The SUTA rate for Thomson Temp Agency is 5.4% and its FUTA rate is 6% less the 5.4% SUTA credit. If its semimonthly payroll is $139,320 and none was for payments to employees in excess of the $7,000 wage base, then what are the total FUTA and SUTA taxes (in $) for the payroll? SUTA tax $ FUTA tax $ Total tax $

The SUTA rate for Thomson Temp Agency is 5.4% and its FUTA rate is 6% less the 5.4% SUTA credit. If its semimonthly payroll is $139,320 and none was for payments to employees in excess of the $7,000 wage base, then what are the total FUTA and SUTA taxes (in $) for the payroll? SUTA tax $ FUTA tax $ Total tax $

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 1E

Related questions

Question

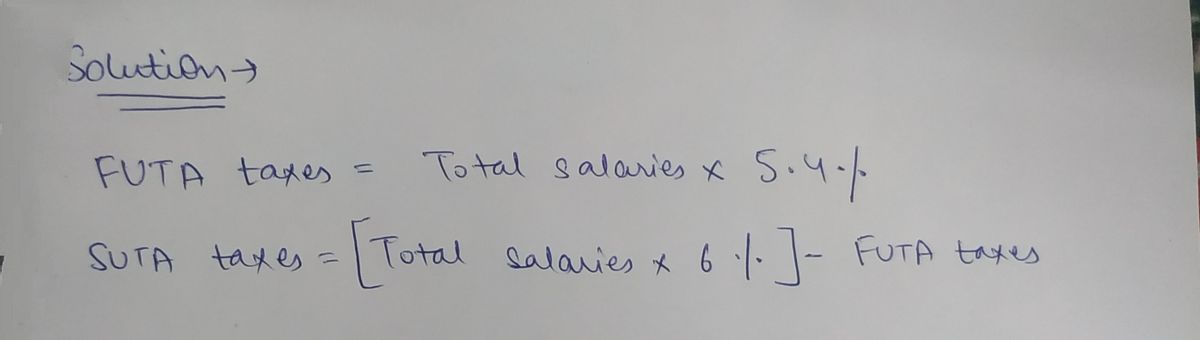

19.The SUTA rate for Thomson Temp Agency is 5.4% and its FUTA rate is 6% less the 5.4% SUTA credit.

If its semimonthly payroll is $139,320 and none was for payments to employees in excess of the $7,000 wage base, then what are the total FUTA and SUTA taxes (in $) for the payroll?

SUTA tax $

FUTA tax $

Total tax $

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage