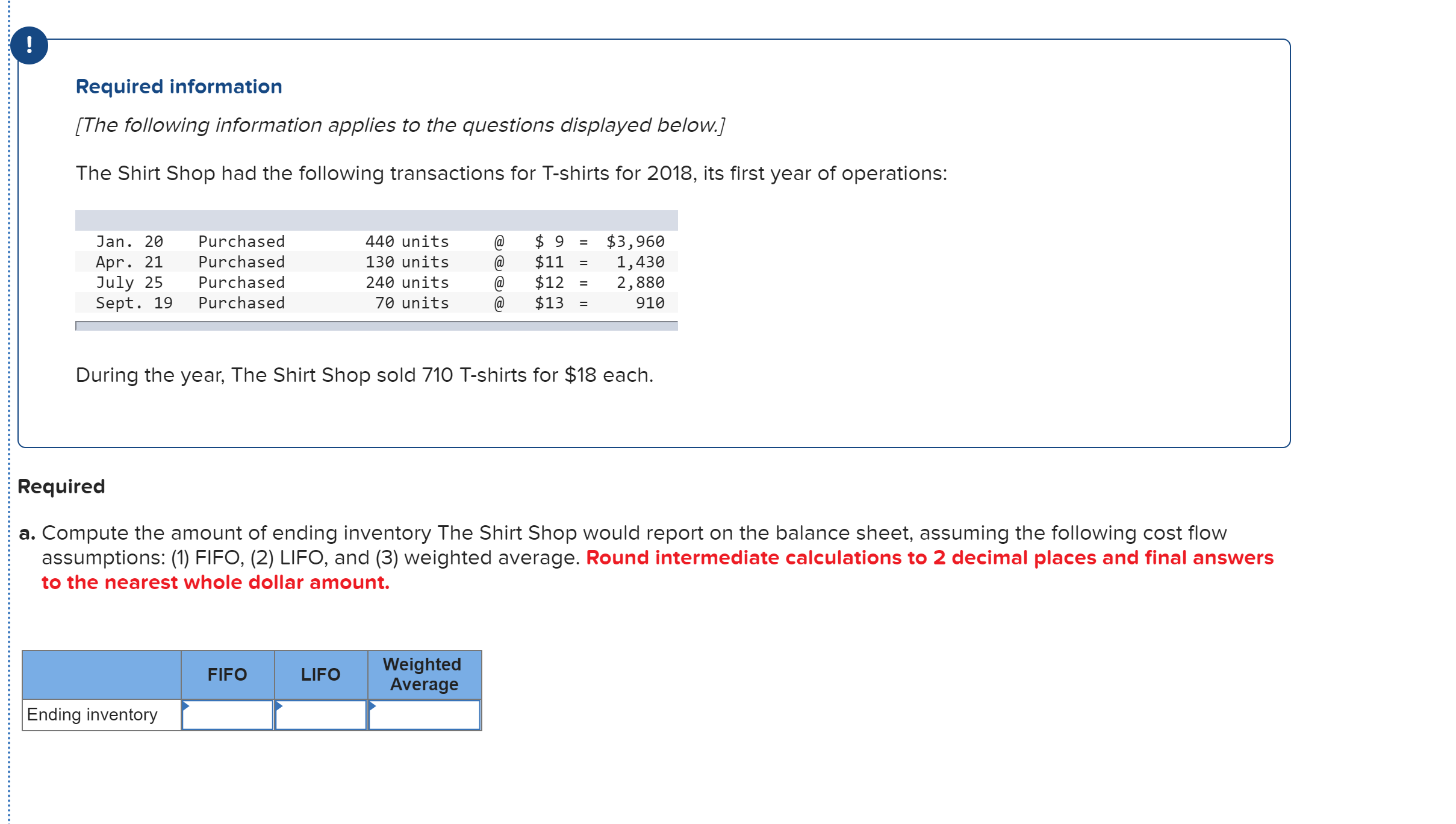

The Shirt Shop had the following transactions for T-shirts for 2018, its first year of operations: $ 9 @ $11 @ $12 = @ $13 440 units $3,960 1,430 2,880 Jan. 20 Purchased Apr. 21 July 25 Sept. 19 Purchased 130 units Purchased 240 units Purchased 70 units 910 %3D During the year, The Shirt Shop sold 710 T-shirts for $18 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount. Weighted Average FIFO LIFO Ending inventory Il || ||II

The Shirt Shop had the following transactions for T-shirts for 2018, its first year of operations: $ 9 @ $11 @ $12 = @ $13 440 units $3,960 1,430 2,880 Jan. 20 Purchased Apr. 21 July 25 Sept. 19 Purchased 130 units Purchased 240 units Purchased 70 units 910 %3D During the year, The Shirt Shop sold 710 T-shirts for $18 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount. Weighted Average FIFO LIFO Ending inventory Il || ||II

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:The Shirt Shop had the following transactions for T-shirts for 2018, its first year of operations:

$ 9

@

$11

@

$12 =

@

$13

440 units

$3,960

1,430

2,880

Jan. 20

Purchased

Apr. 21

July 25

Sept. 19

Purchased

130 units

Purchased

240 units

Purchased

70 units

910

%3D

During the year, The Shirt Shop sold 710 T-shirts for $18 each.

Required

a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow

assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. Round intermediate calculations to 2 decimal places and final answers

to the nearest whole dollar amount.

Weighted

Average

FIFO

LIFO

Ending inventory

Il || ||II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College