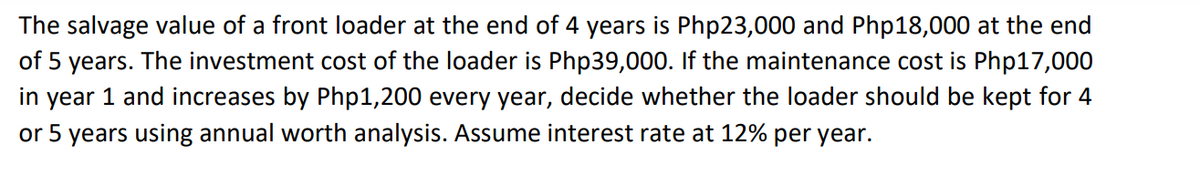

The salvage value of a front loader at the end of 4 years is Php23,000 and Php18,000 at the end of 5 years. The investment cost of the loader is Php39,000. If the maintenance cost is Php17,000 in year 1 and increases by Php1,200 every year, decide whether the loader should be kept for 4 or 5 years using annual worth analysis. Assume interest rate at 12% per year.

The salvage value of a front loader at the end of 4 years is Php23,000 and Php18,000 at the end of 5 years. The investment cost of the loader is Php39,000. If the maintenance cost is Php17,000 in year 1 and increases by Php1,200 every year, decide whether the loader should be kept for 4 or 5 years using annual worth analysis. Assume interest rate at 12% per year.

Fundamentals Of Construction Estimating

4th Edition

ISBN:9781337399395

Author:Pratt, David J.

Publisher:Pratt, David J.

Chapter9: Pricing Construction Equipment

Section: Chapter Questions

Problem 6RQ

Related questions

Question

100%

Solve the Engineering Economics Problem

Transcribed Image Text:The salvage value of a front loader at the end of 4 years is Php23,000 and Php18,000 at the end

of 5 years. The investment cost of the loader is Php39,000. If the maintenance cost is Php17,000

in year 1 and increases by Php1,200 every year, decide whether the loader should be kept for 4

or 5 years using annual worth analysis. Assume interest rate at 12% per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, civil-engineering and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Construction Estimating

Civil Engineering

ISBN:

9781337399395

Author:

Pratt, David J.

Publisher:

Cengage,

Fundamentals Of Construction Estimating

Civil Engineering

ISBN:

9781337399395

Author:

Pratt, David J.

Publisher:

Cengage,