The Salalah Golf Resorts is redoing its golf course at a cost of 2744320 OMR. It expects to generate cash flows of OMR 1223445, OMR 2007812, and OMR 3147890 over the next three years. If the appropriate discount rate for the firm is 13 percent, what is the NDV of this proiect?

The Salalah Golf Resorts is redoing its golf course at a cost of 2744320 OMR. It expects to generate cash flows of OMR 1223445, OMR 2007812, and OMR 3147890 over the next three years. If the appropriate discount rate for the firm is 13 percent, what is the NDV of this proiect?

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 17P: EQUIVALENT ANNUAL ANNUITY A firm has two mutually exclusive investment projects to evaluate; both...

Related questions

Question

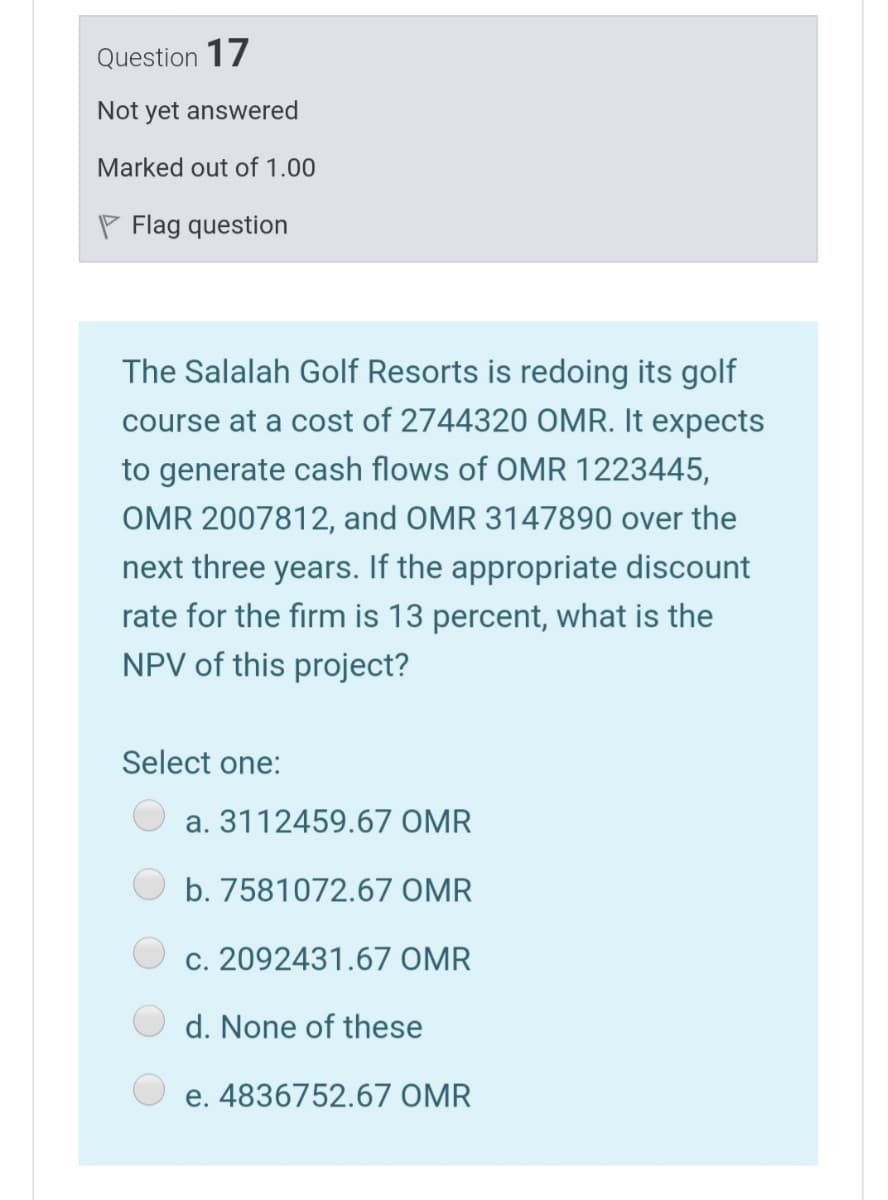

Transcribed Image Text:Question 17

Not yet answered

Marked out of 1.00

P Flag question

The Salalah Golf Resorts is redoing its golf

course at a cost of 2744320 OMR. It expects

to generate cash flows of OMR 1223445,

OMR 2007812, and OMR 3147890 over the

next three years. If the appropriate discount

rate for the firm is 13 percent, what is the

NPV of this project?

Select one:

a. 3112459.67 OMR

b. 7581072.67 OMR

c. 2092431.67 OMR

d. None of these

e. 4836752.67 OMR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning