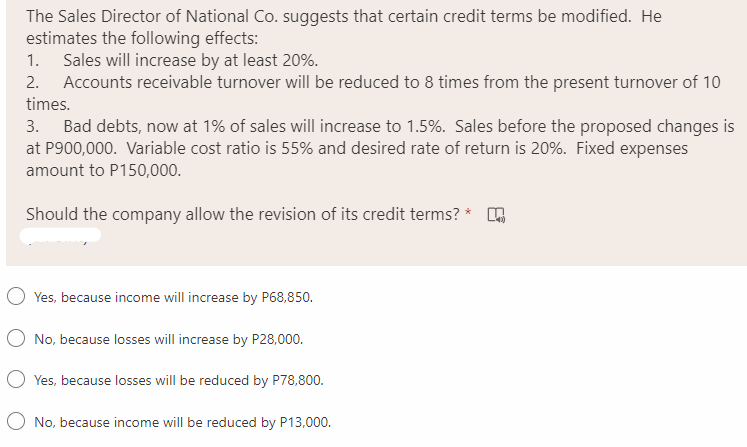

The Sales Director of National Co. suggests that certain credit terms be modified. He estimates the following effects: 1. Sales will increase by at least 20%. 2. Accounts receivable turnover will be reduced to 8 times from the present turnover of 10 times. 3. Bad debts, now at 1% of sales will increase to 1.5%. Sales before the proposed changes is at P900,000. Variable cost ratio is 55% and desired rate of return is 20%. Fixed expenses amount to P150,000. Should the company allow the revision of its credit terms? * O Yes, because income will increase by P68,850. O No, because losses will increase by P28,000. Yes, because losses will be reduced by P78,800. O No, because income will be reduced by P13,000.

The Sales Director of National Co. suggests that certain credit terms be modified. He estimates the following effects: 1. Sales will increase by at least 20%. 2. Accounts receivable turnover will be reduced to 8 times from the present turnover of 10 times. 3. Bad debts, now at 1% of sales will increase to 1.5%. Sales before the proposed changes is at P900,000. Variable cost ratio is 55% and desired rate of return is 20%. Fixed expenses amount to P150,000. Should the company allow the revision of its credit terms? * O Yes, because income will increase by P68,850. O No, because losses will increase by P28,000. Yes, because losses will be reduced by P78,800. O No, because income will be reduced by P13,000.

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 14P

Related questions

Question

3

Transcribed Image Text:The Sales Director of National Co. suggests that certain credit terms be modified. He

estimates the following effects:

1. Sales will increase by at least 20%.

2. Accounts receivable turnover will be reduced to 8 times from the present turnover of 10

times.

3. Bad debts, now at 1% of sales will increase to 1.5%. Sales before the proposed changes is

at P900,000. Variable cost ratio is 55% and desired rate of return is 20%. Fixed expenses

amount to P150,000.

Should the company allow the revision of its credit terms? *

Yes, because income will increase by P68,850.

No, because losses will increase by P28,000.

O Yes, because losses will be reduced by P78,800.

O No, because income will be reduced by P13,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning