The size of the monthly payment required to pay off the loan over the 30-year period The total payments he is required to make over the life of the loan How much of the loan would still be outstanding after 20 years of payments The portion of the monthly payment that goes towards principal reduction versus interest coverage (use the first payment, the payment at the end of year 10, the payment at the end of year 20, and the very last payment as an example) How much interest he would have to pay in a given year (use the first and the last year as an example)

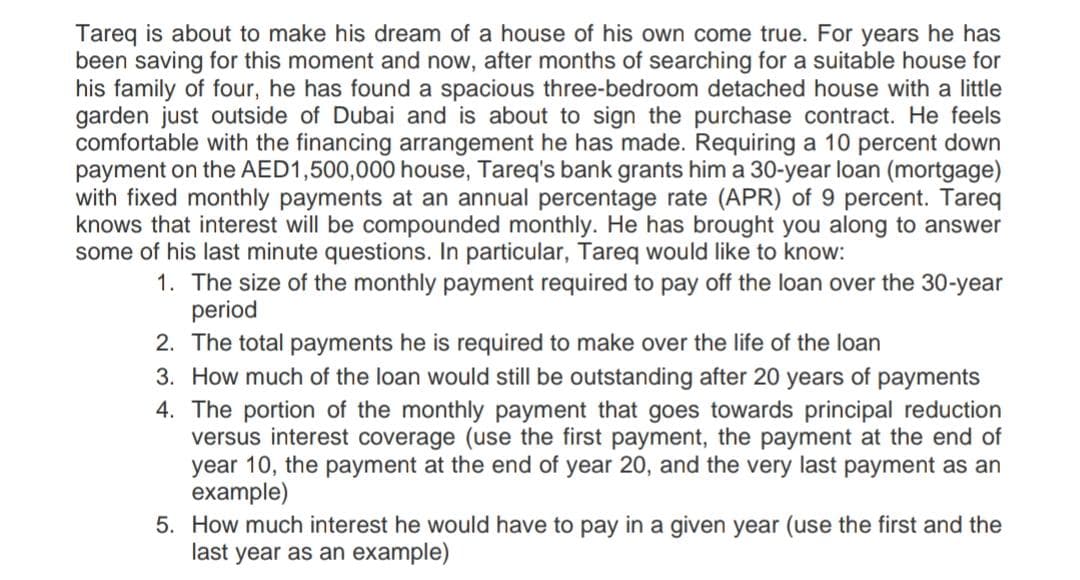

Tareq is about to make his dream of a house of his own come true. For years he has been saving for this moment and now, after months of searching for a suitable house for his family of four, he has found a spacious three-bedroom detached house with a little garden just outside of Dubai and is about to sign the purchase contract. He feels comfortable with the financing arrangement he has made. Requiring a 10 percent down payment on the AED1,500,000 house, Tareq's bank grants him a 30-year loan (mortgage) with fixed monthly payments at an annual percentage rate (APR) of 9 percent. Tareq knows that interest will be compounded monthly. He has brought you along to answer some of his last minute questions. In particular, Tareq would like to know:

- The size of the monthly payment required to pay off the loan over the 30-year period

- The total payments he is required to make over the life of the loan

- How much of the loan would still be outstanding after 20 years of payments

- The portion of the monthly payment that goes towards principal reduction versus interest coverage (use the first payment, the payment at the end of year 10, the payment at the end of year 20, and the very last payment as an example)

- How much interest he would have to pay in a given year (use the first and the last year as an example)

Step by step

Solved in 7 steps with 4 images