The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $.50 per share, and there are 20,000 shares of stock outstanding. The market-value balance sheet for Payout is shown in the following table. Assets Liabilities & Equity Cash $100,000 Fixed assets 900,000 Equity $1,000,000 Total $1,000,000 Total $1,000,000 Required: (a.) What price is Payout stock selling for today? (b.) What price will it sell for tomorrow? Ignore taxes. (c.) Suppose that instead of paying a dividend, Payout Corp. announces that it will repurchase stock with a market value of $10,000. What happens to the stock price when the repurchase proposal is announced?

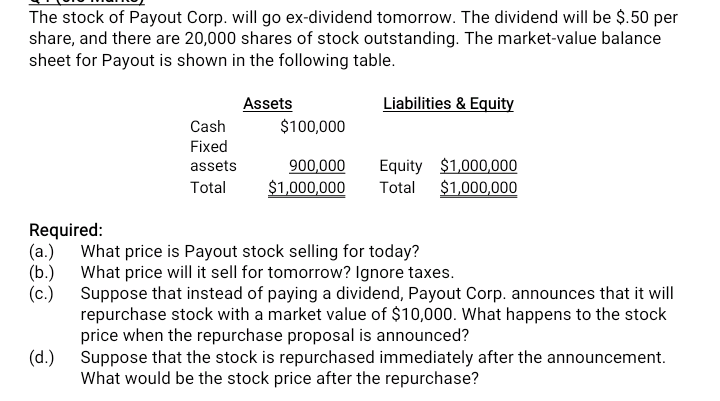

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $.50 per share, and there are 20,000 shares of stock outstanding. The market-value balance sheet for Payout is shown in the following table.

Assets

Liabilities & Equity

Cash

$100,000

Fixed assets

900,000

Equity

$1,000,000

Total

$1,000,000

Total

$1,000,000

Required:

(a.) What price is Payout stock selling for today?

(b.) What price will it sell for tomorrow? Ignore taxes.

(c.) Suppose that instead of paying a dividend, Payout Corp. announces that it will repurchase stock with a market value of $10,000. What happens to the stock price when the repurchase proposal is announced?

(d.) Suppose that the stock is repurchased immediately after the announcement. What would be the stock price after the repurchase?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images