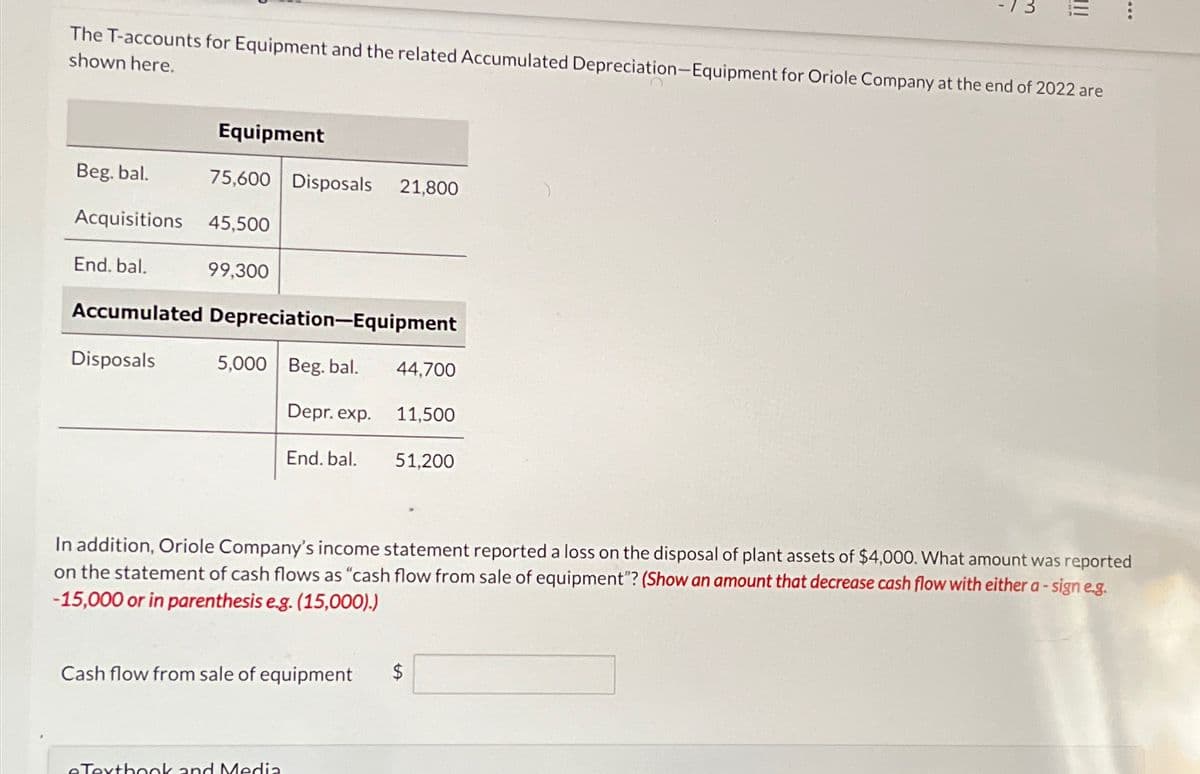

The T-accounts for Equipment and the related Accumulated Depreciation-Equipment for Oriole Company at the end of 2022 are shown here. Equipment Beg. bal. 75,600 Disposals 21,800 Acquisitions 45,500 End. bal. 99,300 Accumulated Depreciation-Equipment Disposals 5,000 Beg. bal. 44,700 Depr. exp. 11,500 End. bal. 51,200 .. In addition, Oriole Company's income statement reported a loss on the disposal of plant assets of $4,000. What amount was reported on the statement of cash flows as "cash flow from sale of equipment"? (Show an amount that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flow from sale of equipment $

The T-accounts for Equipment and the related Accumulated Depreciation-Equipment for Oriole Company at the end of 2022 are shown here. Equipment Beg. bal. 75,600 Disposals 21,800 Acquisitions 45,500 End. bal. 99,300 Accumulated Depreciation-Equipment Disposals 5,000 Beg. bal. 44,700 Depr. exp. 11,500 End. bal. 51,200 .. In addition, Oriole Company's income statement reported a loss on the disposal of plant assets of $4,000. What amount was reported on the statement of cash flows as "cash flow from sale of equipment"? (Show an amount that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flow from sale of equipment $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 60E

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:n

The T-accounts for Equipment and the related Accumulated Depreciation-Equipment for Oriole Company at the end of 2022 are

shown here.

Equipment

Beg. bal.

75,600 Disposals 21,800

Acquisitions 45,500

End. bal.

99,300

Accumulated Depreciation-Equipment

Disposals

5,000 Beg. bal.

44,700

Depr. exp.

11,500

End. bal.

51,200

In addition, Oriole Company's income statement reported a loss on the disposal of plant assets of $4,000. What amount was reported

on the statement of cash flows as "cash flow from sale of equipment"? (Show an amount that decrease cash flow with either a-sign e.g.

-15,000 or in parenthesis e.g. (15,000).)

Cash flow from sale of equipment

eTextbook and Media

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning