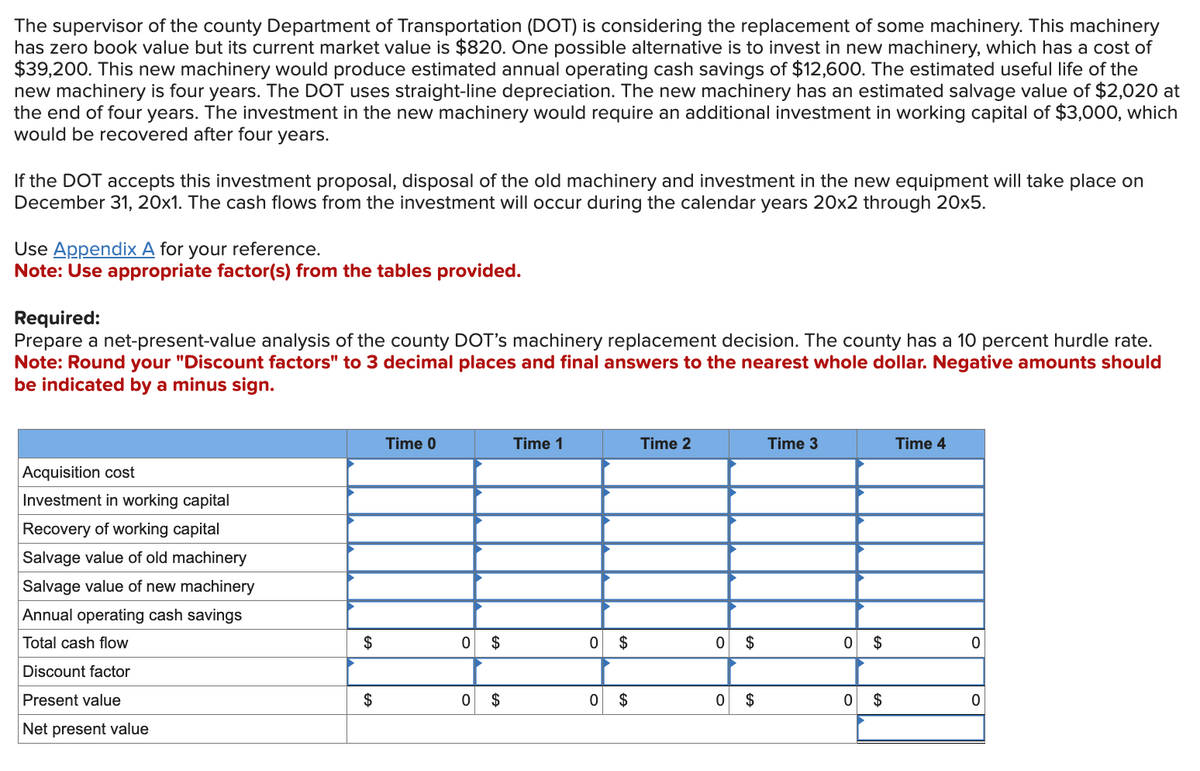

The supervisor of the county Department of Transportation (DOT) is considering the replacement of some machinery. This machinery has zero book value but its current market value is $820. One possible alternative is to invest in new machinery, which has a cost of $39,200. This new machinery would produce estimated annual operating cash savings of $12,600. The estimated useful life of the new machinery is four years. The DOT uses straight-line depreciation. The new machinery has an estimated salvage value of $2,020 at the end of four years. The investment in the new machinery would require an additional investment in working capital of $3,000, which would be recovered after four years. If the DOT accepts this investment proposal, disposal of the old machinery and investment in the new equipment will take place on December 31, 20x1. The cash flows from the investment will occur during the calendar years 20x2 through 20x5. Use Appendix A for your reference. Note: Use appropriate factor(s) from the tables provided. Required: Prepare a net-present-value analysis of the county DOT's machinery replacement decision. The county has a 10 percent hurdle rate. Note: Round your "Discount factors" to 3 decimal places and final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign. Acquisition cost Investment in working capital Recovery of working capital Salvage value of old machinery Salvage value of new machinery Annual operating cash savings Total cash flow Discount factor Present value Net present value $ $ Time 0 0 $ 0 $ Time 1 0 0 $ $ Time 2 0 $ 0 $ Time 3 0 $ 0 $ Time 4 0 0

The supervisor of the county Department of Transportation (DOT) is considering the replacement of some machinery. This machinery has zero book value but its current market value is $820. One possible alternative is to invest in new machinery, which has a cost of $39,200. This new machinery would produce estimated annual operating cash savings of $12,600. The estimated useful life of the new machinery is four years. The DOT uses straight-line depreciation. The new machinery has an estimated salvage value of $2,020 at the end of four years. The investment in the new machinery would require an additional investment in working capital of $3,000, which would be recovered after four years. If the DOT accepts this investment proposal, disposal of the old machinery and investment in the new equipment will take place on December 31, 20x1. The cash flows from the investment will occur during the calendar years 20x2 through 20x5. Use Appendix A for your reference. Note: Use appropriate factor(s) from the tables provided. Required: Prepare a net-present-value analysis of the county DOT's machinery replacement decision. The county has a 10 percent hurdle rate. Note: Round your "Discount factors" to 3 decimal places and final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign. Acquisition cost Investment in working capital Recovery of working capital Salvage value of old machinery Salvage value of new machinery Annual operating cash savings Total cash flow Discount factor Present value Net present value $ $ Time 0 0 $ 0 $ Time 1 0 0 $ $ Time 2 0 $ 0 $ Time 3 0 $ 0 $ Time 4 0 0

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:The supervisor of the county Department of Transportation (DOT) is considering the replacement of some machinery. This machinery

has zero book value but its current market value is $820. One possible alternative is to invest in new machinery, which has a cost of

$39,200. This new machinery would produce estimated annual operating cash savings of $12,600. The estimated useful life of the

new machinery is four years. The DOT uses straight-line depreciation. The new machinery has an estimated salvage value of $2,020 at

the end of four years. The investment in the new machinery would require an additional investment in working capital of $3,000, which

would be recovered after four years.

If the DOT accepts this investment proposal, disposal of the old machinery and investment in the new equipment will take place on

December 31, 20x1. The cash flows from the investment will occur during the calendar years 20x2 through 20x5.

Use Appendix A for your reference.

Note: Use appropriate factor(s) from the tables provided.

Required:

Prepare a net-present-value analysis of the county DOT's machinery replacement decision. The county has a 10 percent hurdle rate.

Note: Round your "Discount factors" to 3 decimal places and final answers to the nearest whole dollar. Negative amounts should

be indicated by a minus sign.

Acquisition cost

Investment in working capital

Recovery of working capital

Salvage value of old machinery

Salvage value of new machinery

Annual operating cash savings

Total cash flow

Discount factor

Present value

Net present value

$

$

Time 0

0

0

$

$

Time 1

0 $

0

$

Time 2

0

0

$

$

Time 3

0 $

0

$

Time 4

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning