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000...

Related questions

Question

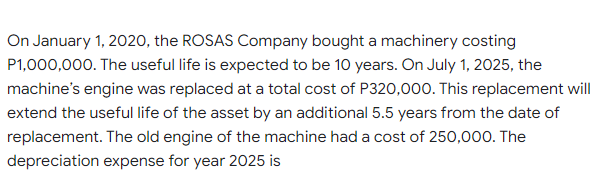

Transcribed Image Text:On January 1, 2020, the ROSAS Company bought a machinery costing

P1,000,000. The useful life is expected to be 10 years. On July 1, 2025, the

machine's engine was replaced at a total cost of P320,000. This replacement will

extend the useful life of the asset by an additional 5.5 years from the date of

replacement. The old engine of the machine had a cost of 250,000. The

depreciation expense for year 2025 is

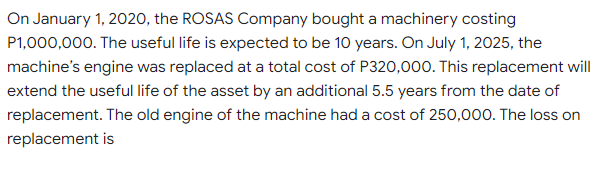

Transcribed Image Text:On January 1, 2020, the ROSAS Company bought a machinery costing

P1,000,000. The useful life is expected to be 10 years. On July 1, 2025, the

machine's engine was replaced at a total cost of P320,000. This replacement will

extend the useful life of the asset by an additional 5.5 years from the date of

replacement. The old engine of the machine had a cost of 250,000. The loss on

replacement is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT