The Stable Utility Fund has an offering price of $54.11 and an NAV of $52.48. What is the front- end load percentage? A) 3.0 percent B) 3.1 percent C) 3.5 percent D) 3.8 percent E) 4.0 percent

The Stable Utility Fund has an offering price of $54.11 and an NAV of $52.48. What is the front- end load percentage? A) 3.0 percent B) 3.1 percent C) 3.5 percent D) 3.8 percent E) 4.0 percent

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

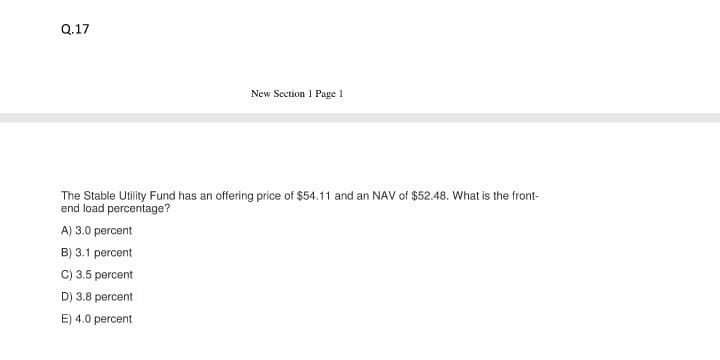

Transcribed Image Text:Q.17

New Section 1 Page 1

The Stable Utility Fund has an offering price of $54.11 and an NAV of $52.48. What is the front-

end load percentage?

A) 3.0 percent

B) 3.1 percent

C) 3.5 percent

D) 3.8 percent

E) 4.0 percent

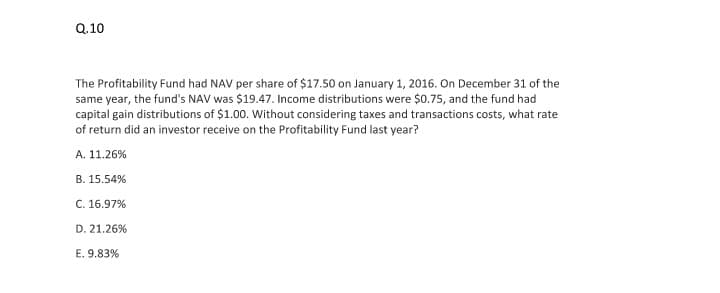

Transcribed Image Text:Q.10

The Profitability Fund had NAV per share of $17.50 on January 1, 2016. On December 31 of the

same year, the fund's NAV was $19.47. Income distributions were $0.75, and the fund had

capital gain distributions of $1.00. Without considering taxes and transactions costs, what rate

of return did an investor receive on the Profitability Fund last year?

A. 11.26%

B. 15.54%

C. 16.97%

D. 21.26%

E. 9.83%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning