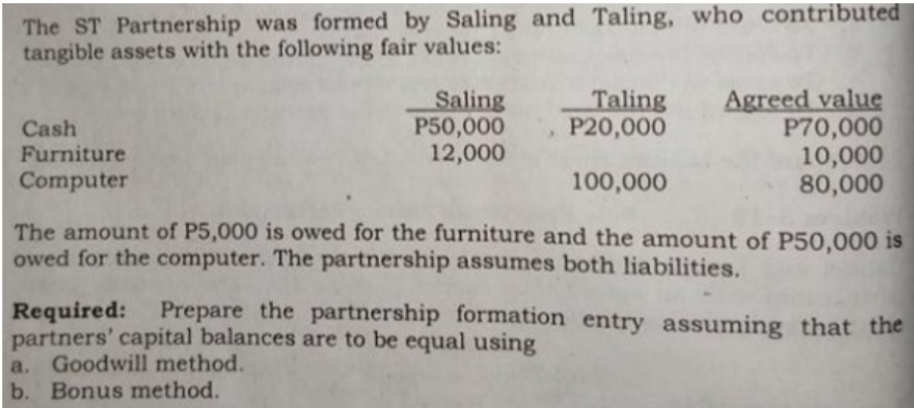

The ST Partnership was formed by Saling and Taling, who contributed tangible assets with the following fair values: Taling P20,000 100,000 The amount of P5,000 is owed for the furniture and the amount of P50,000 is owed for the computer. The partnership assumes both liabilities. Cash Furniture Computer Saling P50,000 12,000 a. Goodwill method. b. Bonus method. Agreed value P70,000 10,000 80,000 Required: Prepare the partnership formation entry assuming that the partners' capital balances are to be equal using

The ST Partnership was formed by Saling and Taling, who contributed tangible assets with the following fair values: Taling P20,000 100,000 The amount of P5,000 is owed for the furniture and the amount of P50,000 is owed for the computer. The partnership assumes both liabilities. Cash Furniture Computer Saling P50,000 12,000 a. Goodwill method. b. Bonus method. Agreed value P70,000 10,000 80,000 Required: Prepare the partnership formation entry assuming that the partners' capital balances are to be equal using

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Kk162.

Transcribed Image Text:The ST Partnership was formed by Saling and Taling, who contributed

tangible assets with the following fair values:

Cash

Furniture

Computer

Saling

P50,000

12,000

Taling

P20,000

Goodwill method.

Bonus method.

Agreed value

P70,000

10,000

80,000

100,000

The amount of P5,000 is owed for the furniture and the amount of P50,000 is

owed for the computer. The partnership assumes both liabilities.

Required:

Prepare the partnership formation entry assuming that the

partners' capital balances are to be equal using

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT